Reviews

Applying for the PREMIER Bankcard® Mastercard® Card: learn how!

Not everyone has a good credit history, but everyone needs a good credit card. Learn how to apply for the PREMIER Bankcard® Mastercard® Card and get an unsecured credit line up to $700.

Advertisement

PREMIER Bankcard® Mastercard® Card: fast and easy application

Getting a credit card with a bad credit score is a great difficulty for many. But the PREMIER Bankcard® Mastercard® Card is a solid option that can save you if that’s your situation.

However, it is not just the score that will be taken into account for approval. It is essential that your data is filled in correctly, as it increases the chances. So, check out how to apply correctly.

Apply online

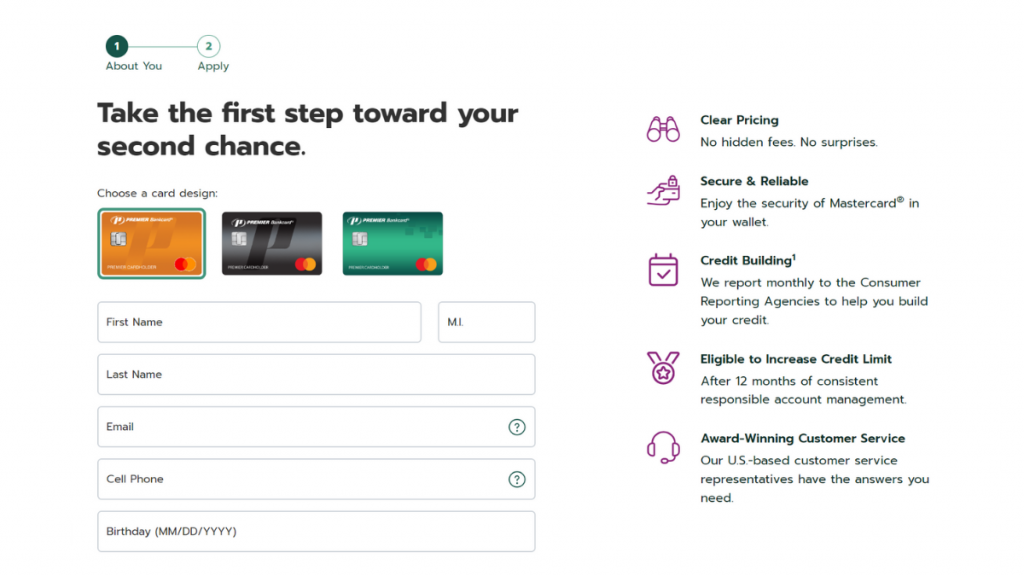

Visit PREMIER Bankcard®’s official website. Then, on the homepage, look for the “Apply Now” option for the Mastercard® Card. Click on it to get started.

You’ll be prompted to enter your personal details. This typically includes your name, email, date of birth, and cell phone number. Ensure accuracy for smooth processing.

Next, take a few minutes to review the card’s fees, interest, and important disclosures. Then, check the box agreeing to the Communications Authorization and click on “continue”.

Then, provide employment details and income information. This helps determine your credit limit and approval. Always be honest and provide up-to-date details.

Once you’ve reviewed your application, click on the “submit” button. Wait for the system to process your information; this may take a few moments.

Most online applications offer instant decisions. If not, you’ll receive an email about your application results. Check your email regularly.

If approved, your new PREMIER Bankcard® Mastercard® Card should arrive at your address within a few business days.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

The PREMIER Bankcard® Mastercard® mobile app lets you effortlessly track balances and transactions. You can also make payments, and much more.

However, you cannot apply for the PREMIER Bankcard® Mastercard® Card through it.

Applying online ensures stronger security protocols, and the website’s designed to handle the rigorous checks, guaranteeing your data’s safety.

So while the website handles applications, the app’s tailored for current cardholders. It provides a clear and intuitive experience for account management only.

PREMIER Bankcard® Mastercard® Card vs. First Savings Card

The PREMIER Bankcard® Mastercard® can be a very good option for anyone looking to build credit.

It provides an unsecured credit line, and you can even waive the monthly fee depending on your creditworthiness.

However, a good alternative lies in the First Savings Credit Card. You can get fraud coverage, and there is no penalty APR! Check out the comparison below.

PREMIER Bankcard® Mastercard® Card

- Credit Score: A 500+ score is required;

- Annual Fee: $50 – $125 depending on your creditworthiness;

- Regular APR: 36%;

- Welcome bonus: N/A;

- Rewards: N/A.

First Savings Card

- Credit Score: N/A;

- Annual Fee: It depends on your card and credit score;

- Regular APR: N/A.;

- Welcome bonus: N/A;

- Rewards: N/A.

Do you want to learn more about the First Savings Card’s offerings? Then you can check out our post below to learn all about the application process for this card!

Applying for the First savings card: learn how!

Applying for the First Savings credit card is simple. But can you do it? This article will give you the answer.

Trending Topics

Dovly review: repair your credit with confidence

Rebuilding credit is essential for financial health. Check out this Dovly review and find out if it might be a good option for you.

Keep Reading

Curadebt review: pay off your debts

You'll certainly find the solution for your debt in this Curadebt review. They helped more than 300,000 people, and they can help you too.

Keep Reading

Quick Loan Link review: up to $50K quickly

Looking for a fast and easy loan option? Then read our Quick Loan Link review. Compare several offers and enjoy flexible conditions!

Keep ReadingYou may also like

Luxury Gold credit card full review

If you're looking for a high-end credit card that offers travel redemptions, we’ve got you covered. Read our Luxury Gold card review to find out more!

Keep Reading

What are the best and easiest to get Chase cards?

In this article you will find a selection of the best chase credit cards available, as well as the ones that are the easiest to get

Keep Reading

Chase Freedom Flex℠ or Chase Freedom Unlimited® card: find the best choice!

Want to know if the Chase Freedom Flex℠ or Chase Freedom Unlimited® is right for you? Learn more about both cards to help you decide.

Keep Reading