Credit Cards

Applying for the Credit One Bank® Platinum Visa® Card: Learn how!

If you're looking for a credit card with cash back rewards and the opportunity to rebuild your credit score, look no further than the Credit One Bank® Platinum Visa® card. Read on and learn how to apply!

Advertisement

Credit One Bank® Platinum Visa® Card application: A chance to improve your credit score!

The Credit One Bank® Platinum Visa® Card is an unsecured credit card for people with low and fair credit scores. It offers a cash back program with a 1% rate in eligible purchases.

The redemption option is automatically added to your account as statement credits to help you cover your next credit card bill.

It charges an annual fee of $39. Its APR for purchases is 29.24%, and there is an additional credit increase fee if the option is available to your financial profile.

So if you’re looking to build a healthier financial future, the Credit One Bank® Platinum Visa® Card can put you on the right path.

Apply online

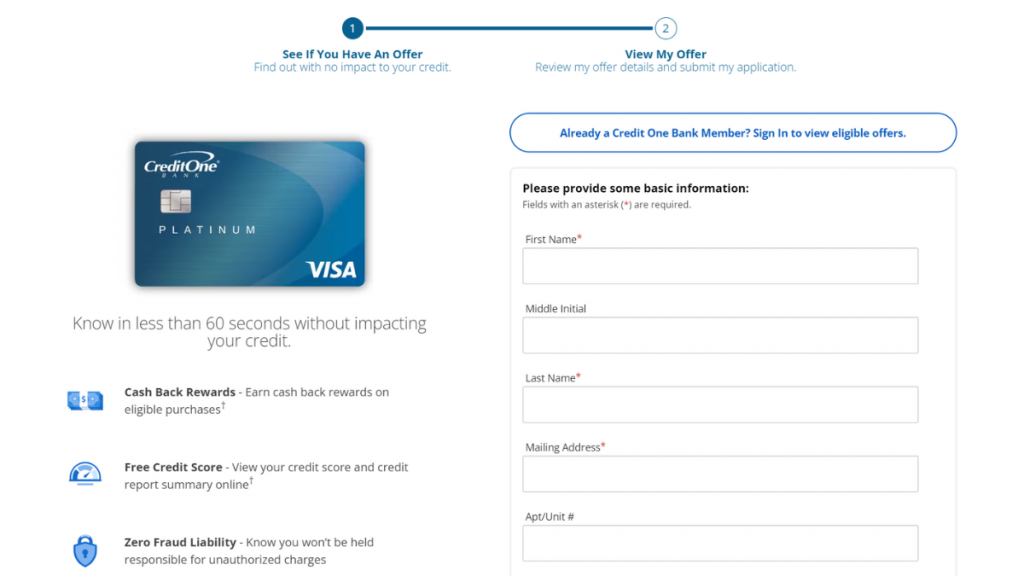

Applying for the Credit One Bank® Platinum Visa® card online is fast and super easy. First, you must access Credit One’s website and locate the credit cards section on the menu.

Then, click the “see if you pre-qualify” button underneath the card’s picture. The next page will show you some of the product’s features next to an online form.

Fill in with your personal information and contact details. You must also provide your social security number and monthly income.

Then, click the “see card offers” below and wait until the Bank makes a quick financial check on your profile.

In under 60 seconds, you should get a response to whether or not the card is available to you. The pre-qualification process does not impact your credit score.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Credit One provides an easy-to-use mobile app for all customers to manage their accounts on the go. You can pay your bills, see recent transactions, and update your preferences with it.

However, you cannot apply for a credit card via mobile. All new applications are made through Credit One’s official website.

Credit One Bank® Platinum Visa® Card vs. Oakstone Platinum Secured Mastercard credit card

If you’re unsure whether the Credit One Bank® Platinum Visa® card is the best choice for you, we got you covered.

We brought you a similar product from the same category so you can compare their features. That way, you can make the best decision for your financial needs!

The Oakstone Platinum Secured Mastercard credit card has a low APR rate and doesn’t require a credit check to help you build or rebuild your credit history.

| Credit One Bank® Platinum Visa® | OakStone Secured Mastercard® Platinum | |

| Credit Score | Bad – Fair | No credit required |

| Annual Fee | $39 | $49 |

| Regular APR | 29.24% variable | 9.99% variable |

| Welcome bonus | N/A | None |

| Rewards | 1% cash back in eligible purchases | N/A |

If you’d like to learn more about OakStone Secured Mastercard® Platinum’s features and how to apply, check the following link.

Applying for the OakStone Platinum Secured Card

No credit checks, a low APR and a modest annual fee to help you rebuild your credit! See how to apply for the OakStone Platinum Secured Card.

Trending Topics

Juno Debit Card full review

Need a good debit card to make your money work? Check out this Juno Debit Card review and find out if it might be what you're looking for.

Keep Reading

FTX exchange might acquire Robinhood Investing soon

Learn more details about the potential acquisition of Robinhood by cryptocurrency exchange FTX and what it could mean for the market.

Keep Reading

Social Welfare Programs: all you need to know

Learn about the history of social welfare programs and how they continue to shape our modern society. Discover what's currently available.

Keep ReadingYou may also like

Applying for the HSBC Premier Checking Account: learn how

Find out what you need to know before applying for an HSBC Premier checking account, and learn how to apply online.

Keep Reading

What type of account is a cash management: the same as a bank account?

What type of account is a cash management account? In this article we cover the basics of this type of account, and whether it is for you.

Keep Reading

OnPoint Community Credit Union Personal Loans: apply now!

Unlock your financial opportunities! Apply for OnPoint Community Credit Union Personal Loans today and ensure up to $25,000 fast! Read on!

Keep Reading