Credit Cards

Applying for the U.S. Bank Cash+™ Visa Signature® Credit Card: learn how!

Looking for a top cash back card with flexible redemption options? Look no further than the U.S. Bank Cash+™ Visa Signature® Card! Read on for the application process and start earning today!

Advertisement

U.S. Bank Cash+™ Visa Signature® Credit Card application: apply today and choose your bonus rewards!

The U.S. Bank Cash+™ Visa Signature® Card is a cash back product that lets customers decide how they want to earn their points. This card is perfect for everyday use, with no annual fee and a 0% intro APR for 15 billing cycles.

You can get up to 5% on $2000 combined purchases in 2 categories of your choice each quarter. An extra 2% unlimited cash back on a daily expense and 1% on all other purchases. U.S. Bank throws in a nice $200 reward after you spend $1000 within 120 of owning the card as a sign-up bonus.

So, keep reading if you want to learn how to apply for a U.S. Bank Cash+™ Visa Signature® card today!

Apply online

The online application process is simple and usually takes no longer than 5 minutes to complete. First, you need to access the U.S. Bank website, click on “personal” at the top menu, “credit cards” and then “view credit cards”.

After that, you should see the U.S. Bank Cash+™ Visa Signature® card option under the “cash back” cards alternative. Click on the “apply now” blue button. U.S. Bank will require you to fill in a form with your personal and contact information. After you’ve done that, click on “save and continue”.

The bank will do a quick assessment of your financial profile. You should get a phone call or an e-mail with more details about your request if you fit the minimum requirements for this card.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

If you already have an open account with U.S. Bank, applying for a U.S. Bank Cash+™ Visa Signature® card via mobile is easy! You can log in with your credentials and find the “credit cards” section on the app.

If the card is available to you, the option to apply for it should appear under “new requests”.

U.S. Bank Cash+™ Visa Signature® credit card vs. OpenSky Secured Visa credit card

If you’re not sure the U.S. Bank Cash+™ Visa Signature® card is the best choice for you, we can help. Maybe what you’re looking for a secured card to control your expenses better. In that case, meet the OpenSky Secured Visa credit card!

If you have a bad credit history and want to rebuild it, the OpenSky secured card can significantly assist you. Check out its main features in the comparison below and follow the recommended link for the application process!

| U.S. Bank Cash+™ Visa Signature® | OpenSky Secured Visa | |

| Credit Score | Good – Excellent | Low – Fair |

| Annual Fee | $0 | $35 |

| Regular APR | 14.24 – 24.24% (variable) | 20.39% (variable) for Purchases and Cash Advances |

| Welcome bonus | $200 after spending a minimum $1000 in the first 120 days of account opening | None |

| Rewards | 5% cash back on $2000 combined eligible purchases within 2 categories 2% unlimited cash back in a category of your choosing 1% cash back in all other purchases | N/A |

Applying for the OpenSky Secured Visa Credit Card

Learn how to rebuild your credit score with the help of OpenSky Secured Visa Credit Card! Learn how to apply here.

Trending Topics

Top 10 Free Movie and Series Streaming Apps You Need to Try

Unplug your cable box! Access free movies and series with these must-have apps to watch your favorite content for free. Read on!

Keep Reading

Pay $0 annual fee: Assent Platinum Secured Credit Card review

You just found the card that works for you! Read our Assent Platinum Secured Credit Card review and learn how! Build credit quickly!

Keep Reading

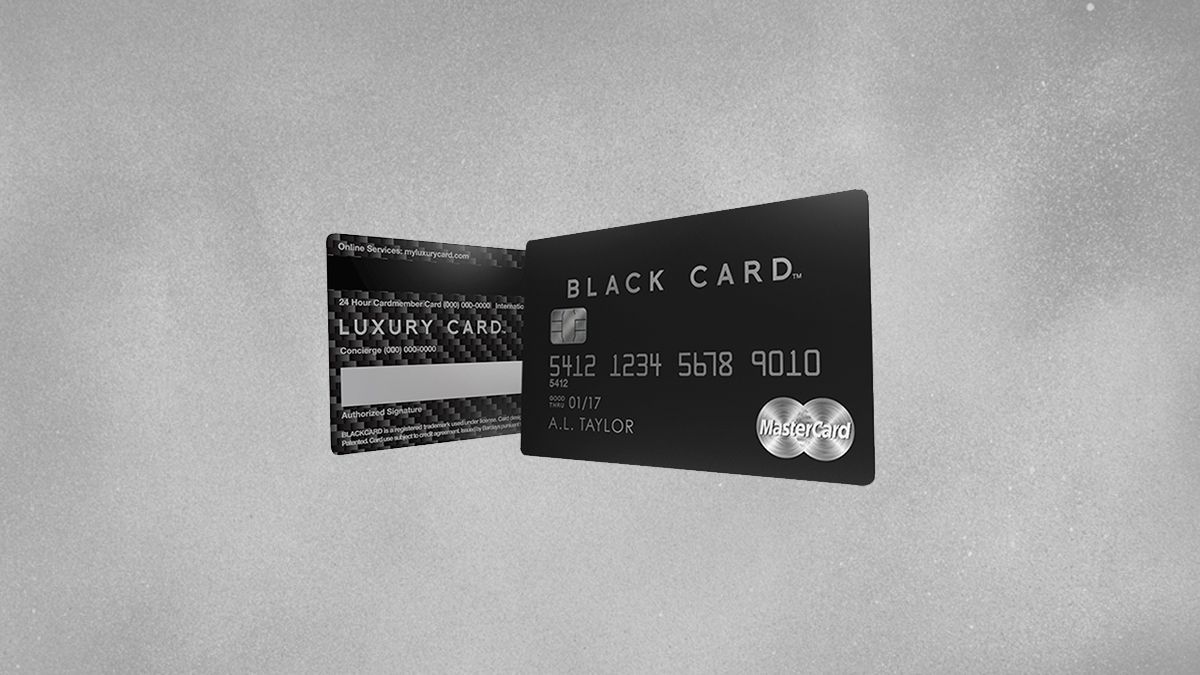

Luxury Black credit card full review

Check out our Luxury Black credit card full review to learn all about its exclusive travel rewards and high-end experiences.

Keep ReadingYou may also like

Bear market: what is it in investing terms?

Check this article to find out everything you need to know about what is a bear market! From what they are to how long they last.

Keep Reading

Savings vs. Checking Accounts: A Comprehensive Comparison

Savings vs. checking accounts: Discover their contrasts and similarities to identify the right one. Learn more!

Keep Reading

Scotia Momentum Visa Infinite credit card full review

See our Scotia Momentum Visa Infinite review and find out if this card is right for you. Learn about its cash back program and other benefits!

Keep Reading