Credit Cards

Chase Freedom Flex® Credit Card Review

The Chase Freedom Flex® Credit Card is a cash-back credit card that regularly offers 5% back. But does this versatile cash-back card have other strengths? Find out in our full review!

Advertisement

Earn 5% cash back on rotating categories!

If you’re looking for a solid card with cash back benefits, you’ve found it! Read our Chase Freedom Flex® Credit Card review to learn all about this one-of-a-kind product.

The card offers 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate and 1% to 3% cash back on other purchases.

Plus, there is no annual fee! Do you want more information about this card’s features and benefits? Then let’s get started!

| Credit Score | Good – Excellent |

| Annual Fee | $0 |

| Regular APR | 0% intro APR for 15 months from account opening on purchases and balance transfers. Then, a variable 19.49%–28.24%. |

| Welcome bonus | $200 after spending $500 on purchases within 90 days of account opening |

| Rewards | 5% cash back on fixed bonus categories; 5% cash back on travel booked through Chase Ultimate Rewards; 3% cash back on dining and drug stores; 1% cash back on all other purchases. |

How does the Chase Freedom Flex® Credit Card work?

The Chase Freedom Flex® Credit Card is a World Elite Mastercard product, Issued by Chase and Mastercard.

That means you get exclusive perks like cell phone insurance, discounts in services like Lyft and Fandango, and hotel benefits through the Mastercard Luxury Hotel program.

The card charges no annual fee and provides a 0% intro APR for 15 billing cycles on balance transfers and purchases. The recommended credit score for applications is between 690 and 850.

Its welcome bonus for new cardholders provides a $200 bonus after spending just $500 within the first 3 months of card membership.

Since this is primarily a cash-back card, you get a lot of bonus points for everyday spending.

In that sense, you can earn up to 5% cash back in quarterly bonus categories. There is a 3% cash back on dining and drug stores and 1% on all other purchases.

The flexible redemption options allow Chase Freedom Flex® customers to get a statement credit or direct cash deposit into a checking or savings account.

That means the more you spend, the more you’ll earn. Since the bonus points never expire, prioritizing this card on daily purchases can mean a profitable return.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Chase Freedom Flex® Credit Card pros and cons:

To help you make the best decision for your financial profile, we’ve compiled this product’s perks and drawbacks in our Chase Freedom Flex® Credit Card review.

Pros

- Exciting $200 sign-up bonus;

- $0 annual fee;

- 5% cash back in rotating categories;

- 0% intro APR

- 1% cash back on every purchase.

Cons

- Require Good/Excellent category;

- Needs bonus rewards tracking;

- Complicated rewards system

Want to apply for the Chase Freedom Flex® Credit Card?

Now that you’ve seen how beneficial this card can be for your finances, how about applying for one?

Read on for a quick and easy application process with Chase and get your Chase Freedom Flex® Credit Card today!

Does my credit score need to be good?

Since this product has cash back benefits, Chase requires all new clients to have a credit score between Good and Excellent.

Therefore, the recommendation for a new Chase Freedom Flex® Credit Card is between 690 and 850.

Requirements

- Age: Must be at least 18 years old (or the legal age of majority in your state).

- Residency: Requires a valid U.S. physical address (P.O. boxes may not be accepted).

- Identification: A valid Social Security Number (SSN) or ITIN is required.

- Credit Score: Designed for individuals with good to excellent credit (FICO score 690+).

- Income: Proof of sufficient income to handle monthly payments is required.

- Credit History: Must demonstrate responsible credit use (e.g., on-time payments).

- Chase 5/24 Rule: May be denied if you’ve opened 5 or more credit cards in the past 24 months.

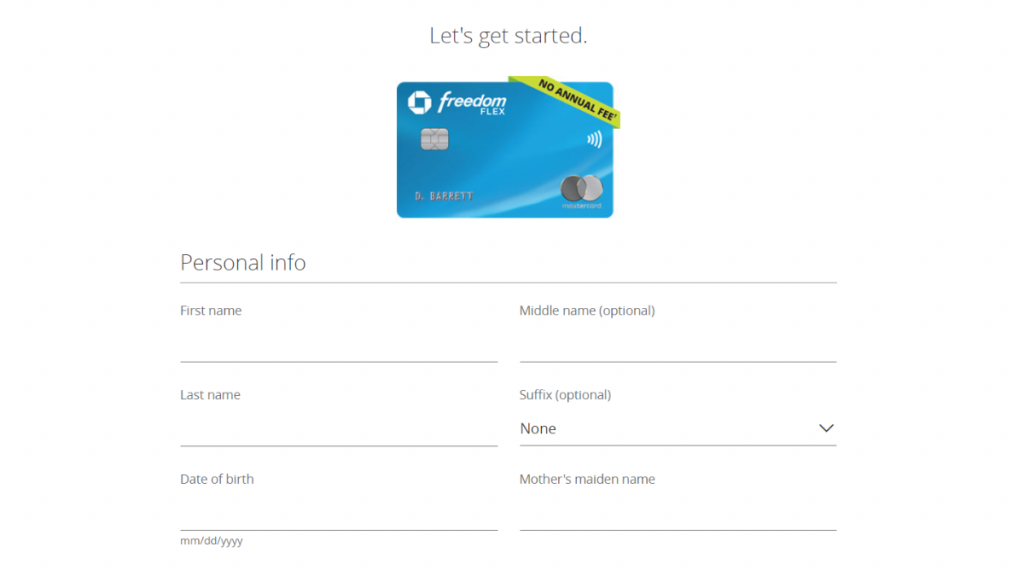

Apply online

The Chase Freedom Flex® Credit Card online application is simple and takes no longer than 5 minutes. First, you need to access the Chase Credit Cards website.

In the “cash back” category, the Freedom Flex alternative is under Freedom Unlimited. Click on “learn more”.

You can log in and speed up the process if you’re a Chase customer. If you don’t have an account with the bank, you can click on the “apply as a guest” button.

Fill out the online form with your personal, financial, and contact details and agree with the terms & conditions before clicking the “submit” button.

Chase will verify your financial profile, and the response to your request should come quickly via phone call or e-mail.

Apply using the app

You can also apply for a Chase Freedom Flex® Credit Card by using their mobile app.

The process is very similar to the online application. However, you might need to create an account before requesting a product.

Chase Freedom Flex® Card vs. Chase Freedom Unlimited® Card

If you feel like the Chase Freedom Flex℠ credit card doesn’t fit your needs; it’s okay!

We brought another recommendation from Chase: the Freedom Unlimited® credit card.

Check the comparison below and follow the recommended link for the application process!

| Chase Freedom Flex® | Chase Freedom Unlimited® | |

| Credit Score | Good – Excellent | Good – Excellent |

| Annual Fee | $0 | $0 |

| Regular APR | 0% intro APR for 15 months from account opening on purchases and balance transfers. Then, a variable 19.49%–28.24%. | 0% intro APR for 15 months from account opening on purchases and balance transfers. Then, a variable 20.49%–29.24% |

| Welcome bonus | $200 after spending $500 on purchases within 90 days of account opening | $200 after spending $500 on purchases within 90 days of account opening |

| Rewards | 5% cash back on fixed bonus categories; 5% cash back on travel booked through Chase Ultimate Rewards; 3% cash back on dining and drug stores; 1% cash back on all other purchases. | 5% cash back on travel purchased through Chase Ultimate Rewards; 3% cash back on dining and takeout; 3% back on drugstore; 1.5% cash back on all other purchases. |

Chase Freedom Unlimited® Review

Check the easy and fast application for the Chase Freedom Unlimited® Credit Card and start earning today!

Trending Topics

FIT™ Platinum Mastercard® Review: Build credit easily

If you're having trouble getting a credit card because of a poor credit score, check the FIT™ Platinum Mastercard® terms in this review.

Keep Reading

Indigo® Mastercard® with Fast Pre-qualification credit card full review

Check our Indigo® Mastercard® with Fast Pre-qualification card review and learn how to build a better financial future.

Keep Reading

No credit check payday loan in Canada: how does it work?

If you need money fast, take a look at this article to find the best no refusal payday loans in Canada and learn about this type of loan.

Keep ReadingYou may also like

650 credit score: is it a good score?

Considering applying for a loan or credit card but unsure if your credit score is enough? Read on to learn what a 650 credit score means.

Keep Reading

Credit Score: How Does It Work and Why Is It Important?

Want to know how credit score works? Dive into our comprehensive guide for a clear understanding. And discover how to improve yours!

Keep Reading

5 Credit Cards for Fair Credit: Best Options for You!

Looking to improve your FICO score or rebuild your credit? Here are 5 great options of credit cards for fair credit.

Keep Reading