Credit Cards

Credit card rewards: does it make you spend more money?

Are you one of those people who love getting credit card rewards? If so, does that mean you spend more money than you would without the rewards? Recent studies seem to indicate that may be the case. Read on to learn more about it!

Advertisement

Is it worth having credit cards with rewards? Find out!

Credit card payment has been an ever growing trend, and there have been a number of studies where researchers have noticed that people tend to spend more when they pay with their credit cards than when they pay cash. Having a cash back card can add to the problem, since credit card rewards make you spend more.

What research shows is that purchases made on debit have an immediate pain associated with it, whereas if you buy something on credit you will only feel that pain a month later. Over time this “being able to avoid pain” becomes its own little source of pleasure, and that’s when we start spending more on things we don’t really need.

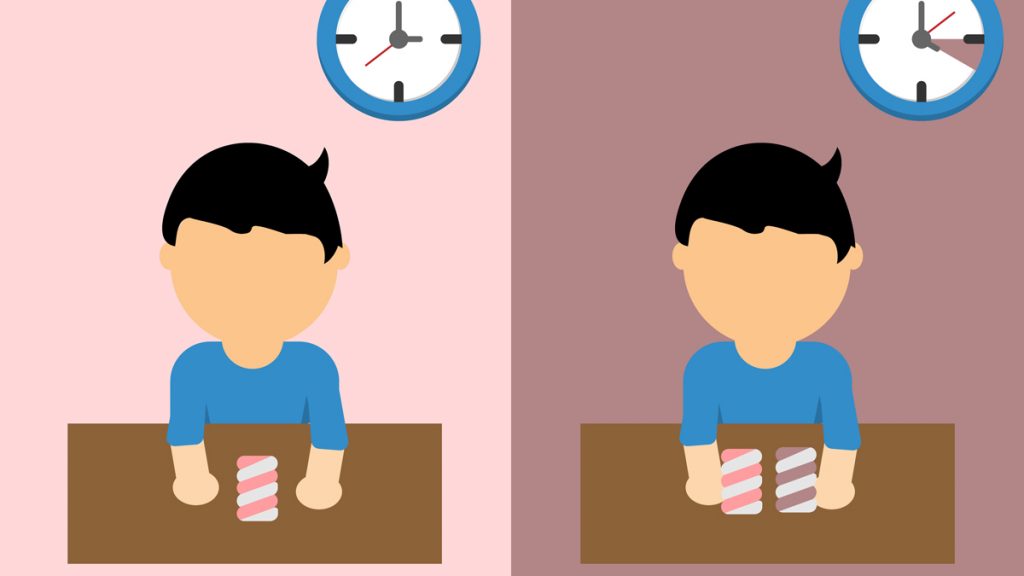

This impulsive buying behavior reminds me of another experiment conducted by psychologist Walter Mischel in 1972 called the Stanford marshmallow experiment. This experiment can help us get some insight on spending addiction (yes, spending addiction is a real thing).

Balance transfer credit card: what is it?

Learn what are balance transfer credit cards and how they can help you pay down your debt faster!

The Marshmallow Experiment

The Stanford marshmallow experiment was a study on delayed gratification. A child was offered two choices: Getting one marshmallow right there on the spot, or getting two marshmallows if they waited for some time, while the researcher was out of the room.

In the following decades researchers conducted follow-up studies with the same children and found that those who were able to hold on tended to have brighter outcomes in life than those who didn’t.

Given that we are constantly exposed to tempting little spending offers, whether through social media advertising, TV ads, billboards or strategically positioned Sneaker bars at checkout lines, controlling spending is largely a function of delayed gratification.

What drives us to always spend a little more on credit is the same reward mechanism which keeps addicts going back to the drug they’re addicted to. It is this inability to control the drive to do the drug, to make the purchase, that characterizes the addiction. Credit card companies thrive on this mechanism, hence they will never warn you about it. Quite the opposite.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What do you do then?

So the answer to the question of whether credit cards with rewards make you spend more couldn’t be more in our faces. Yes! They do. So let’s ask ourselves a different question then: Are you capable of resisting the urge? Are you the kid who eats the marshmallow or the one who waits for the researcher to come back?

Besides being able to control yourself so that you don’t overspend and always pay your balance on time and in full, if you really want to get a rewards credit card, you need to understand some of its other possible traps so that you never fall for them.

For example, let’s say you have the flashy American Express Platinum which offers you 60,000 reward points if you spend $5,000 in the first three months from account opening. One point is usually worth something around $0.01 and $0.02.

So if you have one big purchase to make with the card you get a nice big extra $600 or $1,200 that month. That’s a nice deal. But let’s say you usually spend $500 on your credit card every month. Then, you increase your spending to $1,666 for three months racing for those 60,000 points. Sure, you will get the $1,200. But you will still have spent $2,300 more than you normally would. The math is simple, but time makes it hard to see.

And the truth of the matter is that $1,200 is the max you will likely get back. It might as well be less because learning exactly how much you’re being rewarded for every dollar you spend is a very tricky task. So next we’ll tell you a little bit about how these rewards credit cards work.

How does a rewards credit card work?

These kinds of credit cards offer bonuses for timely payments and keep consumers using the card. They usually offer cash back, travel miles or points which can be redeemed for products or services with some of the issuer’s business partners.

These types of cards represent a huge portion of the credit card market, and there is an enormous variety of rewards programs available to the public. A number of credit card companies offer what is commonly known as a “welcome bonus”.

Those offers usually present themselves as an introductory 0% APR for the first 12 to 15 months, a 40% return on the first $500 you spend in the first 3 months from account opening or something of the sort, and so on.

Selecting the right rewards credit card is less about the card itself, and more about you. What are your spending habits? How can you seamlessly add the card to your spending routine without getting washed overboard because you mistook credit for free money? What is your credit score and how can you improve it?

Once you’ve thought through these questions, analyzing pros and cons becomes an exercise of making the card fit your needs rather than making your needs fit the card.

Learn 3 pros of having a rewards credit card!

Even though credit card rewards make you spend more, there’s always great perks and benefits to owning a card if you use it correctly. One great way to make sure you keep your financial health is understanding the upside and downside of all financial products you decide to acquire.

Rewards credit cards are no different in that respect. They offer a great upside potential if you’re smart in how you use them, but also an enormous downside if you’re not.

Check it out!

Pros

- Cash back rewards of up to 5%

- Excellent mileage rewards

- Shopping perks of all kinds

Cons

- Cashback spending caps

- Complex eligible spending categories

- Intro offers can be tricky

If you want a more in-depth review of the benefits a rewards credit card can provide when used correctly, follow the link below and learn more about it!

Rewards credit cards: learn their pros

Learn about the most popular kinds of rewards credit card accounts and why they might suit your needs!

Trending Topics

Honest Loans: how to apply now!

Learn how to apply for Honest Loans. It is easier than ever. Borrow up to $50K for several purposes! Keep reading for more!

Keep Reading

H&R Block Emerald Prepaid Mastercard® full review

A good prepaid card can help your finances. Know this H&R Block Emerald Prepaid Mastercard® review and find out if it might be the ideal.

Keep Reading

Best Credit Cards for Bad or Low Credit — Rebuild & Rise!

Looking to rebuild your credit? Discover the best credit cards for low credit — compare top options. Start your credit journey today!

Keep ReadingYou may also like

Get up to $500K quickly: Apply for PenFed HELOC

Learn how to apply for a PenFed HELOC now - get the money you need quickly and use it for several purposes! Keep reading and learn more!

Keep Reading

Coutts World Silk credit card full review

Discover everything you need to know about the Coutts World Silk credit card, including its features and benefits. Keep reading to see more!

Keep Reading

The best rewards credit cards of 2022: choose your favorite

The best rewards credit cards are the ones that meet our needs. Check out some amazing options for 2022 and choose your favorite!

Keep Reading