Credit Cards

Applying for the Capital One Venture Rewards card: learn how!

If you're a traveler looking for a new rewards card, consider the Capital One Venture Rewards. Earn two miles for every dollar you spend, unlimited. Read on and learn how to get yours.

Advertisement

Capital One Venture Rewards Card: turn your expenses into travel experiences with the best rewards program

With the Capital One Venture Rewards card, you can travel the world and get rewarded for it.

This card lets you earn unlimited miles on every purchase you make. Plus, you can use your rewards to book any type of travel— plane tickets, hotel rooms, car rentals, and more.

So if you’re looking for a versatile and rewarding travel credit card, the Capital One Venture Rewards is a great option. Keep reading to learn how to apply for it.

Apply online

You can apply for this card online. It is easy, and you get the answer in your email.

On the Capital One website, you can see all the credit cards it has to offer. Search for the Capital One Venture Rewards credit card.

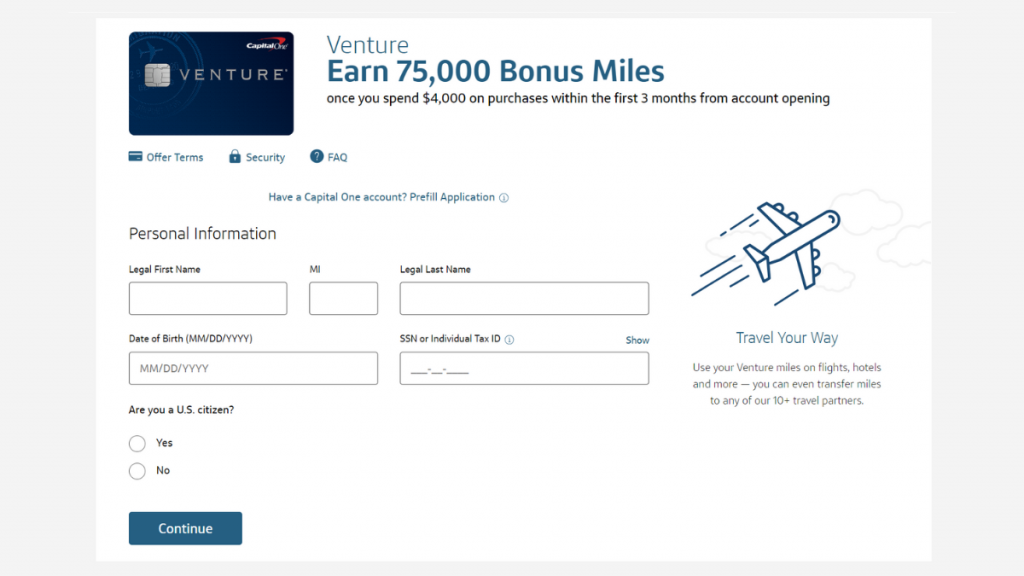

There will be an “apply now” button that will redirect you to the application form. You’ll answer questions about your personal and financial information.

At the end of the form, you’ll find the terms and conditions to apply. Read everything to know exactly which payment conditions you’ll face and how the rewards program works.

Once you finish to fill the form and accept the terms and conditions, send your application. You’ll get the answers in your email.

If you’re not approved for this card you may receive an offer for another Capital One credit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Capital One has a great app for its cardholders to administer their accounts. However, you can’t apply for a new credit card on it. For application, go to the Capital One website.

Capital One Venture Rewards Credit Card vs. Chase Sapphire Preferred® Credit Card

To help you decide whether you should apply for this card, we present you with a comparison with another card in the same category.

The Chase Sapphire Preferred credit card has similar benefits. Instead of miles, you’ll get reward points, but you can also exchange them for travel and hotels booking.

| Capital One Venture Rewards Credit Card | Chase Sapphire Preferred® Credit Card | |

| Credit Score | Excellent. | 690 or higher. |

| Annual Fee | $95. | $95. |

| Regular APR | 19.99% – 29.99% variable, based on your creditworthiness. | 21.49% – 28.49% variable APR. |

| Welcome bonus | 75,000 bonus miles after spending $4,000 on the first 3 months. | 60,000 bonus points after $4,000 spent in the first 3 months |

| Rewards | 2 miles per dollar on every purchase; 5 miles per dollar on car rentals and hotels booked through Capital One Travel. | 5x points on travel purchased through Chase Ultimate Rewards; 2x points on other travel buys; 3x points on dining at restaurants; 3x points on select streaming services and online grocery purchases; 1 point per $1 spent on all other purchases. |

If you found the Chase Sapphire Preferred® Credit Card an interesting option, you can check the post with more info about it. Check the content below to learn how to apply for it.

How do you get the Chase Sapphire Preferred® Card?

The Chase Sapphire Preferred® Credit Card will amaze you. If you like being rewarded for your purchases and traveling, consider applying for this card.

Trending Topics

Make up to $20 per hour working at Outback: see job vacancies

Outback is hiring now for different jobs! Join their team and make up to $20/hour. Keep reading to know the ones available today!

Keep Reading

Credit-builder loans: get the help you need to improve your credit score

Need to build credit or improve your credit score? Then you need to know about credit-builder loans. Check out!

Keep Reading

Applying for the Huntington Bank Voice Rewards card: learn how!

The Huntington Bank Voice Rewards card offers one of the most flexible points program out there. We are going to show you how to get yours!

Keep ReadingYou may also like

Applying for the First savings card: learn how!

Do you know how to apply for the First Savings credit card? This post will show you how to get a new credit card and use it to build credit.

Keep Reading

An easy guide to combining finances as a couple

Planning to combine finances as a couple? Read what research shows about this, and what are the best methods for combining finances.

Keep Reading

LoanPioneer: how to apply now!

LoanPioneer has the solution for your small debts up to $5,000. But how to apply for LoanPioneer? Find out in this post.

Keep Reading