Credit Cards

Indigo® Mastercard® Credit Card full review

Want to rebuild credit and need a card? We may have the best option for you! Read our Indigo® Mastercard® Credit Card review to learn more!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Indigo® Mastercard® Credit Card: no credit score requirement and fair APR

This may be the way out if you need a credit card but don’t have enough score for regular options. This Indigo® Mastercard® Credit Card Review will show you what the qualifications and benefits of this option are.

This credit card allows you to rebuild credit and use it for extra money. Although the limit is low, this card’s approval helps many who need it. So, check out the features.

- Credit Score: Bad / Poor;

- Annual Fee: $175 the first year; then $49 annually;

- Regular APR: 35.9%;

- Welcome bonus: N/A;

- Rewards: N/A.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the Indigo® Mastercard® Credit Card work?

The Indigo® Mastercard® Credit Card is a credit option for those with a bad or poor credit score. It has a relatively low fee compared to other similar cards and includes higher annual fees.

It allows for quick and easy application over the internet and provides monthly reports to credit bureaus. So, you use your limit and can increase your credit score by making regular payments.

Indigo® Mastercard® Credit Card pros and cons

This Indigo® Mastercard® Credit Card Review shows that this card option can be great at recovering credit. However, like any credit card, it also has its downsides.

In this case, the limit is low as the card can be requested by people without a good credit score. In addition, there are associated annual fees. Therefore, check out the pros and cons.

Pros

- No requirement for a good credit score for Prequalification, even if you have previously declared bankruptcy;

- Reports sent monthly on credit usage to the main agencies;

- No security deposit is required to secure approval;

- Relatively low APR rate for this type of card.

Cons

- The potentially high annual rate, depending on the credit score being evaluated;

- No associated benefits and welcome bonus;

- Low credit limit;

- Difficulty in wide use of credit due to low limit.

Does my credit score need to be good?

As you can see, the Indigo® Mastercard® Credit Card is a great option for anyone who doesn’t have a good FICO score. That is, you do not need to have a good credit score to apply for this credit card option.

In that sense, having a score above 300, you are already considered qualified to apply for that card. While it has a relatively lower APR rate compared to similar options, it has high annual fees to compensate.

Want to apply for the Indigo® Mastercard® Credit Card?

The Indigo® Mastercard® Credit Card is a great option for those who need a card but don’t have enough score. It allows us to pay bills while helping to rebuild credit.

However, it is not enough to meet the requirements to qualify and be approved, it is essential to know how to apply.

The application can be made online and by application and requires the correct filling. Know more!

Apply online

Applying for the Indigo® Mastercard® Credit Card is essential to fulfilling the requirements. In this sense, it is important to be over 18 years of age and to be a US citizen residing in the US.

The online application can be made through a notebook or computer with internet access.

However, it is important to fill in the registration with as much data as possible and wait for the evaluation.

Apply using the app

Unfortunately, there is not much information about a mobile app for Indigo. So, if you think this card is the bets option for you to build credit, you can follow the steps above to complete your application!

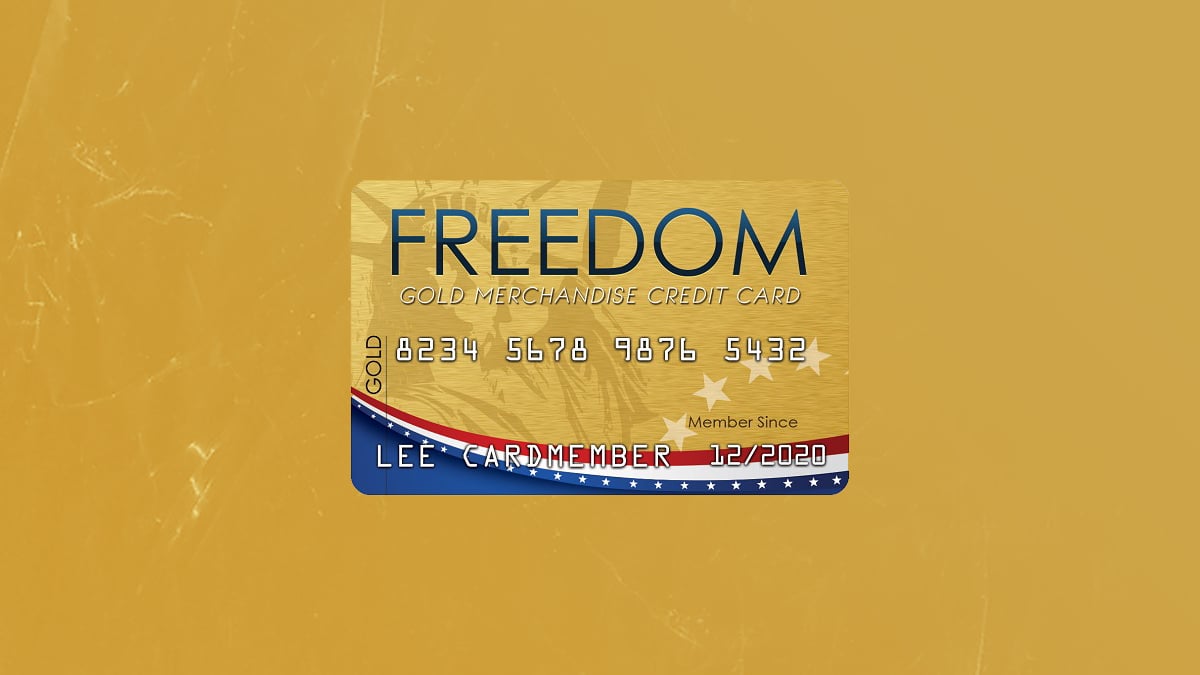

Indigo® Mastercard® Credit Card vs. Freedom Gold Card

While the Indigo® Card is a great option for anyone needing credit, it’s not the only one. An alternative to this card is the Freedom Gold Card.

In addition, the Freedom Gold Card allows for a higher credit limit, which can be as high as $750. Annual fees may be higher than Indigo® Mastercard® Credit Card due to the low APR.

However, the options must be evaluated individually, according to each person’s objective. Check out the comparison between these options and see which makes the most sense in your routine.

Indigo® Mastercard® Credit Card

- Credit Score: Bad / Poor;

- Annual Fee: $175 the first year; then $49 annually;

- Regular APR: 35.9%;

- Welcome bonus: N/A;

- Rewards: N/A.

Freedom Gold Card

- Credit Score: Bad / Poor;

- Annual Fee: $177.24 ($14.77/month);

- Regular APR: 0%;

- Welcome bonus: N/A;

- Rewards: N/A.

And if you’re interested in learning more about the Freedom Gold Card and how to apply for it, check out our post below to find out!

Freedom Gold Credit Card Review

The Freedom Gold card is an excellent no-red-tape option for individuals with poor credit who need to get their hands on a credit card fast. Let us help you do that.

Trending Topics

Avant Credit Card Review: Boost your credit!

Discover the benefits and drawbacks of the Avant Credit Card in this comprehensive review. Uncover the low fees and easy application process!

Keep Reading

Is the crypto market going down? Here’s what you need to know

Inflation has impacted the cryptocurrency market. Is crypto market going down? That's what you'll find out in this post.

Keep Reading

Universal Credit Personal Loans review: up to $50K

Get full insights into what Universal Credit Personal Loans has to offer in this full review! Flexible rates and terms! Read on!

Keep ReadingYou may also like

Supplemental Security Income (SSI): ensure financial help

Have a disability that limits your ability to work? Learn about Supplemental Security Income, who is eligible for it, how to apply, and more!

Keep Reading

H&R Block Emerald Prepaid Mastercard® Review

A good prepaid card can help your finances. Know this H&R Block Emerald Prepaid Mastercard® review and find out if it might be the ideal.

Keep Reading

Crypto with the most potential in 2022: great investment opportunities

Do you know which is the crypto with the most potential in 2022? Bitcoin has given way to other currencies like Ethereum. Read on!

Keep Reading