Loans

Achieve your full potential: Navy Federal HELOC review

Ready to use your home equity with a Navy Federal Credit Union HELOC? Don't go in blind- read our detailed review and get all the information you need upfront.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

What Military Members Need to Know About Navy Federal HELOC: An Overview

Find out the pros and cons of Navy Federal Credit Union HELOC in our all-inclusive review.

Get the details on terms, rates, and everything else you need to know right here. Keep reading!

| APR | Starting from 7.250%; |

| Loan Purpose | Debt consolidation, home renovation and repairs, life events, large purchases; |

| Loan Amounts | $10,000 – $500,000; |

| Credit Needed | 680 |

| Terms | 20 years drawing period, followed by 20 years of repayment; |

| Origination Fee | N/A. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Navy Federal HELOC overview

In simple terms, a HELOC is a revolving line of credit secured by your home equity.

HELOCs operate like credit cards, so they allow you to borrow from a predetermined limit as needed.

Also, they offer flexibility and potentially lower costs, making them a useful option for uncertain borrowing needs.

Navy Federal Credit Union HELOC

With that in mind, the Navy Federal Credit Union’s HELOC stands out from its competitors because of its prolonged 20-year draw period.

Also, it comes with a loan-to-value ratio of 95%.

However, only eligible borrowers can join the credit union.

Current or former military personnel, as well as their immediate family members, can apply, in addition to Department of Defense employees.

Loan Amount

The minimum draw amount for this HELOC is $10,000. In addition, the loan can take around 60 days to be processed.

Funding options

Once approved, borrowers from the Navy Federal HELOC can access their funds via checks, cards, or transfer options.

Property types accepted

When applying for a Navy Federal HELOC, borrowers have the flexibility to use various types of properties as collateral.

It includes primary properties, secondary homes, and vacation homes, as well as investment properties and house-flipping projects.

Is it worth it to apply for Navy Federal HELOC?

If you’re a service member, veteran, or civilian working for the Department of Defense with no immediate need for funds, then this HELOC could be worth considering.

However, it’s important to review its advantages and disadvantages before deciding.

Benefits

- Long draw period (20 years);

- No annual fee;

- No origination fee;

- CLTV of 95%.

Disadvantages

- Limited eligibility for Navy members and family;

- Minimum draw amount of $10,000;

- The payback term is limited to 20 years.

What credit score is required for the application?

If you meet the eligibility requirements and have a credit score of 680 or higher, then you might be able to be approved.

However, they review other factors when analyzing your application to the Navy Federal HELOC. So, it depends on each process.

How does the application process work?

A Navy Federal HELOC isn’t for everyone to apply for. Military members and their families are part of the select group.

Do you want to know who else is eligible for this home equity line of credit? So keep reading!

Apply online

Before applying for a HELOC with Navy Federal, it’s important to understand the timeline for the process.

Generally, it takes between 35 and 45 days to close the deal after you receive your application.

It varies according to documentation and appraisal.

Requirements

To apply for a HELOC with Navy Federal, you’ll need to gather certain information beforehand, such as:

- The estimated value of your property;

- Navy Federal savings or checking account number;

- Gross monthly income;

- Tax and insurance information, lien information;

- The original purchase price and date of your property;

- Additionally, you’ll need to know the date your home was built.

Application Submission

All set? Then complete and submit the HELOC application online through Navy Federal’s website.

Then be sure to fill out all required fields accurately and completely to avoid delays or complications in the approval process.

Documentation

Next, Navy Federal may request additional documentation to verify your income, employment, or other financial information, such as pay stubs, tax returns, etc.

Approval and Closing

If your application is approved, you’ll receive detailed information on the terms and conditions of the loan.

You’ll then need to close on the loan by signing the agreement and paying any closing costs associated with the loan.

Once the loan is closed, you can access your funds.

Apply on the app

Indeed, applications on the app aren’t available. So try their phone, or visit their website.

Navy Federal HELOC vs. PNC HELOC: which one is the best for you?

If you meet their requirements, PNC will approve your loan application and allow you to borrow a minimum of $100,00.

However, Navy Federal is exclusively for military members and their families; thus, you can only borrow $10,000.

So it’s important to compare the two options and choose the one that best suits your needs.

| Navy Federal HELOC | PNC HELOC | |

| APR | Starting from 8.500%; | Current Prime Rate: 8,25%; |

| Loan Purpose | Debt consolidation, home renovation, and repairs, life events, large purchases; | Debt consolidation, home renovation, mortgage refinance, large purchases; |

| Loan Amounts | $10,000 – $500,000; | $100 and up; |

| Credit Needed | 680; | 680; |

| Terms | 20 years drawing period, followed by 20 years of repayment; | 5–30 years ( except for Tennessee, where it ranges from 5-20 years); |

| Origination Fee | N/A. | N/A. |

Further, discover how to apply for the PNC HELOC- we’ve broken down all pieces of the application, one step at a time to ensure you don’t have any questions.

So keep reading and learn more!

Apply for the PNC HELOC

Here's our detailed explanation of how to apply for the PNC HELOC in just a few minutes- all stages covered. Read on!

Trending Topics

Destiny Card or Revvi Card: find the best choice!

Unsure if you should get a Destiny or Revvi card? Check out this comparison to see which one comes out on top for your financial needs!

Keep Reading

NetCredit Personal Loans review: is it worth it?

Read our full NetCredit Personal Loans review and find out what this lender is all about! Any type of credit is accepted! Keep reading!

Keep Reading

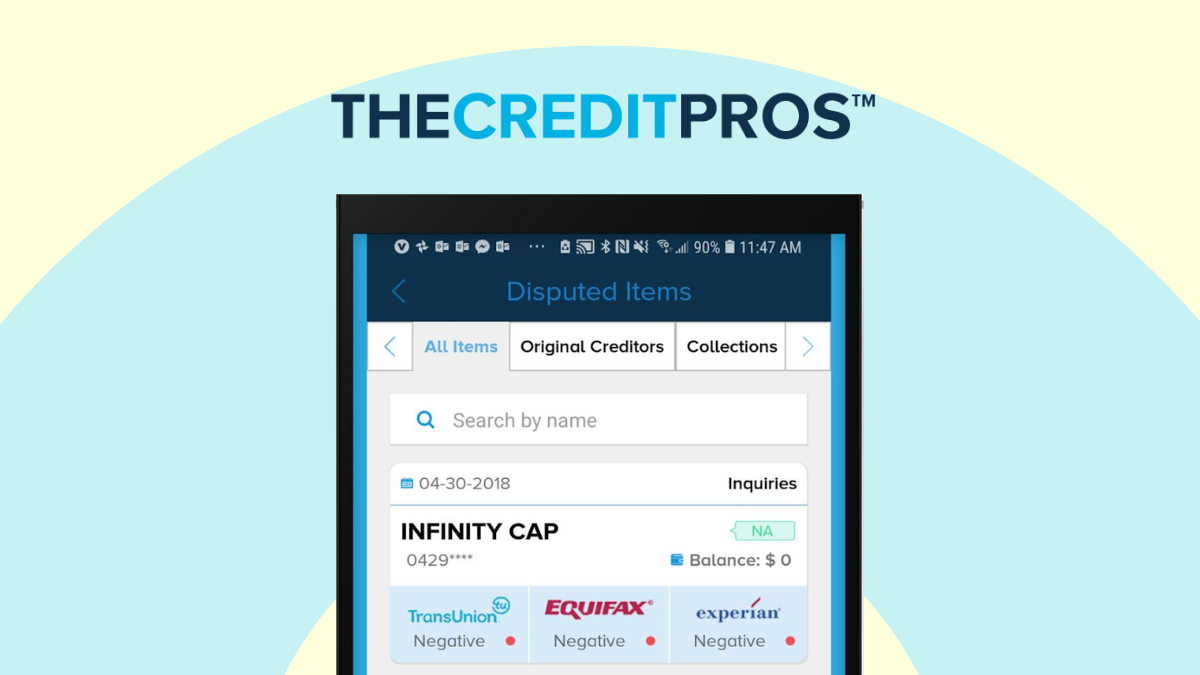

The Credit Pros review: become debt-free!

The Credit Pros deserves this review because it is one of the best credit repair companies in the US. Read to learn how it works.

Keep ReadingYou may also like

Best student credit cards of 2022: 7 great options

Choosing among the best student credit cards is not easy. Discover the best options for 2022 and decide which one will be yours.

Keep Reading

Surge® Platinum Mastercard® Review: Strengthen Your Finances

Check our Surge® Platinum Mastercard® review to learn how you can boost your credit score with a $1,000 initial credit limit.

Keep Reading

5 Credit Cards for Fair Credit: Best Options for You!

Looking to improve your FICO score or rebuild your credit? Here are 5 great options of credit cards for fair credit.

Keep Reading