Reviews

Oportun® Visa® Credit Card Review

If you're looking for a card that accepts fair credit and has good fees, read our Oportun® Visa® Credit Card review to learn more!

Advertisement

Oportun® Visa® Credit Card: Pre-qualify even with a limited credit history!

If you are looking for a credit card but have a limited credit history, then our Oportun® Visa® Credit Card review is definitely worth checking out.

Applying for the Oportun® Visa® Credit Card

If you are considering applying for an Oportun® card, here's some valuable information to guide you. We'll walk you through their process.

This is because it is possible for you to prequalify, in Oportun’s own words, within minutes. And no credit history will be asked of you.

- Credit Score: Fair – Good.

- Annual Fee: $0 – $49.

- Regular APR: 24.90% to 29.90% variable.

- Welcome Bonus: None.

- Rewards: None.

How does the Oportun® Visa® Credit Card work?

The Oportun® Visa® Credit Card is simpler than traditional credit cards. With it, paying your bills online is as easy as logging in to your account and making one-time or recurring payments.

You can have the product of your choosing: checking or savings accounts, debit cards, and Oportun also allow you to apply for personal loans.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Oportun® Visa® Credit Card pros and cons

This credit card offers many benefits but can also have some downsides. So, read our list of pros and cons below!

Pros

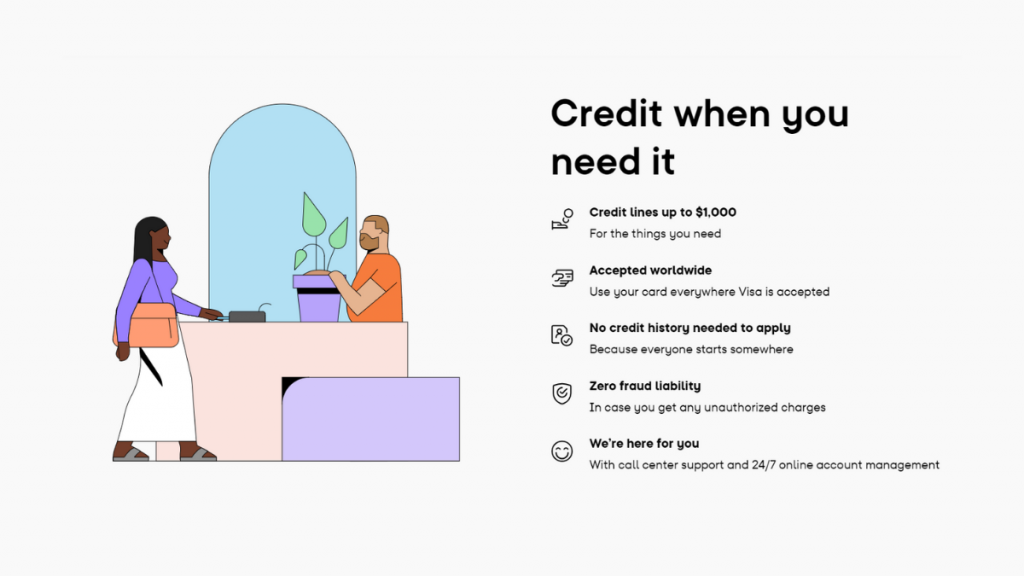

This credit card has many pros that you should pay attention to. They range from credit lines of up to US$ 1,000 to zero fraud liabilities.

All these, in addition to providing 24/7 online account management while you make your daily purchases at grocery and gasoline stores domestically and worldwide.

Cons

Although this Oportun credit card’s benefits make this product a winner, there are a few cons you must consider, depending on how you want to use your new credit card.

Despite the news that there is an Oportun® Cash Back Visa® Credit Card on the way, there are still no signs of rewards or bonuses for their credit holders.

Lastly, this card has a high regular APR compared to other credit products.

Does my credit score need to be good?

This is the most important section of this Oportun® Visa® Credit Card review. Because the answer is no, it does not need to be good.

However, it is important that you understand that they do run both a soft and a hard credit pull. So, you need to be sure that you understand this concept.

Briefly explained, although you can be qualified for this card with a poor or fair credit score, their credit pull may be able to affect your score.

But do not be upset. Because Oportun monthly reports your account behavior to credit bureaus around the country, they have the power to help you build a good credit history.

Want to apply for the Oportun® Visa® Credit Card?

If, after reading this Oportun® Visa® Credit Card review, you feel like you are willing to apply for it, we recommend that you go and read our how-to-apply article on this credit card.

Applying for the Oportun® Visa® Credit Card

If you are considering applying for an Oportun® card, here's some valuable information to guide you. We'll walk you through their process.

Trending Topics

How to save money on groceries during inflation

Inflation can have a serious impact on your finances if you're not prepared. Learn some tips on how to save money during these times.

Keep Reading

Should you invest in dividend-paying stocks?

Are dividend-paying stocks right for you? Here's what you need to know about this tried and true stock market strategy. Read on for more.

Keep Reading

Applying for the Sable Account: learn how!

This is a quick step-by-step guide with all the information you need to open your Sable Account today in just a few minutes!

Keep ReadingYou may also like

Achieve your full potential: Navy Federal HELOC review

Dive into our review of the Navy Federal Credit Union HELOC and get all the facts to decide how to use your home equity - up to $500K!

Keep Reading

PenFed Platinum Rewards Visa Signature® Card full review

Looking for a rewards credit card? Read our PenFed Platinum Rewards Visa Signature® Card review to see if it's the right card for you.

Keep Reading

Fortiva® Credit Card full review

Need to rebuild credit and catch up on finances? Then check out this Fortiva® Credit Card review that will help you!

Keep Reading