Credit Cards

Petal® 2 Visa® Credit Card Review

Are you looking for a card with cashback and no fees? If so, read our Petal® 2 Visa® Credit Card review to learn more!

Advertisement

Build up your score and earn cash back!

Are you looking for a credit card with cashback and no fees? If so, this Petal® 2 Visa® Credit Card review may perfectly fit you.

With incredible credit-building features and a standout commitment to its users, this financial solution is ready to surprise you in the best way.

This card offers up to 1.5% cash back and has no annual fee. Read on to learn more about the Petal credit card and whether it is the right choice.

- Credit Score: Fair – Good;

- Annual Fee: $0;

- Regular APR: 28.99% – 30.99% variable;

- Welcome bonus: N/A;

- Rewards: 1%–1.5% cashback on eligible everyday purchases. Plus, up to 10% on selected merchants.

How does the Petal® 2 Visa® Credit Card work?

Designed with your success in mind, Petal 2 is their most sophisticated card to date. It has no fees and is intended to help you build credit.

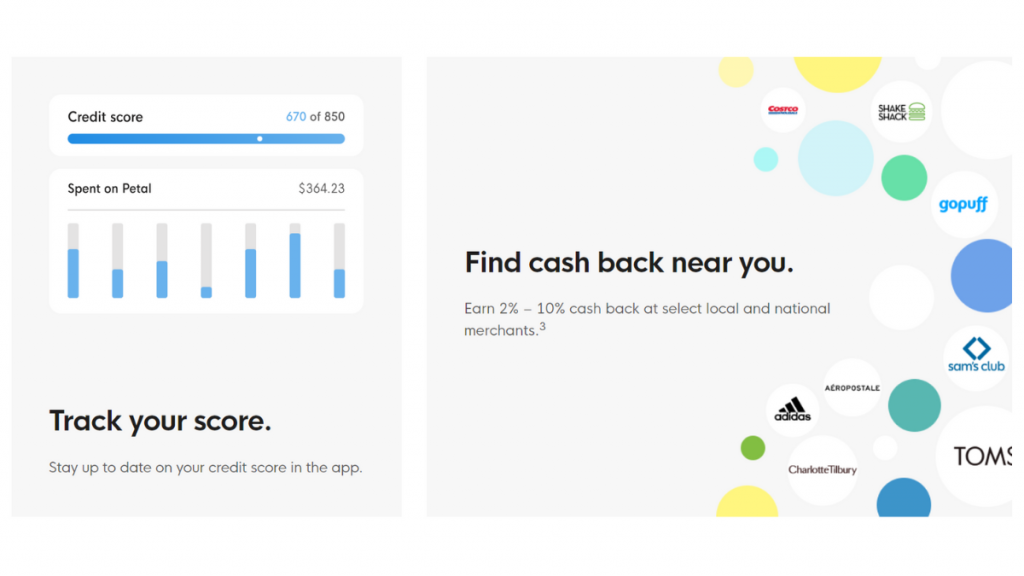

With Petal, credit building is made simple. After all, your credit score is critical, right? You can check your score anytime via their app.

A payment calculator is also available: Determine how much interest you will most likely owe based on the amount you choose to pay.

We recommend it because it allows people to plan their month, create a budget, and track how much they spend against it.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Petal® 2 Visa® Credit Card pros and cons

The Petal® 2 card is ideal for individuals looking to build or improve their credit score while enjoying meaningful perks like cash back rewards.

When you shop at select local merchants, you can earn anywhere from 2% to 10% cashback. Petal 2 also allows you to earn cash back on everyday purchases.

Another fantastic feature is the subscription option. Petal automatically highlights popular subscriptions charged to your credit card for your convenience.

So, check out the pros and cons of this card below!

Pros

- No Fees: Say goodbye to annual fees, late payment fees, or foreign transaction fees.

- Cash Back Rewards: Earn up to 1.5% cash back after making 12 on-time monthly payments. Eligible purchases earn 1% cash back initially.

- Extra Rewards: Enjoy up to 10% cash back at select merchants.

- Credit Building: Reports to all three major credit bureaus, helping you establish or boost your credit score.

- Cash Score System: Offers opportunities for individuals with limited or no credit history to qualify based on financial habits.

Cons

- No Welcome Bonus: While many competitors offer sign-up bonuses, the Petal® 2 card does not.

- No Introductory APR: No 0% introductory APR offers on purchases or balance transfers.

- Limited Cash Back Structure: Higher cash back rates are only available after consistent on-time payments or with select merchants.

Want to apply for the Petal® 2 Visa® Credit Card?

Getting the Petal® 2 Visa® Credit Card is a simple process, but understanding the qualifications and steps to apply is essential. Let’s explore how you can secure this financial tool.

Does my credit score need to be good?

Yes. Those with poor credit should not apply for the Petal® 2 Visa® Credit Card.

The best candidates have either established credit or are credit novices with strong cash flow (income, savings, and on-time payment history) that can be measured with banking data.

Qualification Requirements

To apply for the Petal® 2 Visa® Credit Card, you’ll need to meet a few essential criteria:

- Age and Residency: Must be at least 18 years old (19 in some states) and a U.S. resident with a valid Social Security Number or ITIN.

- Credit History: While a traditional credit score helps, Petal® 2 can use your financial history to evaluate eligibility through its Cash Score system.

- Income Verification: Proof of a stable income source is required to assess your ability to repay.

- Bank Account: Connecting your bank account may improve your chances of approval by providing insight into your financial habits.

Apply online

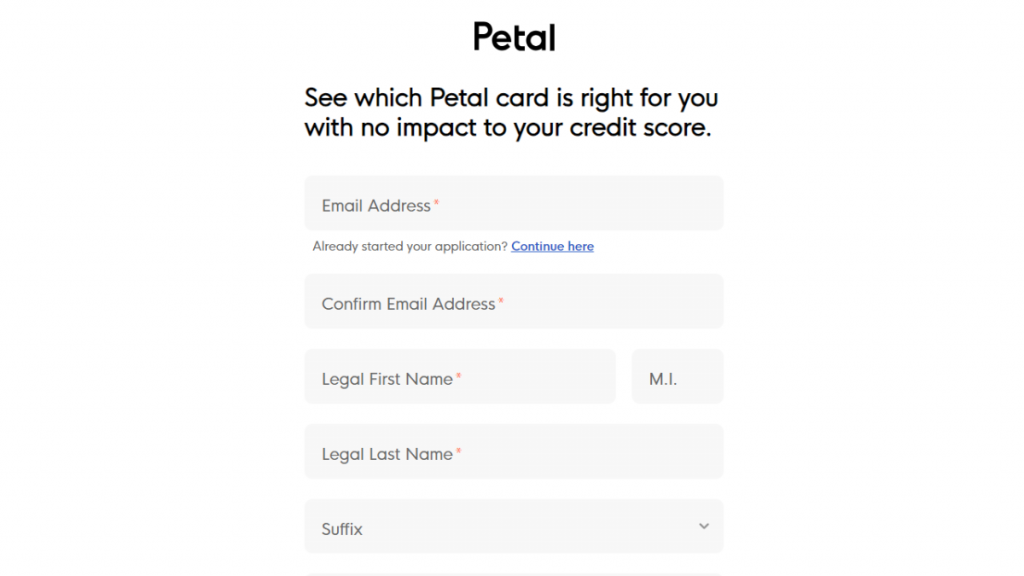

To apply for the Petal® 2 Visa® Credit Card, you must fill out an online form on Petal’s website with your personal information. Follow the guide below:

- Visit the Official Website: Go to the Petal 2 card official website, we’ve provided the link for you.

- Pre-Approval Check: Start with the pre-approval process, which won’t impact your credit score.

- Submit Your Application: Provide personal information such as your name, address, Social Security Number, and income details.

- Link Your Bank Account (Optional): Petal allows you to link your bank account to demonstrate financial habits, potentially increasing approval chances.

- Await Approval: You’ll typically receive a decision within minutes. If approved, your card will be mailed to you.

Apply using the app

If you are one of those people who do everything through your mobile phone, there is not much information about applying via their app, but it is surely possible.

After all, Petal is about reimagining credit, and it knows that the new reality is based on technology.

So, your new card will work with Apple Pay® or Google Pay™. Just tap and go. Also, you can easily manage your card through the app, so don’t hesitate to use it!

Petal® 2 Visa® Credit Card vs. Upgrade Triple Cash Rewards Visa®

Shall we compare to see if the Petal® 2 Visa® Credit Card is worth it? For starters, both cards below have similar score requirements.

Moreover, both have annual fees totaling zero, although the competition’s variable regular APR is more likely to be lower.

But Petal also has another credit card option, and on their website, you can compare which one you prefer without impacting your credit score just to check options out.

Petal® 2 Visa® Credit Card

- Credit Score: Fair – Good;

- Annual Fee: $0;

- Regular APR: 28.99% – 30.99% variable;

- Welcome bonus: N/A;

- Rewards: 1%–1.5% cashback on eligible purchases.

Upgrade Triple Cash Rewards Visa®

- Credit Score: Fair – Excellent;

- Annual Fee: $0;

- Regular APR: 14.99% – 29.99% variable;

- Welcome bonus: $200 bonus when you open a rewards checking account and perform three debit card transactions;

- Rewards: 1%–3% cashback, depending on purchase categories.

If the Upgrade Triple Cash Rewards is the best option, read our post below to learn how to apply for it!

Upgrade Triple Cash Rewards Visa® Review

Are you looking for a credit card with low costs and high rewards? Stop looking and check the Upgrade Triple Cash Rewards Visa® Credit Card benefits on this review.

Trending Topics

Get up to $500K quickly: Apply for PenFed HELOC

Learn how to apply for a PenFed HELOC now - get the money you need quickly and use it for several purposes! Keep reading and learn more!

Keep Reading

Companies are resorting to robots as a response to labor shortages

Labor shortages caused the orders for workplace robots to rise over 40% during the first quarter in the United States. Read on for more!

Keep Reading

The USDD stablecoin has fallen below its dollar peg

Concerns over stability of the USDD stablecoin, meant to always be worth $1, have led to fears of a repeat of the TerraUST saga.

Keep ReadingYou may also like

Great news! Based on your selection, we’ve listed the best cards for you below

Explore the top credit cards tailored to your score! Navigate your choices and pick the right card for your financial health and lifestyle!

Keep Reading

Loan while in a consumer proposal: is it possible?

Are you wondering whether or not you can get a loan in a consumer proposal? The answer may surprise you! Read on and learn more.

Keep Reading

Choose a credit card to build credit and improve your finances

Having a good credit score is critical to good business. See how choosing a credit card to build credit can be important!

Keep Reading