Great, I've just found the perfect credit card for you!

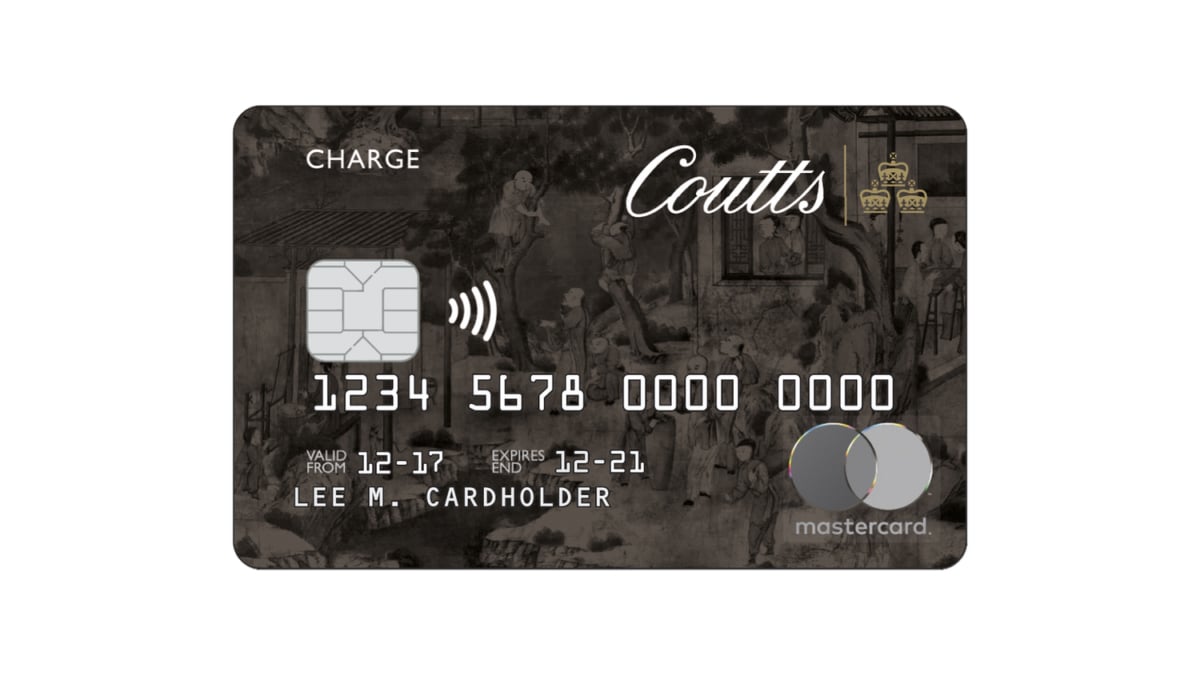

Coutts World Silk, the ultimate credit card for luxury-seekers.

Advertisement

If you’re looking for a prestigious and exclusive credit card, then look no further – Coutts World Silk is perfect for you. With its excellent rewards scheme and wide range of benefits, this card really does have it all!

See below some of the Coutts World Silk credit card’s main advantages and what they can do for you!

You will remain in the same website

Coutts World Silk surpasses other cards with its zero foreign transaction fees, comprehensive travel insurance including trip cancellation and baggage loss, access to airport lounges worldwide, and a rewards program redeemable for travel, merchandise, and more.

Yes, Coutts Bank is primarily focused on serving high-net-worth individuals. While they welcome clients with diverse financial backgrounds and aspirations, their core offering is tailored to managing existing wealth and facilitating its growth through personalized private banking solutions and bespoke investment strategies.

Compared to other travel credit cards, Coutts World Silk offers wider coverage for medical expenses, emergency evacuation, and travel disruptions, along with a dedicated 24/7 assistance hotline for seamless travel support.

Yes, unfortunately, they do. But don’t worry. You have five years to accumulate and redeem your Coutts Crowns points.

Trending Topics

Applying for the Buy on Trust Account: learn how!

With a minimum monthly income of $1000 in your checking account, you can get up to $5000 in credit limits with a Buy On Trust Account!

Keep Reading

Capital One Venture Rewards Credit Card Review

If you love traveling the world, you will love the Capital One Venture Rewards Credit Card. Read this review to learn about its benefits.

Keep Reading

Apply for the Avant Credit Card: It’s only a few minutes

Apply for the Avant Credit Card effortlessly in just a few minutes. Discover the simplified application process!

Keep ReadingYou may also like

Apply for Raising Cane’s Job Vacancies: Life insurance

No experience? No problem! This guide shows how to apply for job vacancies at Raising Cane's. Keep reading!

Keep Reading

Netflix announces layoffs of 150 employees

As the streaming giant continues to face increased competition, Netflix is cutting an estimated 150 staffers in its latest round of layoffs.

Keep Reading

Applying for the IHG® Rewards Traveler Credit Card: learn how!

IHG® Rewards Traveler Credit Card offers several benefits for travelers. Pay no annual fee and earn points on every dollar spent! Read on!

Keep Reading