Account

Applying for the Buy on Trust Account: learn how!

Have you been looking for a place to get quality electronics but don't have the best credit? Buy On Trust can help! They offer lease-to-own plans so you can get the product you want today.

Advertisement

Buy on Trust Account application: Buy now, pay later with Buy On Trust.

Lease-to-own programs are a great alternative for people who want to upgrade their electronic devices but can’t afford to pay them outright. The Buy On Trust Account offers that possibility for customers with all types of credit history. That means you can get a credit line even if your score is less-than-perfect.

The fast, online pre-qualification process provides up to $5000 in credit for all kinds of electronics from top-shelf brands like Apple and Samsung. You need to have a checking account opened for more than 3 months, no overdraft or negative balance, and a monthly income of at least $1000 to qualify for a Buy on Trust account.

Best Buy fulfills all purchases from the company, and you can schedule same-day pick-up once you’ve finished shopping. Buy On Trust requires a $50 fee at the online check-out cart. You can choose a 12-month payment plan to fit around your paycheck.

Once you’ve finished all installments, you can choose whether or not you want to own the products you’ve got and buy your lease. Easy, right? Keep reading if you want to learn how to apply for a Buy on Trust Account!

Apply Online

For an online application, you need to access the Buy On Trust official website first. Then, select the “click here to get pre-qualified” button. You’ll be directed to fill in an online form with your personal information right after.

To have a Buy On Trust account, you’ll need to inform the company of your identification and contact details. You’ll also need to show proof of a checking account to your name.

After submitting your information, the company requires you to confirm your cell phone number and write down your social security number. Then you’ll get a text message with a confirmation link to the account.

Before approving your request, buy On Trust might ask you to show proof of your monthly income and other financial data. Should everything check out, they will contact you via e-mail or phone with more details about your new credit line.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Buy on Trust Account vs. One Finance Hybrid account

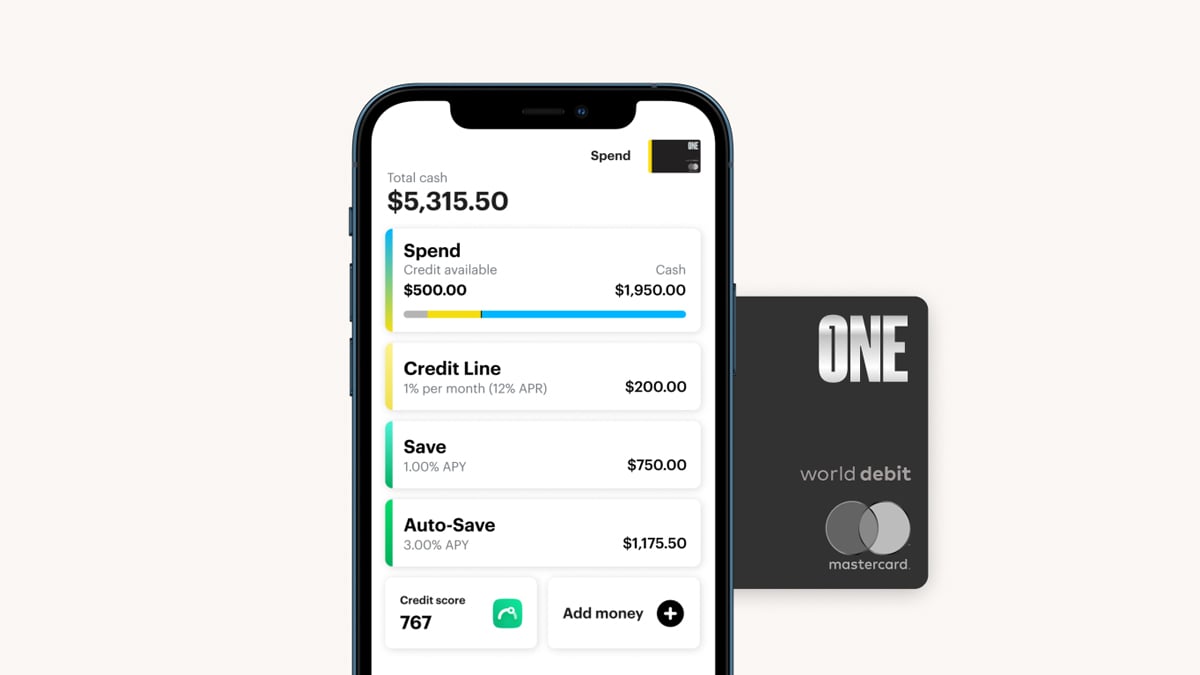

The Buy On Trust Account is an excellent option for customers looking for a lease-to-own program. But maybe what you’re looking for is an online banking solution with a credit line to help you with different needs.

If so, meet the One Finance Account! This free-for-all app is easy to use and has all the best features of a regular bank account. If you’re interested in checking its perks and benefits, check the link below for the application process!

| One Finance Account | Buy On Trust Account | |

| Intro Balance Transfer APR | N/A | N/A |

| Regular Balance Transfer APR | None | None |

| Balance Transfer Fee | Does not apply | Does not apply |

How to apply for a One Finance Account?

See the easy step-by-step guide on how to apply for a One Finance Account!

Trending Topics

Chase Freedom® Student credit card full review

Want a card to build credit? Discover the Chase Freedom® Student credit card and the rewards it offers in this review!

Keep Reading

Venmo Mastercard Debit Card full review

Love using Venmo to pay friends back? You can use it to make purchases too! Read our full review of the new Venmo Mastercard Debit Card.

Keep Reading

Affordable loans: Apply for Republic Bank Loans

Need funding for your next big expense? Learn how to apply for Republic Bank Loans with our comprehensive guide.

Keep ReadingYou may also like

8 best credit cards for excellent credit

Credit card with rewards is all good! Discover the 8 best credit cards for excellent credit, and choose yours today!

Keep Reading

Extra debit card full review

Your debit card can be better. This review will show the benefits of using Extra debit card to spend your money in a better way.

Keep Reading

Applying for the Merrick Bank Double Your Line Secured Visa credit card: learn how!

The Merrick Bank Double Your Line Secured Visa credit card is an excellent choice if you need to improve credit and double your limit quickly.

Keep Reading