Great, I've just found the perfect credit card for you!

Luxury Titanium, perfect card for luxury lovers.

Advertisement

If you’re looking for a high-end card with great rewards and premium benefits, then the Luxury Titanium credit card is designed for you. From earning points on everyday purchases to enjoying exclusive traveling experiences, this card is the perfect choice for those who want to get the most out of life.

If you’re looking for a high-end card with great rewards and premium benefits, then the Luxury Titanium credit card is designed for you. From earning points on everyday purchases to enjoying exclusive traveling experiences, this card is the perfect choice for those who want to get the most out of life.

You will remain in the same website

See below for some of this card’s most exciting features and how they can take your lifestyle to the next level!

Yes, you can manage your Luxury Titanium card account online by visiting the issuer’s website, where you can log in, view your account details, and perform various account management tasks. Additionally, you can get the mobile app that allow you to manage your account on your smartphone or tablet. These apps provide similar features to the website, giving you the flexibility to handle your account on the go.

Yes, the Luxury Titanium cards come with enhanced security features such as EMV chips, contactless payment options, advanced fraud monitoring, and zero liability protection.

Yes, you can use a travel credit card for everyday purchases. Travel credit cards are versatile and can be used for a wide range of transactions, including everyday expenses like groceries, dining, gas, shopping, and more. In fact, many travel credit cards also offer rewards and benefits for these everyday spending categories, not just for travel-related expenses.

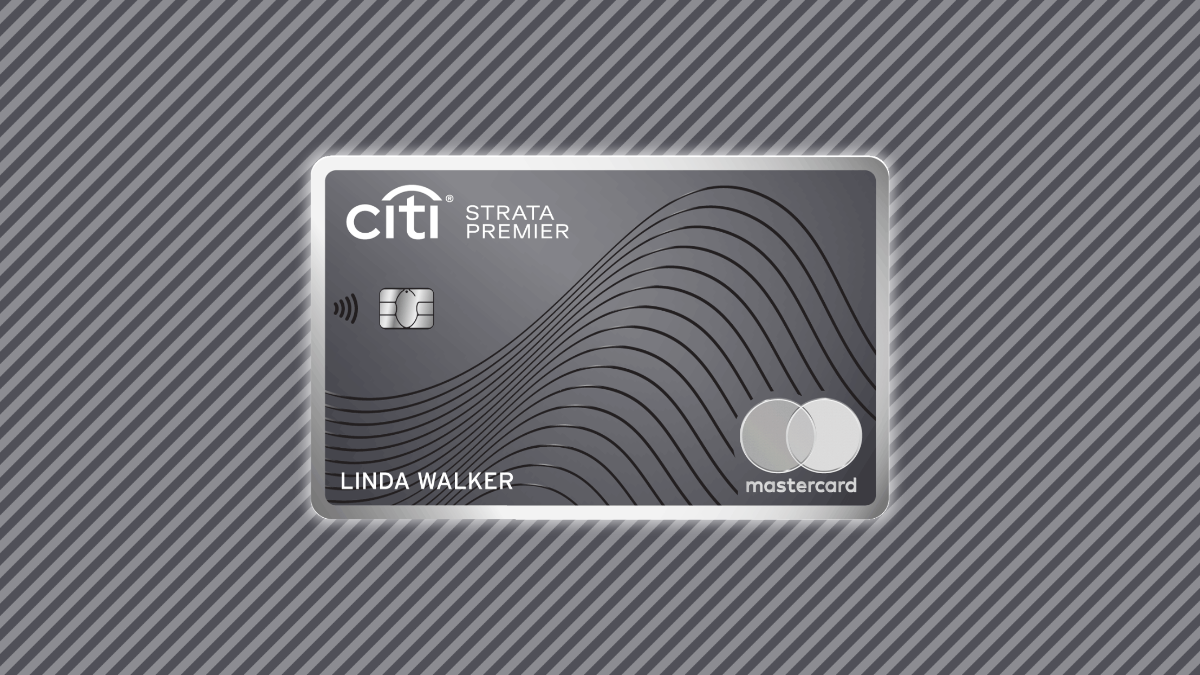

Citi Strata Premier℠ Card Review

The Citi Strata Premier℠ Card has everything a smart traveler could ask for. It gives you reward points with everyday purchases to turn into air tickets or cashback.

Trending Topics

Regions Prestige Visa® Signature Credit Card full review

Check out our full review of the Regions Prestige Visa® Signature Credit Card. Earn points on every purchase and pay $0 annual fee!

Keep Reading

Spotify is testing the display of artists’ NFT galleries

Some users on Android are seeing a new feature from Spotify that allows artists to showcase their non-fungible token collections.

Keep Reading

Chase Freedom Flex® Credit Card Review

In this Chase Freedom Flex® Credit Card review, we'll look at the features of this cash-back powerhouse product. Keep reading to see more!

Keep ReadingYou may also like

Upgrade Rewards Checking Account Review

Want to have the best checking account in town? Don't miss out on our Upgrade Rewards Checking Account review to learn more!

Keep Reading

Savings vs. Checking Accounts: A Comprehensive Comparison

Savings vs. checking accounts: Discover their contrasts and similarities to identify the right one. Learn more!

Keep Reading

The Robinhood Investing brokerage platform full review

The Robinhood Investing brokerage platform was designed for inexperienced investors to start building their portfolios fast and easy.

Keep Reading