Credit Cards

Capital One Savor Rewards Credit Card Review

The Capital One Savor Rewards Credit Card will give you cash back and charge you no annual fee. The bonus categories are handy. Read this review to learn about this card.

Advertisement

Get cash back to enjoy dinner and entertainment events

Having a Capital One Savor Rewards credit card is a great deal if you like to eat good food and watch excellent movies. And who doesn’t like it?

Capital One is growing its cards portfolio and becoming a tough competitor to other credit card issuers. This card stands among the best credit cards regarding cost benefits.

Disclaimer: This credit card used to be called Capital One SavorOne Cash Rewards Credit Card.

It has everything to be an excellent card: unlimited cash back rewards, a generous welcome bonus, and no annual fee.

If these features interest you, dive into this review to learn about its benefits and determine if this card is for you.

- Credit Score: Excellent

- Annual Fee: Does not charge an annual fee

- Regular APR: 0% for the first 15 months, then a variable 19.24% – 29.24%

- Welcome bonus: Spend $500 within the first 3 months to earn $200

- Rewards: 1% cash back on everything, 3% cash back on selected categories, like dining and entertainment, and 5% on hotels and rental cars booked through Capital One Travel.

How does Capital One Savor Rewards credit card work?

Capital One Savor Rewards is outstanding in every aspect. It’s hard to find a con among its pros. A card with valuable benefits that charges a $0 annual fee and offers 0% APR for 15 months.

The rewards program suits almost everyone. After all, it’s hard to find someone who doesn’t like to eat and watch good movies and shows.

These are its bonus categories. But even when you’re not buying groceries, dining, or paying for entertainment, you still earn 1% cash back.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Capital One Savor Rewards Credit card pros and cons

This card has so many benefits that you’ll be amazed and probably desire one for yourself. See the pros and cons of the Capital One Savor Rewards credit card next.

Pros

- Excellent bonus categories in the rewards program. Grocery stores, restaurants, popular streaming services, and entertainment events will give you 3% cash back.

- Enjoy 5% cash back on hotels and rental cars booked through Capital One Travel.

- Unlimited cash back, with at least 1% on every purchase.

- The sign-up bonus is easy to get. All you have to do is spend $500 on the three first months to receive a $200 cash bonus.

- The 0% intro APR lasts for 15 months and makes this card an excellent choice for a credit card balance transfer.

- The annual fee is surprisingly $0. You’ll pay nothing to receive all these benefits, perks, and rewards.

- Also, you will pay no foreign transaction fees, so you can take your card abroad.

Cons

- Capital One requires a high credit score for this card.

Want to apply for Capital One Savor Rewards card?

Capital One Savor Rewards card is a champion for the best rewards credit cards. Finding a single flaw is hard, and almost every review gives it 5 stars.

If you doubt it, look at this card’s features. If you don’t like paying for your credit cards, you will love the $0 annual fee.

And if you enjoy having dinner with your family and friends or attending the best cultural events, you will love the 3% bonus cash back.

Also, if you like doing these things, and traveling around the world, enjoy the 0% foreign transaction fee.

As you can see, this card is worth it. Keep reading to see how the application process works and the eligibility requirements.

Does my credit score need to be good?

Short answer: yes. This Capital One has a demanding eligibility requirement for new cardholders to apply for it, and to have one, you should have an excellent credit score.

Requirements

Here are the requirements to apply for the Capital One Savor Rewards Credit Card:

- Age: At least 18 (or legal age in your state).

- Residency: A valid U.S. physical address is required.

- Identification: A Social Security Number (SSN) or ITIN.

- Credit Score: Designed for good to excellent credit (FICO 670+).

- Income: Proof of steady income is needed.

- Credit History: Demonstrates responsible credit use (e.g., on-time payments).

Apply online

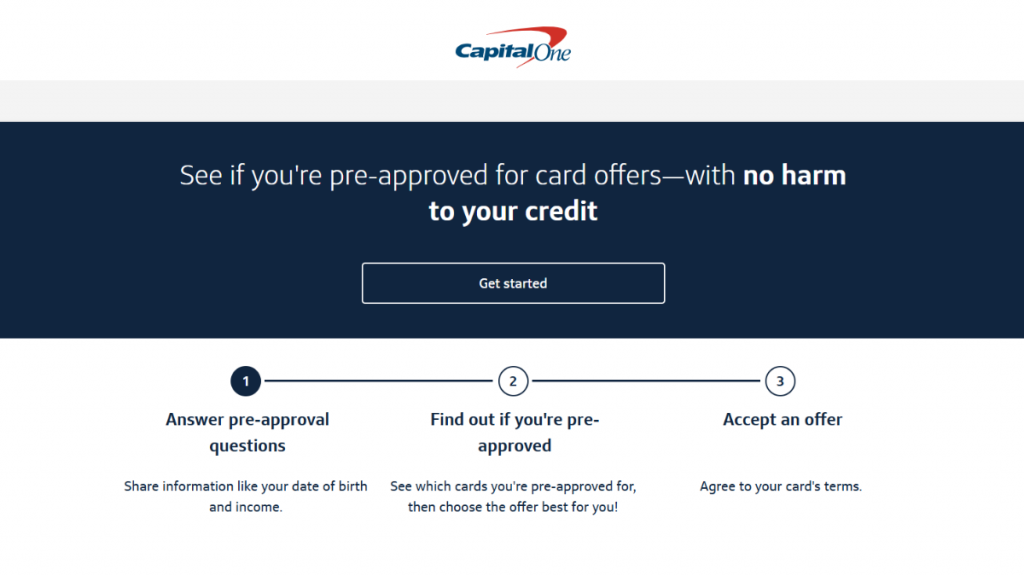

The internet has its pros and cons. One of the good things about the internet is how much it has streamlined bureaucratic processes such as applying for a new credit card.

You can try it if you have a good or excellent credit score.

Access the Capital One website, look for the Savor Rewards, and hit the “apply now” button. You can check the card details and read important disclosures about it.

There will be a small form to fill out. Inform your full name, date of birth, and SSN. Once you submit it, you will receive an offer that you can accept or decline.

Apply using the app

Capital One mobile app will help you manage your account and control your expenses and rewards. You can download it to use all its features as soon as you get approved.

However, the application has to be done on the Capital One website.

Capital One Savor Rewards credit card vs. Capital One Venture Rewards card

If you’re looking for an excellent card, Capital One has many. The Capital One Savor Rewards is good for everyday expenses. If you prefer a travel card, look at the Venture Rewards.

Capital One Savor Rewards

- Credit Score: Excellent

- Annual Fee: Does not charge an annual fee

- Regular APR: 0% for the first 15 months, then a variable 19.24% – 29.24%

- Welcome bonus: Spend $500 within the first 3 months to earn $200

- Rewards: 1% cash back on everything, 3% cash back on selected categories, like dining and entertainment, and 5% on hotels and rental cars booked through Capital One Travel.

Capital One Venture Rewards

- Credit Score: Excellent

- Annual Fee: $95

- Regular APR: 19.99% – 29.49% variable, based on your creditworthiness

- Welcome bonus: 75,000 bonus miles after spending $4,000 on the first 3 months

- Rewards: 2 miles per dollar on every purchase; 5 miles per dollar on car rentals and hotels booked through Capital One Travel

Learn how to apply for the Capital One Venture Rewards and enjoy its travel benefits.

Capital One Venture Rewards Credit Card Review

This card has an excellent reputation in the market for giving great rewards to its cardholders. Consider applying for the Capital One Venture Rewards credit card.

Trending Topics

Make up to $20 per hourworking at Texas Roadhouse: see job vacancies

Receive weekly pay at Texas Roadhouse: browse job openings now, plus average salary. Medical coverage, paid vacation, and much more!

Keep Reading

What is an annual fee on a credit card?

Annual fee on a credit card is a common thing, but do they make sense? How can you get rid of them? When should you accept them?

Keep Reading

Applying for the Net First Platinum card: learn how!

With the Net First Platinum credit card you can shop at the Horizon Outlet website. Applying is simple and approval is fast. Come get yours!

Keep ReadingYou may also like

Housing Assistance: different programs to help you and your family

Unsure of where to turn for help with your housing situation? Learn everything you need to know about the different types of programs.

Keep Reading

What are the best and easiest to get Chase cards?

In this article you will find a selection of the best chase credit cards available, as well as the ones that are the easiest to get

Keep Reading

Unique Platinum credit card full review

The Unique Platinum credit card offers 0%, fast approval and no credit checks and- in spite of being a subprime credit card - rewards.

Keep Reading