Great, I've just found the perfect account for you!

One Finance Account, say goodbye to multiple bank accounts. Hello to One!

Advertisement

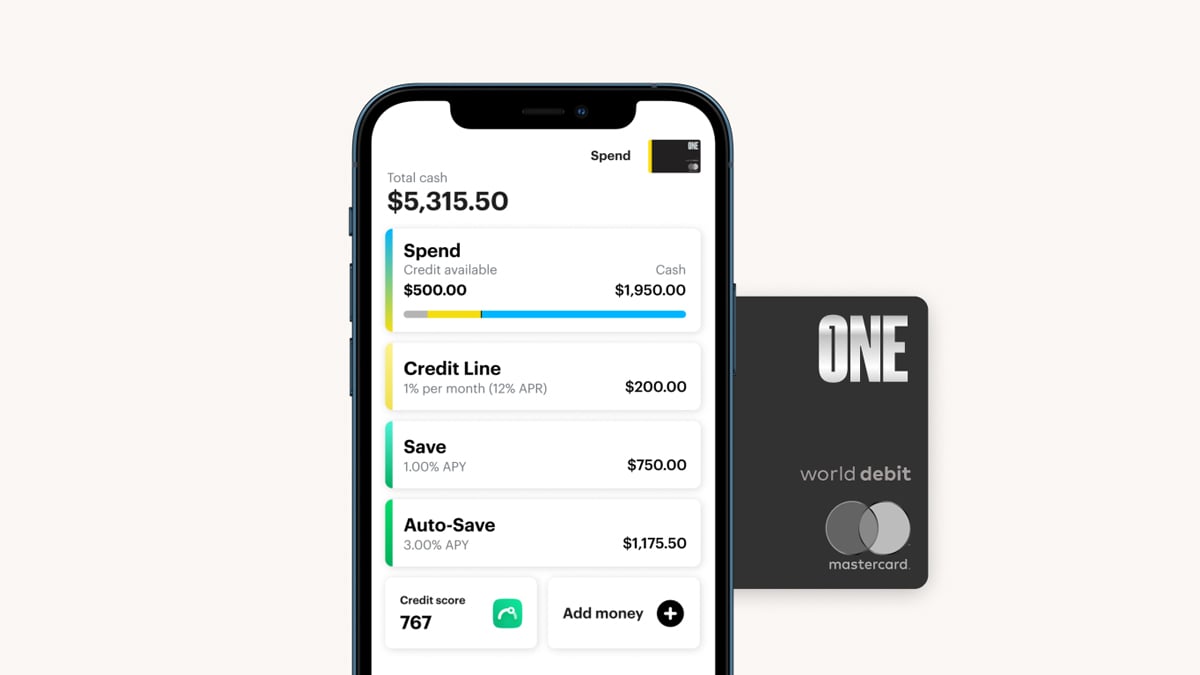

Are you looking for a smart way to manage your money? If so, then look no further than One Finance! This account offers a variety of features that can help you save money and stay organized. So if you’re looking for a trustworthy and easy-to-use application, be sure to check out our One Finance Hybrid Account review!

Are you looking for a smart way to manage your money? If so, then look no further than One Finance! This account offers a variety of features that can help you save money and stay organized. So if you’re looking for a trustworthy and easy-to-use application, be sure to check out our One Finance Hybrid Account review!

You will remain in the same website

See below for One Finance’s most attractive benefits and how it can help you shape a better financial future!

If you’re looking for the best way to manage your money, it is probably because you are a responsible person. So let’s give you a little more information so you know this account is worth your time of reading our full review:

Upsides and Advantages

- Earn a Competitive Interest Rate on Your Savings: Maximize your savings growth with a high-yield interest rate that surpasses the rates offered by many traditional banks. This means your money will work harder for you, accumulating more interest over time.

- Get Cash Back on Everyday Purchases: Enjoy a rewarding bonus on your everyday spending with a cash-back program that provides cashback on eligible purchases. This effectively reduces your expenses, putting more money back in your pocket.

- Eliminate Monthly Fees and ATM Charges: Free yourself from the burden of recurring fees that can erode your savings. One Finance eliminates monthly maintenance fees, ATM fees, and overdraft fees, allowing you to keep more of your hard-earned money.

- Automate Your Savings with Effortless Transfers: Set up automatic transfers from your checking account to your savings account, ensuring consistent and disciplined savings habits. You can customize the transfer amount and frequency to suit your financial goals.

Possible Drawbacks

- No Physical Branches for In-Person Banking: As an online bank, One Finance does not maintain physical branches. This may be a drawback for individuals who prefer the convenience of in-person banking services.

- Limited Customer Support: One Finance’s customer support primarily focuses on online chat and email interactions. This may pose a challenge for those who prefer phone support or face-to-face assistance.

- Account Availability Varies by State: One Finance’s services are not available to residents of all states. It’s important to check the One Finance website to determine if your state is eligible for account opening.

One Finance stands out by offering a compelling blend of the perks of traditional banks and the advantages of online banks. It combines the security and reliability of a traditional bank with the convenience and innovation of an online bank.

Thankfully, no! One Finance doesn’t impose any minimum balance requirements to earn interest on your savings or access its account features. You can start saving with as little as you want, and you’ll still enjoy the same competitive rates and perks.

Absolutely! One Finance’s mobile app is designed to put you in complete control of your finances. You can perform virtually all account management tasks from the app, including: Checking your balances and transaction history, transferring funds between your checking and savings accounts, paying bills electronically, and much more.

Trending Topics

An easy guide to combining finances as a couple

Planning to combine finances as a couple? Read what research shows about this, and what are the best methods for combining finances.

Keep Reading

OakStone Gold Secured Mastercard credit card full review

In this review, find out the benefits of the OakStone Gold Secured Mastercard, such as no credit checks, low APR, and more!

Keep Reading

Join the Carrabba’s Italian Grill Fam: Apply for a job!

Apply for a job at Carrabba's Italian Grill and start your career in the restaurant industry. Learn more here!

Keep ReadingYou may also like

Petal® 2 Visa® Credit Card Review

Check our Petal® 2 Visa® Credit Card review to learn how to boost your score and earn up to 10% cash back along the way!

Keep Reading

Aspire® Credit Card full review

Want to recover your credit score using a card? So learn more about the Aspire® Credit Card in this review and see if it works for you.

Keep Reading

Earned Income Tax Credit (EITC): eligibility and benefits

The Earned Income Tax Credit is a refundable tax credit for low or moderate-income workers. Learn more!

Keep Reading