Credit Cards

Reflex® Platinum Mastercard® Review

Finding card options when you don't have a good credit score can be difficult. Get to know the Reflex® Platinum Mastercard® and how it can help you!

Advertisement

Boost your score, no credit required!

If you’re looking for a credit card with a good starting limit to help you build credit, this Reflex® Platinum Mastercard® review is for you.

The Reflex® Platinum Mastercard® is an option with relatively high APR rates but accepts all credit scores.

In addition, it contributes to credit reconstruction to expand your negotiation possibilities. Keep reading!

- Credit Score: Fair/Poor/Bad/Limited;

- Annual Fee: $75 to $125, depending on your credit limit.

- Regular APR: 35.90% variable;

- Welcome bonus: N/A;

- Rewards: There are no rewards programs available at this time.

How does the Reflex® Platinum Mastercard® work?

The Reflex® Platinum Mastercard® is an excellent option for rebuilding credit. After all, it allows people with bad credit scores to apply.

Therefore, the creditor reports to the main credit agencies after the payment is made on time.

This credit card also offers a wide range of benefits, including Mastercard Zero Liability Protection, free credit score access monthly, and an initial credit limit of up to $1,000.

In addition, there are reasonable fees to give the creditor security that you will pay the installments. However, there is an associated annual fee, depending on the analysis.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Reflex Mastercard® pros and cons

Credit cards aimed at those who do not have a good credit score usually have high fees. This results from the creditor’s lack of confidence that you make timely payments.

However, these options, like the Reflex® Platinum Mastercard® in this review, allow credit rebuilding and can open doors. Check out the pros and cons this option can bring you.

Pros

- Get an initial credit limit up to $1,000;

- There is no minimum credit score to apply for;

- Ideal for those looking to rebuild their credit;

- Fraud protection program;

- Wide possibility of use in establishments that accept Mastercard;

- Monthly reports to the three major credit bureaus.

Cons

- Very high interest rates, with an APR that can reach 35.90%, and more monthly and annual fees;

- Requires the creation of an associated current account;

- The initial credit limit is considered low compared to agencies aimed at people with higher credit scores.

Want to apply for the Reflex® Platinum Mastercard®?

The Reflex® Platinum Mastercard® Card is an excellent option for rebuilding credit. It also has a good starting limit and is open to requests by people with any credit score.

If you know how to apply, you can increase your chances and have a higher starting limit. Check out how to apply online below!

Does my credit score need to be good?

As you can see in this Reflex® Platinum Mastercard® review, this credit card has a lot of possibilities. In this sense, it is open to all types of credit, including low credit scores.

That is, this may be the ideal option if you do not have a good credit score. After all, it allows a good initial limit and credit reconstruction without needing a good score.

Requirements

Here are the application requirements for the Reflex® Platinum Mastercard®:

- Age: Must be at least 18 (or the age of majority in your state).

- Residency: Must be a U.S. resident with a valid physical address.

- Social Security Number (SSN): Required for identity verification.

- Income: Demonstrate sufficient income to support credit card payments.

- Bank Account: An active checking account or debit card is required.

- Credit History: Suitable for individuals with less-than-perfect credit; pre-qualification is available without impacting your credit score.

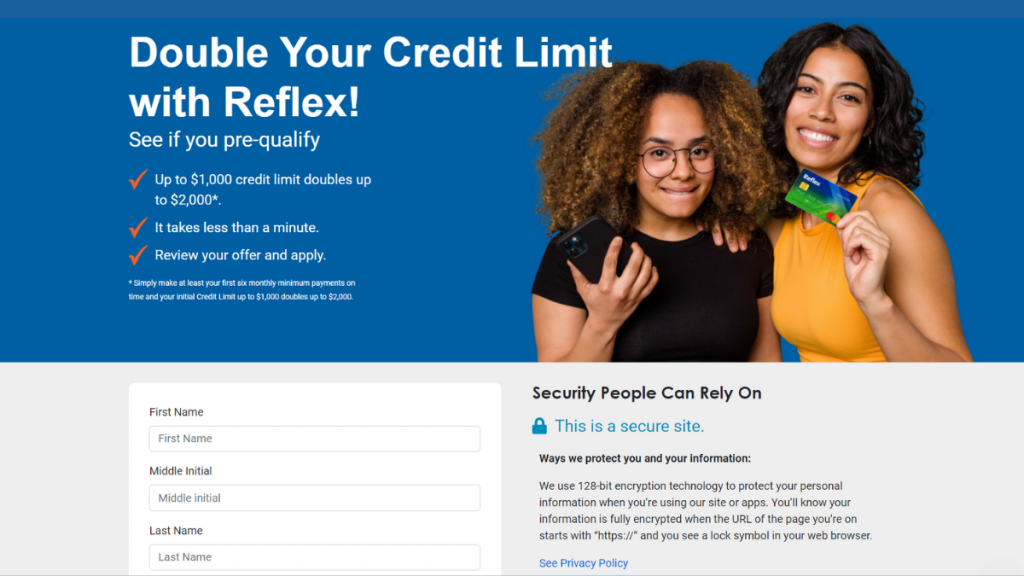

Apply online

Before considering applying for your Reflex® Platinum Mastercard® Card, it is important to consider whether you are eligible.

If you have the requirements, go ahead. Log in to the Reflex® Platinum Mastercard® official website using a computer or notebook with internet access.

Then, fill in the form with your personal and financial data and wait for your evaluation.

It is worth mentioning that the analysis can bring immediate results if there is no outstanding problem.

However, you can also be approved after a few days if there are any serious defaults.

Apply using the app

You can apply for the card through the official website by following the steps above. However, you can’t apply through the app.

But once you’re approved for the credit card, you can use the mobile app to manage your account anytime, anywhere.

Reflex® Platinum Mastercard® vs. FIT™ Platinum Mastercard®

As we have seen, the Reflex® Platinum Mastercard® Card is a great option for those with a bad credit score.

In addition, it carries reasonable APR rates and reports good usage to major credit bureaus. However, it is not the only option. You can also opt for the FIT™ Platinum Mastercard®.

After all, this credit card is ideal for rebuilding credit and does not require a good credit score. However, there is no initial bonus. Check out the comparison below.

Reflex® Platinum Mastercard®

- Credit Score: Fair/Poor/Bad/Limited;

- Annual Fee: $75 to $125, depending on your credit limit.

- Regular APR: 35.90% variable;

- Welcome bonus: N/A;

- Rewards: There are no rewards programs available at this time.

FIT™ Platinum Mastercard®

- Credit Score: Poor/Fair;

- Annual Fee: $99;

- Regular APR: 29.99% variable;

- Welcome bonus: N/A;

- Rewards: None.

And now, if you think the FIT™ Platinum Mastercard® will be a better option for you, check out our post below to learn about the application process!

FIT™ Platinum Mastercard® Review

If you're having trouble getting a credit card because of a poor credit score, check the FIT™ Platinum Mastercard® terms in this review.

Trending Topics

Types of personal loans: pros, cons and how to choose

Looking for a personal loan? Check out our guide to the different types of loans available, with pros and cons.

Keep Reading

What type of account is a cash management: the same as a bank account?

What type of account is a cash management account? In this article we cover the basics of this type of account, and whether it is for you.

Keep Reading

OakStone Gold Secured MastercardReview

In this review, find out the benefits of the OakStone Gold Secured Mastercard, such as no credit checks, low APR, and more!

Keep ReadingYou may also like

What is a debt consolidation loan?

A debt consolidation loan can help you pay off your debts faster and more easily. Find out what is a debt consolidation loan! Red on!

Keep Reading

Would a rise in corporate taxes help curb inflation?

Could a rise in corporate taxes help curb inflation? Learn more about how corporate taxes could impact prices and the economy as a whole.

Keep Reading

Learn how to Make Money with Online Trading

Learn how to make money with online trading and turn a small investment into big profits. Start earning money today!

Keep Reading