Reviews

Curadebt application: learn how to relieve your debt!

There is nothing fun about having debt, so let Curadebt help you find a way out of it. This article will show you how you can get your savings plan.

Advertisement

Curadebt relief: don’t worry, they have a plan for you.

Stop digging into your debt role and ask Curadebt for a helping hand. They are specialists in finding gaps where you can pay way less interest on your balance and get rid of debts the best way possible.

You can try to make this plan on your own. But Curadebt has a map, a strategy, and a personalized plan.

You’ll get a consultation with a debt counselor and a savings account to get ready for paying down all of your debts.

Apply online

Applying to Curadebt online is quick. However, as every case is a special case, you’ll need a personal consultation with one of their counselors to see how your program will work.

You can check if you qualify through their website. You can also leave your contact and debt info on their form to receive an e-mail or a call.

Or you can call them on 1-877-850-3328 to get a free consultation and a saving estimate, and complete your application to the program.

You’ll be asked for more personal and financial information once you agree with the plan to enter the program.

Remember that the success of the program depends on your effort. Curadebt can not solve your debt if you don’t compromise on the savings plan and put the money in your savings account.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Unfortunately, Curadebt does not offer any mobile app where you can apply or track your savings.

But you can log in to the client’s area on their website to check your account information.

Scroll down to the bottom of their home page to find the “current client logon” to click on.

Another recommendation: First Savings credit card

And while you build your way to a debt-free life, you can also plan your way to a better credit score. carrying a debt for too long can hurt your credit score, so you’ll need a credit building card too.

First Savings have the right credit card for you. You can apply with any credit score, even if it’s a bad one.

With a good strategy and responsible use, you can build your way up to an excellent score.

To get a second chance and rebuild your credit history, take a look at the First Savings credit card.

If you’d like to get more info about its benefits, please, read the following content.

First savings credit card full review

You can only get a credit card if you have a good credit score, right? Wrong! We'll show you how the First Savings credit card works.

Trending Topics

Mogo debit card review

Mogo debit card will give you rewards for a $0 annual fee. If you care about sustainability, you'll love this card. Keep reading to see why.

Keep Reading

TOP 10 benefits of investing in real estate: start today!

The benefits of investing in real estate are numerous. Here, we'll show you 10 reasons to start investing on it right away!

Keep Reading

NetCredit Personal Loans: how to apply now!

Do you need financial assistance? Learn how to apply now and get up to $10,000 with NetCredit Personal Loans. Start your application today!

Keep ReadingYou may also like

Total Select Visa Card full review

The Total Select Visa Card of this review is a great way to establish or rebuild your credit score. See why it's one of the best cards.

Keep Reading

Applying for the Mercury Credit Card: learn how!

Applying for the Mercury Credit Card may be the perfect option for you, if you want to build credit and enjoy low interest rates. Learn how!

Keep Reading

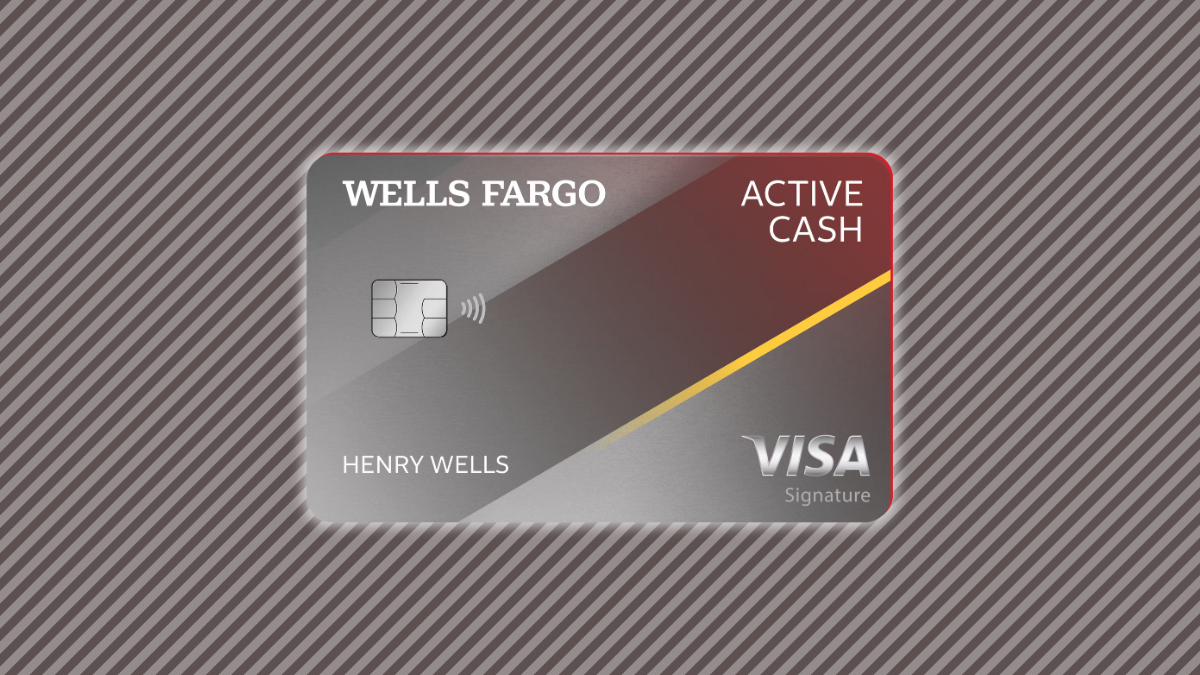

Apply for the Wells Fargo Active Cash® Credit Card: Learn how!

Wells Fargo Active Cash® Card allows you to earn a $200 cash rewards bonus when you spend $1,000 in the first 3 months. See how to apply!

Keep Reading