Loans

Get the Funds You Need with Ease: Republic Bank Loans review

With competitive APRs and flexible terms, find out if their loans are right for you. Discover all there is to know about Republic Bank Loans!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Discover an affordable way to borrow!

Are you in need of some extra funds? Whether it’s to cover unexpected expenses or make a major purchase, this Republic Bank Loans review can help.

Indeed, with their competitive APR starting and flexible loan amounts, they are a popular choice for many borrowers. So, read on and learn more about this lender.

| APR | Starting at 6.50%; |

| Loan Purpose | Various |

| Loan Amounts | A minimum of $1,000, up to a maximum limit that was not disclosed; |

| Credit Needed | Not Disclosed; |

| Terms | Up to 180 months; |

| Origination Fee | Not Disclosed; |

| Late Fee | Not disclosed; |

| Early Payoff Penalty | Not Disclosed; |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Republic Bank Loans overview

Republic Bank offers personal loans for a variety of purposes, including debt consolidation, home improvement, and unexpected expenses.

Thus, the loans are unsecured, meaning that you don’t need to provide any collateral to be approved.

Furthermore, the terms of the loans can range from 12 to 180 months, depending on the loan amount and your creditworthiness.

Also, one of the most appealing aspects of Republic Bank Loans is their competitive APR.

Additionally, Republic Bank does not disclose its origination fees, so it’s important to factor in any potential fees when considering the total cost of your loan.

Is it worth it to apply for Republic Bank Loans?

Whether or not it’s worth it to apply for a loan with Republic Bank Loans depends on your individual financial situation and needs.

Indeed, if you’re looking for a competitive APR and flexible loan terms, they can be a good option.

So, the decision of whether or not to apply for a loan with Republic Bank Loans is up to you and your unique financial circumstances. Further, check out the pros and cons.

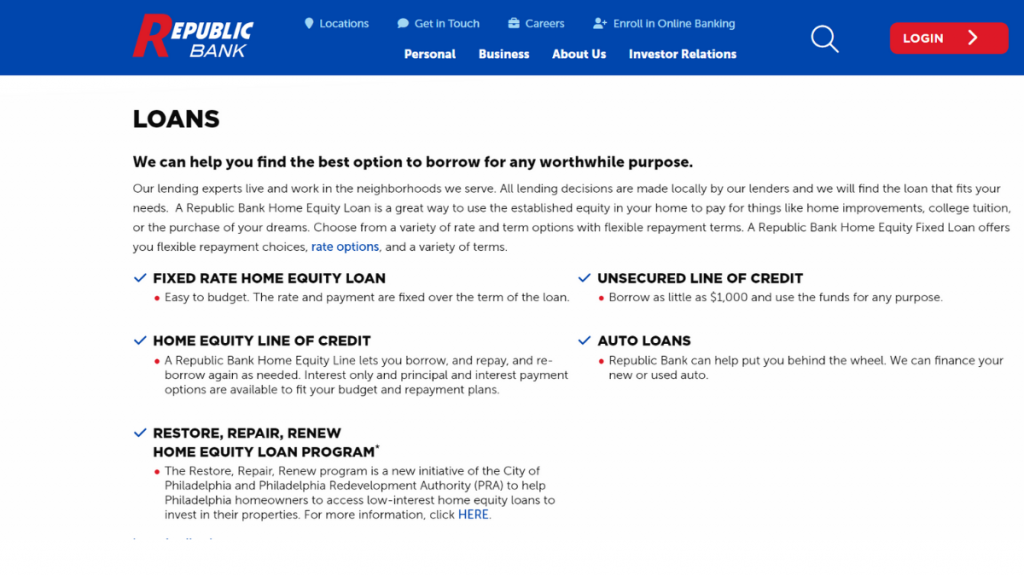

Benefits

- Competitive APR starting at 6.50%;

- Unsecured loans, meaning no collateral required;

- Flexible loan terms ranging from 12 to 180 months;

- The quick and easy online application process.

Disadvantages

- Origination fees are not disclosed;

- Late fees can be as high as 5% of the unpaid amount or $15, whichever is less;

- Early payoff penalties are not disclosed.

What credit score is required for the application?

Republic Bank does not disclose its credit score requirements for loan approval, but it’s safe to assume that a higher credit score will result in a better chance of approval.

They do take into account a variety of factors when considering loan applications, including credit history, debt-to-income ratio, and employment history.

How does the application process work?

Republic Bank Loans may be a great option if you’re looking for a personal loan, and we’re here to teach you how to apply for it!

Further, we’ll guide you through the application process and help you decide if Republic Bank Loans is the right choice for you.

Apply online

Indeed, with Republic Bank Loans, you can apply online from the comfort of your own home. The process is simple and easy; you can complete it in just a few minutes.

So all you need is a computer or smartphone and an internet connection. Then here’s how to apply for a loan online:

- Firstly, visit the Republic Bank Loans website and click on “Apply Now:”

- Fill out the online application form with your personal information, employment details, and loan amount;

- Apply and wait for a decision from Republic Bank.

Requirements

Indeed, you must meet certain requirements to apply for a loan with Republic Bank. Here’s what you need:

- You must be at least 18 years old;

- You must be a US citizen or permanent resident;

- You must have a valid Social Security number;

- You must have a verifiable source of income;

- You must have an active bank account.

In addition to these requirements, Republic Bank may also look at your credit history and score to determine your eligibility for a loan.

Also, remember that meeting the minimum requirements doesn’t guarantee approval for a loan.

Apply on the app

Also, if you prefer to apply for a loan on your mobile device, you can download the Republic Bank Loans app from the App Store or Google Play.

Indeed, the app allows you to apply for a loan, check your account balance, make payments, and more. Then, check how to apply for a loan on the app:

- Firstly, download the Republic Bank Loans app from the App Store or Google Play;

- Create an account or log in if you already have one;

- Fill out the loan application form with your personal and employment information;

- Apply and wait for a decision from Republic Bank.

Applying for a loan on the app is a convenient option for those who are always on the go.

You can complete the application from anywhere at any time, making getting the funds you need easier than ever.

Republic Bank Loans vs. Quick Loan Link: which is best for you?

Indeed, regarding personal loans, many options are available, including Republic Bank Loans and Quick Loan Link.

Both lenders offer competitive rates, flexible terms, and easy application processes.

However, there are some key differences between the two that you should consider before deciding.

| Republic Bank Loans | Quick Loan Link | |

| APR | Starting at 6.50%; | 4.99% to 450% – variable; |

| Loan Purpose | Various; | Variable by a lending partner; |

| Loan Amounts | A minimum of $1,000, up to a maximum limit that was not disclosed; | $100 and $35,000; |

| Credit Needed | Not Disclosed; | 580 minimum; |

| Terms | Up to 180 months; | Variable by a lending partner; |

| Origination Fee | Not Disclosed; | 1% to 5%; |

| Late Fee | Not Disclosed; | Not Disclosed; |

| Early Payoff Penalty | Not Disclosed. | Not Disclosed. |

If you’re interested in learning more about how to apply for Republic Bank Loans or Quick Loan Link, so be sure to check out the full article for detailed information below!

Quick Loan Link: how to apply now!

Discover how to apply for a loan with Quick Loan Link online or through their app! Borrow up to $50,000 with flexible terms! Read on!

Trending Topics

Credit Versio Review: repair your credit with confidence

Struggling with bad credit? Check out our Credit Versio review. A unique credit repair company that puts you in the driver's seat.

Keep Reading

U.S. Bank Cash+™ Visa Signature® credit card full review

In our U.S. Bank Cash+™ Visa Signature® card review, you'll learn why this is the perfect product for those who want maximum flexibility!

Keep Reading

Sable Review: read before applying

Need a Sable account review you can rely on? We got you! In this review we cover fees, perks, benefits, its pros and its cons.

Keep ReadingYou may also like

Dovly review: repair your credit with confidence

Rebuilding credit is essential for financial health. Check out this Dovly review and find out if it might be a good option for you.

Keep Reading

LightStream Personal Loan review: is it worth it?

Do you already know the LightStream personal loan? Credit reaches $100,000 and you have no origination fee. Know more.

Keep Reading

OppLoans review: is it worth it?

Find out if OppLoans is the right solution for you in this comprehensive review. Pay $0 origination fee! Fast application process!

Keep Reading