Reviews

Venmo Mastercard Debit Card full review

Get a complete overview of the Venmo Mastercard Debit Card, including what it is, how it works, and where to use it. Read on to learn more!

Advertisement

Venmo Mastercard Debit Card: perfect for app lovers, and all scores are accepted

Are you ready for our Venmo Mastercard Debit Card full review? This product is the latest payment option from mobile tech giant Venmo that allows users to access their funds anytime, anywhere.

Applying for the Venmo Mastercard Debit Card

Learn how to apply for the Venmo Mastercard Debit Card and earn cashback! Read on to learn more about this product!

With its fast processing time, no fees attached, and enhanced security features. So, the Venmo debit card could be a useful solution to pay for items quickly and easily. Keep Reading!

- Credit Score: All Credit Score is accepted;

- Annual Fee: None;

- Regular APR: N/A;

- Welcome bonus: None;

- Rewards: Earn cash back (Terms apply).

How does the Venmo Mastercard Debit Card work?

The Venmo Mastercard Debit Card, featured in this review, is a great option for cash payments. After all, you can deposit the amount you want and make payments anywhere that accepts the Mastercard brand.

Also, with this card, you have no annual or monthly fees associated with it. However, it also does not have a welcome bonus, but it has free internal transfer services.

Venmo also allows you to make free withdrawals across the entire MoneyPass network. Finally, cardholders can earn cash back in their favorite stores.

This debit card is excellent for app lovers, as it is very practical and easy to make payments.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Venmo Mastercard Debit Card pros and cons

Venmo recently launched their Venmo Mastercard Debit Card. This is a new product tailored to their user base of a mobile app for smartphones.

Moreover, this card offers many different pros for Venmo users, such as the ability to use it anywhere in the US that accepts Mastercard.

Additionally, Venmo has made it possible to apply and get approved quickly, all within the Venmo app.

Unfortunately, Venmo’s debit card also has some cons and limitations, such as being unable to use it for merchants or international trade. Furthermore, there is an associated fee for withdrawing from ATMs outside the MoneyPass network. Know more!

Pros

- Allows use anywhere in the US that accepts the Mastercard brand, avoiding discomfort when using your balance;

- It offers free withdrawals at specific ATMs, such as MoneyPass in the US;

- An associated bank account may cover transactions that may be greater than your balance amount;

- All types of credit are accepted;

- Approval is quick, and the application takes place completely online;

- Earn cash back while spending.

Cons

- Does not allow use by merchants or in international trade, only within the territory;

- There is an associated fee for withdrawing from ATMs outside the MoneyPass network;

- Transactions that need extra value can wreak havoc on your overdraft.

Does my credit score need to be good?

This Venmo Mastercard Debit Card review highlighted this option’s main pros and cons. Therefore, you may have noticed that we also mentioned the necessary credit scores.

As it is a debit card, the Venmo Mastercard Debit Card does not require a credit score. Regardless of your score, you can apply and start using your card.

Want to apply for the Venmo Mastercard Debit Card?

This debit option can make your payments easier. After all, you do not accumulate associated fees and still pay for your purchases in cash.

However, it is essential that you also know how to apply for this option for a quick approval. Check out all the essential tips to help you in this post.

Applying for the Venmo Mastercard Debit Card

Learn how to apply for the Venmo Mastercard Debit Card and earn cashback! Read on to learn more about this product!

Trending Topics

Merrick Bank Personal Loan review: is it worth it?

In this Merrick Bank Personal Loan review you will learn if borrowing from this bank is a good deal, and whether it is for you.

Keep Reading

Applying for the Buy on Trust Account: learn how!

With a minimum monthly income of $1000 in your checking account, you can get up to $5000 in credit limits with a Buy On Trust Account!

Keep Reading

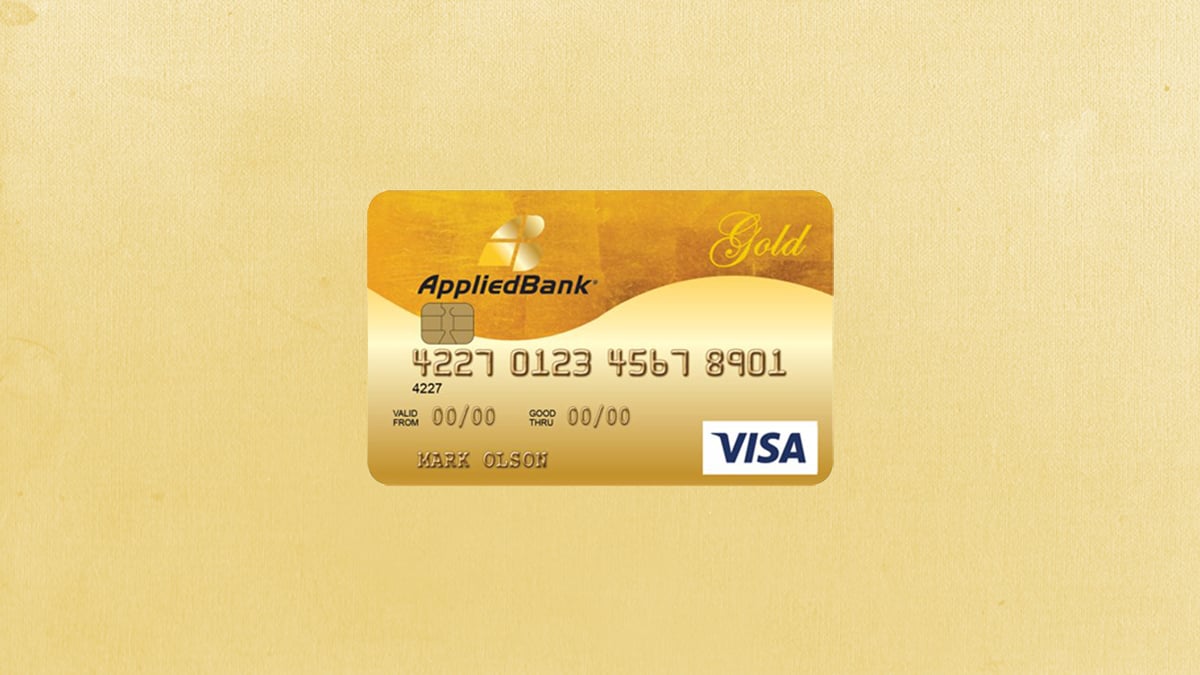

Applied Bank® Secured Visa® Gold Preferred® credit card full review

Looking for a secured credit card that offers a low-interest rate? Check our Applied Bank® Secured Visa® Gold Preferred® card review!

Keep ReadingYou may also like

R.I.A. Federal Credit Union Mastercard® Rewards Card: apply now!

Are you ready to apply for the R.I.A. Federal Credit Union Mastercard® Rewards Card? Then read on! Earn 1.5% cash back and much more!

Keep Reading

What is an annual fee on a credit card?

Annual fee on a credit card is a common thing, but do they make sense? How can you get rid of them? When should you accept them?

Keep Reading

American Express® Gold Card Review: 100K bonus points

The American Express® Gold Card may be the right choice if you want to enjoy traveling and entertainment perks. Learn more about it!

Keep Reading