Credit Cards

Wells Fargo Active Cash® Credit Card Review

Wells Fargo Active Cash® Credit Card is a great way to earn cash back on all of your purchases. Read our full review and find out how you can qualify for a $200 cash rewards bonus.

Advertisement

Wells Fargo Active Cash® Credit Card: Welcome bonuses!

The Wells Fargo Active Cash® Card of this review is a new cash-back credit card that offers unlimited 2% cash back on all purchases, a sign-up bonus, and more!

Interested? Then read our full analysis to learn more about this credit card and why having it might be a great addition to your arsenal.

This makes it an ideal match for those who prefer the ease of using one card whenever they shop.

Therefore, Wells Fargo Active Cash® Card provides a strong overall value proposition that is difficult to find on other cards. Know more!

- Credit Score: Good to Excellent;

- Annual Fee: $0;

- Regular APR: 0% intro APR for 12 months from the account opening date. Then, 19.24%, 24.24% or 29.24% Variable APR for purchases and balance transfers;

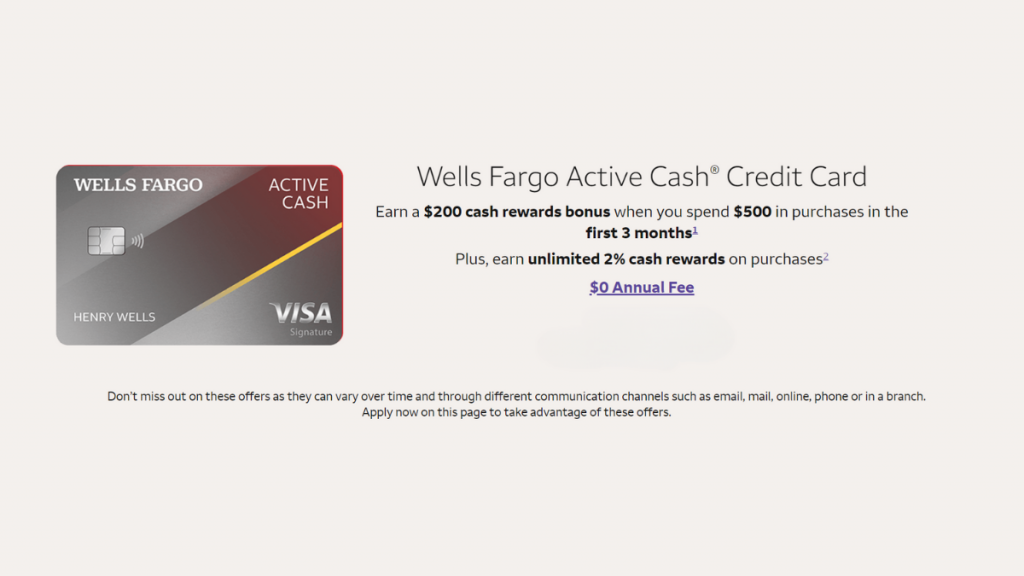

- Welcome bonus: $200 cash reward after spending $500 in the first three months of use;

- Rewards: Unlimited 2% cash rewards on purchases.

- Terms apply.

How does the Wells Fargo Active Cash® Credit Card work?

The Wells Fargo Active Cash® Card, presented in this review, is a new credit card that offers unlimited 2% cash back on all purchases.

It has no annual fee and comes with a sign-up bonus and a no-interest promotion on new purchases and balance transfers.

This makes it an ideal card for those who prefer the ease of using one card whenever they shop. The Wells Fargo Active Cash® Card is a great value proposition.

This card option has no associated annual fees and a $200 introductory bonus. However, you must spend over $1,000 in the first three months of use to use this benefit.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Wells Fargo Active Cash® Credit Card pros and cons

This Wells Fargo Active Cash® Card review brings you the main points of this card. As you’ve seen, it has excellent cashback on all purchases.

However, it does have some associated fees for foreign transactions. In addition, to qualify for the introductory bonus, it is necessary to use the card frequently.

Pros

- Get 2% cash back on all purchases with no limits and no gimmicks;

- 0 percent intro APR for 12 months on purchases and qualifying balance transfers (then 19.24%, 24.24% or 29.24% variable APR);

- Balance transfers made within 120 days of account opening qualify for the intro rate and fee of 3% (then a balance transfer fee of up to 5%, with a minimum of $5);

- Valuable benefits, including cellphone protection and Visa Signature perks;

- No annual fee.

Cons

- For foreign transactions, there is an additional fee of 3%;

- To qualify for the introductory $200, you must spend a relatively large amount in the first few months.

Does my credit score need to be good?

The Wells Fargo Active Cash® Card in this review has many rewards. As such, he requires a good to excellent credit score. You need to have a score between 670 and 850 to apply.

Requirements to Apply

- At Least 18 Years Old – You must be 18 or older (19 in some states) to qualify.

- U.S. Resident with Valid Identification – Only U.S. citizens and permanent residents with a Social Security Number or ITIN are eligible.

- Good Credit Score Needed – A FICO score of around 670 or higher improves approval chances, as this is a rewards card.

- Steady Source of Income – You must prove a reliable income to handle monthly payments and credit responsibilities.

- Manageable Debt-to-Income Ratio – Wells Fargo evaluates how much debt you have compared to your income before approving.

- Established Credit History – A solid record of on-time payments and responsible credit use is essential.

- Legal Capacity to Apply – You must be legally allowed to enter into a financial agreement.

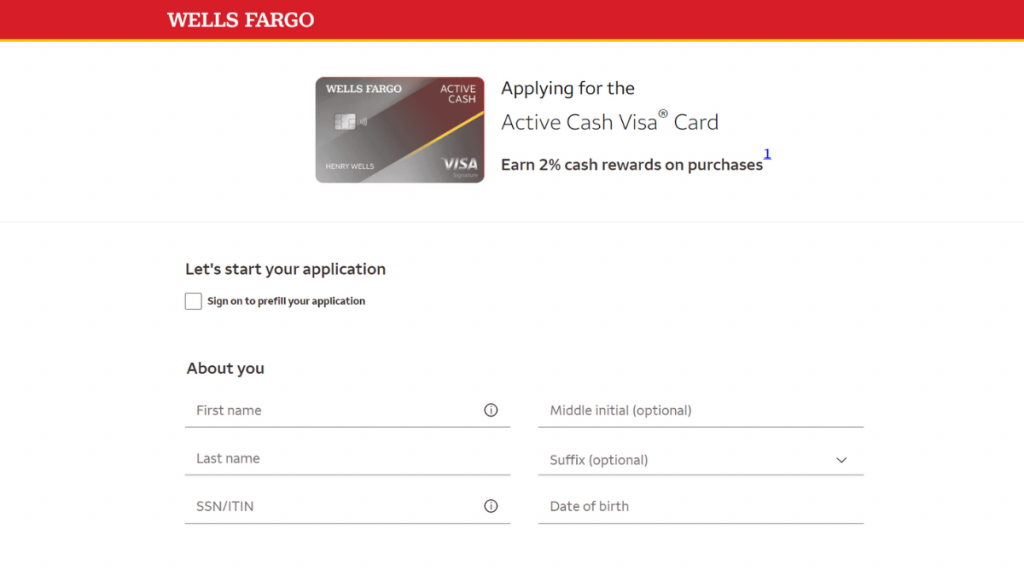

Apply online

Wells Fargo offers the Active Cash® Card, a credit card that can be used for everyday purchases. To apply, go to the Wells Fargo website and provide information.

This includes your name, date of birth, address, and housing and employment status. Wells Fargo will mail you the credit card if you are approved within a few days.

The Active Cash® Card can be used anywhere that accepts credit cards and has some great features. For example, there is no annual fee.

Apply using the app

The Wells Fargo Active Cash® Card can only be applied through the official website.

That is, you can make your request online, through the browser, and later control your expenses through the official application.

Then, you will have to fill in your registration data on the official website, and you will be able to access your account.

In addition, you must leave your credit score unlocked for queries. After all, the company will analyze your score to release this card option.

Wells Fargo Active Cash® Card vs. Truist Enjoy Cash Credit Card

As you’ve seen, the Wells Fargo Active Cash® Card is amazing with its 2% cashback. However, this is not your only option.

The Truist Enjoy Cash Credit Card is an alternative that has very similar features. In that sense, it can offer up to 3% cashback on selected purchases.

Wells Fargo Active Cash® Card

- Credit Score: Good to Excellent;

- Annual Fee: $0;

- Regular APR: 0% intro APR for 12 months from the account opening date. Then, 19.24%, 24.24% or 29.24% Variable APR for purchases and balance transfers;

- Welcome bonus: $200 cash reward after spending $500 in the first three months of use;

- Rewards: Unlimited 2% cash rewards on purchases.

- Terms apply.

Truist Enjoy Cash Credit Card

- Credit Score: Good to excellent;

- Annual Fee: $0;

- Regular APR: 0% intro APR for 12 months on purchases. After that, there will be a 18.49% – 27.49% variable APR;

- Welcome bonus: No welcome bonus besides the 0% intro APR period;

- Rewards: 3% cash back on gas purchases at eligible locations, 2% back on utilities and groceries, 1% on all other purchases, or exchange all previous options for 1.5% cashback on all purchases, unclassified by category.

Maybe you think the Truist Enjoy Cash Credit Card is your best choice. If so, read our post below to learn how to apply for this card!

How to apply for the Truist Enjoy Cash Credit Card

The Truist Enjoy Cash Credit Card is a card that can give you up to 3% cashback and has no annual fee. Check out how to apply and get approved quickly!

Trending Topics

Destiny card or Indigo® Mastercard®: find the best choice!

Wondering if the Destiny or Indigo® Mastercard® with Fast Pre-qualification is right for you? Compare the features of both cards to find out.

Keep Reading

LendingPoint Personal Loan review: is it worth it?

Read our LendingPoint Personal Loan review and discover the main pros and cons of applying for this lender! Secure up to $36,500!

Keep Reading

Scotia Momentum Visa Infinite Card Review

See our Scotia Momentum Visa Infinite review and find out if this card is right for you. Learn about its cash back program and other benefits!

Keep ReadingYou may also like

Extra Debit Card Review

Your debit card can be better. This review will show the benefits of using Extra debit card to spend your money in a better way.

Keep Reading

Elon Musk has secured even more funding for his Twitter deal

In filings released Wednesday, it was revealed that Musk has raised personal funding to complete his deal to purchase Twitter.

Keep Reading

What is tax deduction and how does it work?

Discover the basics of how does tax deduction work. Also, learn the types of deductions available, and how to use them in your favor. Read on!

Keep Reading