Loans

Alliant Credit Union HELOC review: Up to $250K

Do you need some extra cash? Then don't miss Alliant Credit Union HELOC - up to $250K quickly with affordable conditions!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Competitive APR rates for your next improvement home

Looking for a flexible way to finance your home improvement projects or other expenses? Then this Alliant Credit Union HELOC review may be the solution for you.

With competitive rates and flexible terms, Alliant Credit Union’s HELOC product has been gaining attention in the market. So, keep reading and learn more!

| APR | 7.25% to 16.00% |

| Loan Purpose | Home improvements, vacations, consolidate debt, large expenses, and more; |

| Loan Amounts | Up to $250,000; |

| Credit Needed | Not Disclosed; |

| Terms | 10-year draw period and 20-year repayment; |

| Origination Fee | Not Disclosed; |

| Late Fee | Not Disclosed; |

| Early Payoff Penalty | Not disclosed. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

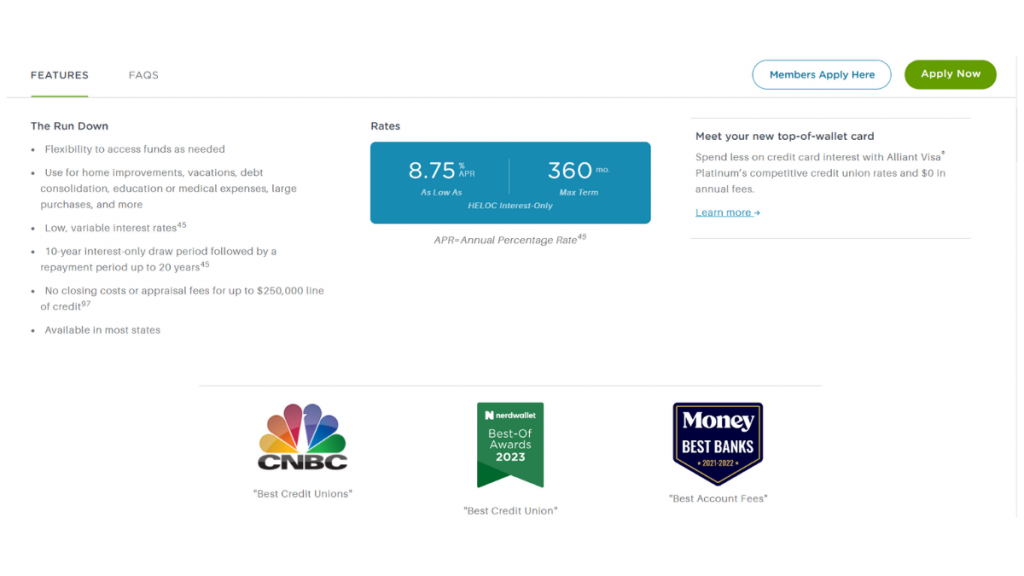

Alliant Credit Union HELOC overview

Alliant Credit Union HELOC is a loan product that allows you to borrow against the equity you have in your home.

It provides a revolving line of credit, giving you access to funds as you need them.

Furthermore, with Alliant Credit Union HELOC, you can borrow between $10,000 and $250,000 with a 10-year draw period and a 20-year repayment period.

Moreover, Alliant Credit Union HELOC also offers the option of making interest-only payments during the draw period, which can be helpful if you’re on a tight budget.

Is it worth it to apply for Alliant Credit Union HELOC?

If you’re looking for a flexible way to finance your home improvement projects or other expenses, Alliant Credit Union HELOC is definitely worth considering.

With competitive rates and flexible repayment terms, you can get the funds you need without breaking the bank.

Additionally, the ability to make interest-only payments during the draw period can help you manage your finances more effectively.

However, the lack of disclosure on credit score requirements and fees can be a drawback for some borrowers. So, check out the pros and cons.

Benefits

- Competitive interest rates;

- Flexible repayment terms;

- Low minimum loan amount of $10,000;

- No application fee or closing costs in most cases;

- Ability to make interest-only payments during the draw period.

Disadvantages

- No disclosure of credit score requirements;

- The origination fee is not disclosed;

- Late fee is not disclosed;

What credit score is required for the application?

Indeed, Alliant Credit Union does not disclose the credit score requirements for HELOC applications.

However, it’s generally recommended that borrowers have a credit score of 680 or higher to qualify for a HELOC.

Keep in mind that credit score is just one of the many factors that lenders consider when evaluating your application.

How does the application process work?

Alliant Credit Union HELOC might be the right option if you’re in the market for a home equity line of credit and we’ll teach you how to apply for it today!

Moreover, it’s perfect for homeowners looking into their home’s equity. So here’s what you need to know to apply for an Alliant Credit Union HELOC.

Apply online

Indeed, to apply for an Alliant Credit Union HELOC online, follow these simple steps:

- Visit the Alliant Credit Union website and navigate to the HELOC page;

- Click on the “Apply Now” button;

- Enter your personal information, such as your name, address, and social security number;

- Provide information about the property you are using as collateral for the loan.

- Input your employment information and income details;

- Review your application and submit it for review.

After submitting your application, you will receive an email confirmation. Alliant Credit Union will review your application and let you know if you have been approved.

Requirements

To be eligible for an Alliant Credit Union HELOC, you must have a minimum credit score 660 and at least 20% equity in your home.

You’ll also need to provide proof of income and other financial information.

Alliant Credit Union doesn’t disclose its origination fees but charges a $200 early payoff penalty.

Apply on the app

Indeed, if you prefer to apply for a HELOC on the go, Alliant Credit Union offers a mobile app that you can download for free.

Thus, the app allows you to check your account balances, make payments, and even apply for a HELOC directly from your phone or tablet.

Alliant Credit Union HELOC vs. PenFed HELOC: which one is the best for you?

When choosing between Alliant Credit Union and PenFed HELOCs, there are a few key factors to consider.

Indeed, Alliant Credit Union offers a slightly lower minimum loan amount.

In terms of credit requirements, Alliant Credit Union doesn’t disclose its minimum credit score requirement, while PenFed requires a minimum credit score of 660.

Furthermore, your best HELOC will depend on your needs and financial situation.

Further, we recommend comparing rates and terms from both lenders to determine which one fits you. So, check out!

| Alliant Credit Union HELOC | PenFed HELOC | |

| APR | 7.25% to 16.00% | Rates starting at 8.625%; |

| Loan Purpose | Home improvements, vacations, consolidate debt, large expenses, and more; | Debt consolidation, home improvement, large purchases, and more; |

| Loan Amounts | Up to $250,000; | $25,000 to $500,000; |

| Credit Needed | Not Disclosed; | 660 Minimum |

| Terms | 10-year draw period and 20-year repayment; | Draw: 10 years, Repayment: 20 years; |

| Origination Fee | Not Disclosed; | Not Disclosed; |

| Late Fee | Not Disclosed; | 5%; |

| Early Payoff Penalty | Not disclosed. | Not Disclosed. |

So we’ve provided an overview of the Alliant Credit Union HELOC and compared it to PenFed HELOC to help you make an informed decision.

However, if you’re interested in applying for a PenFed HELOC, check out our article on “How to Apply for a PenFed HELOC” for more information.

Get up to $500K quickly: Apply for PenFed HELOC

Learn how to apply for a PenFed HELOC now – get the money you need quickly and use it for several purposes! Keep reading and learn more!

Trending Topics

4 best and easiest credit cards to get approved for: apply today!

Looking for the easiest credit cards to get approved for? We’ll show you the different types of cards and give you a few names to consider.

Keep Reading

FIT™ Platinum Mastercard® Review: Build credit easily

If you're having trouble getting a credit card because of a poor credit score, check the FIT™ Platinum Mastercard® terms in this review.

Keep Reading

Reflex® Platinum Mastercard® Review

Rebuild your credit score with the confidence of a good spending limit! Read our Reflex® Platinum Mastercard® review to learn how.

Keep ReadingYou may also like

Home Depot Project Loan review: is it worth it?

Read our Home Depot Project Loan review and learn how this product can help you! Borrow up to $55K to renovate your home! Read on!

Keep Reading

Ethereum blockchain’s merge is on its way

Ethereum blockchain upgrade could set the tone for the future of the crypto market as a whole. Learn why that is and when it’s happening.

Keep Reading

Home Depot Consumer Credit Card full review

Looking for a comprehensive review of how the Home Depot consumer credit card works? Read on to find out! No annual fee!

Keep Reading