Reviews

Applying for the Capital One SavorOne Rewards for Students Card

If you want to earn rewards and enjoy your student life at the same time, read our post to learn about the Capital One SavorOne Rewards for Students card application!

Advertisement

Easy application and no annual fee

Do you already know the Capital One SavorOne Rewards for Students card? With it, you, the student, who is starting your financial life, can have several benefits with incredible cashback.

Through this rewards program, you get 8% cashback on tickets, 5% on hotels and car rentals made by Capital One, 3% on restaurants and streaming services, and 1% on all else.

Are you interested? Then today’s tips are for you! Today, you will learn how to apply for the card through the website and the app. Check out!

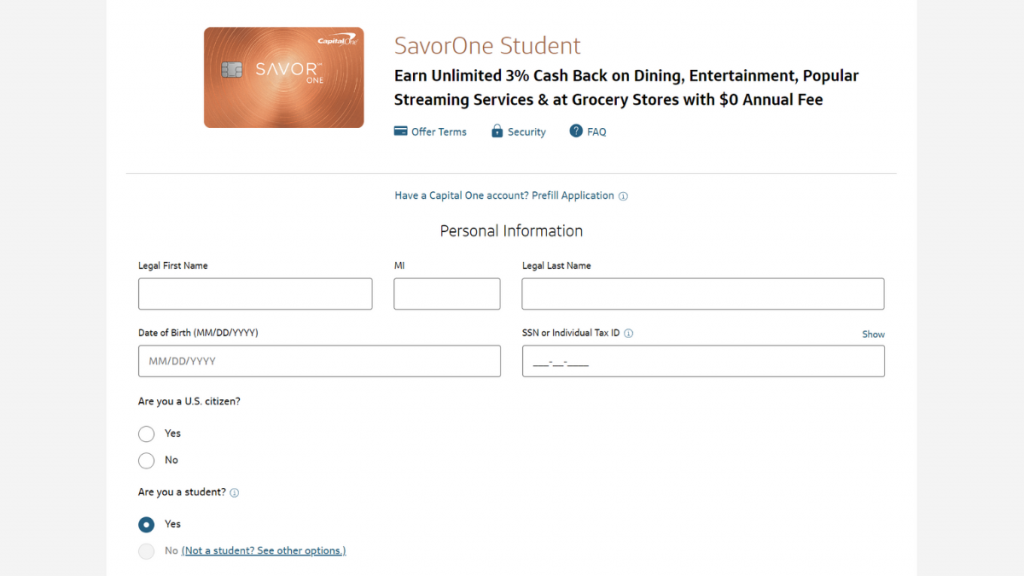

Apply online

If you want to apply for the Capital One SavorOne Rewards for Students credit card online from your computer or tablet, you can do so through the Capital One website.

You will then need to complete the requested fields with your information.

The site requests personal information such as name and MI, contact information such as phone number, and financial information such as income and employment status.

At the bottom of the page, you will find additional information and important disclosures.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

While the application process can be done through the website, you will need the application to manage the account. Therefore, you can also take the opportunity to apply there.

To carry out the application process through the app, you need to check if your smartphone or tablet system is Android or iOS. Then, look for the app in the store, download it, and open registration.

As with the website, the application will ask you to register personal information, such as an address, name, MI, and contact information, such as phone number.

You will also be asked for information about your financial history. From this data, the company will generate a credit proposal, and you can accept or decline it.

Capital One SavorOne Rewards for Students credit card vs. Upgrade Triple Cash Rewards credit card

Choosing a new credit card that meets your needs is not always easy.

However, the Capital One SavorOne Rewards for Students credit card offers similar benefits to others like the Upgrade Triple Cash Rewards credit card, but without requiring an excellent credit history.

Capital One SavorOne Rewards for Students

- Credit Score: Fair

- Annual Fee: $0

- Regular APR: 19.99% – 29.99% for purchases (variable)

- Welcome bonus: Earn a one-time $50 cash bonus after spending $100 on purchases in three months from your account opening

- Rewards: 8% cashback on tickets purchased through the Vivid Seat platform, 5% on hotels and car rentals through Capital One Travel, unlimited 3% cash back on dining, entertainment, streaming services, and at grocery stores, and 1% cash back for other purchases

Upgrade Triple Cash Rewards Visa®

- Credit Score: Average to excellent

- Annual Fee: $0

- Regular APR: variable between 14.99% – 29.99% depending on the credit limit

- Welcome bonus: offer of a $200 bonus if you open a Rewards Checking account and make at least three transactions with your debit card

- Rewards: up to cashback of 3% on selected purchases

Apply for the Upgrade Triple Cash Rewards Visa®

Don't know how to apply for your Upgrade Triple Cash Rewards Visa®? Don't worry. This article has every piece of information you need to get this card.

Trending Topics

Citrus Loans: how to apply now!

Citrus Loan can lend you up to $2,500 with a bad credit score. Learn how to apply for Citrus Loan and get your money today!

Keep Reading

Chase Freedom Unlimited® Review

A great cash back card with plenty of flexibility! Check out our Chase Freedom Unlimited® review to see if it's the right card for you.

Keep Reading

The Federal Reserve announced a rate hike by 0.75%

The Federal Reserve announced a new target federal funds rate raise by 0.75%, and there could be another one on the way. Read on for more!

Keep ReadingYou may also like

Earn Up to $26k Per Employee with the Employee Retention Tax Credit!

Are you looking for ways to reduce your business expenses? The Employee Retention Tax Credit can provide up to $26k per employee.

Keep Reading

SoFi Private Student Loan: how to apply now!

SoFi Private Student Loan is attractive because it has low-interest rates and flexible repayment terms. Learn more to apply.

Keep Reading

Net First Platinum credit card full review

The Net First Platinum credit card is the perfect card for individuals who shop at the Horizon Outlet website. Check it out!

Keep Reading