Reviews

Apply for the Petal® 2 Visa® Credit Card: Learn how!

If you need a card with no fees and great perks, read on to learn how to apply for the Petal® 2 Visa® Credit Card!

Advertisement

Petal® 2 Visa® Credit Card: One hundred percent free of fees!

So you have decided that you want to apply for the Petal® 2 Visa® Credit Card. This card is a great choice for a no-fee card offering cashback rewards.

In this post, we will go over the steps you need to take to apply for this card. Remember that you must be at least 18 years old to apply. Let’s get started!

Apply online

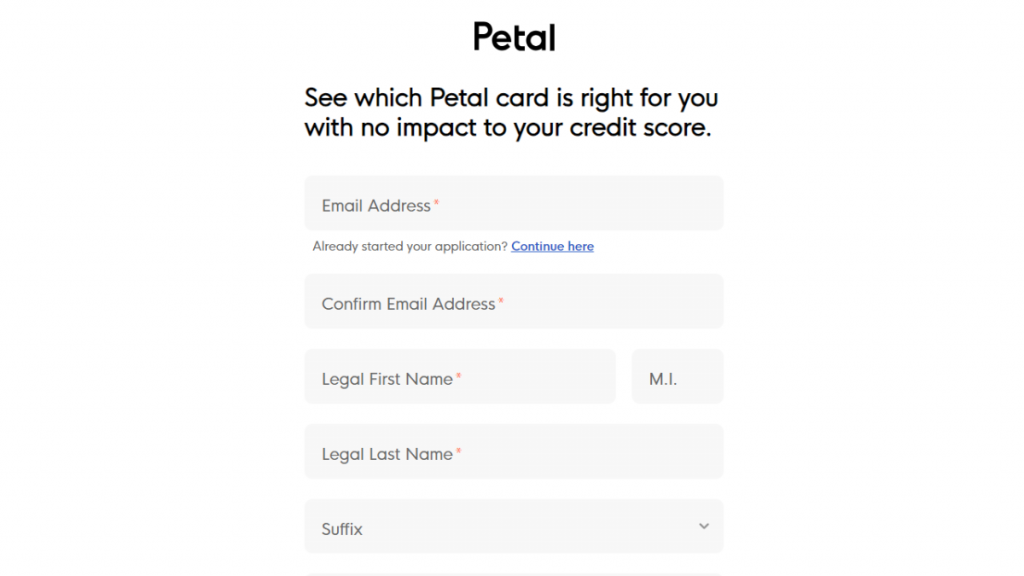

To apply for the Petal® 2 Visa® Credit Card, you need to fill out an online form on Petal’s website with your personal information.

Another way to apply is by receiving a mail offer. If you did get one, enter the ten-digit invitation code and get started.

Once applicable criteria are met, and your identity is verified, your application process will start. You can go back to it anytime, continuing from where you left off.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

If you are one of those people who do everything through your mobile phone, there is not much information about applying via their app, but it is surely possible.

After all, Petal is all about reimagining credit, and it knows that the new reality is based on technology.

So, your new card will work with Apple Pay® or Google Pay™. Just tap and go.

Petal® 2 Visa® Credit Card vs. Upgrade Triple Cash Rewards Visa®

Shall we compare to see if the Petal® 2 Visa® Credit Card is worth it for you? For starters, both cards below have similar score requirements.

Moreover, both have annual fees totaling zero, although the competition’s variable regular APR is more likely to be lower.

But Petal also has another credit card option, and on their website, you can compare which one you prefer without impacting your credit score just for checking options out.

Petal® 2 Visa® Credit Card

- Credit Score: Fair – Good;

- Annual Fee: $0;

- Regular APR: 18.24% – 32.24% variable;

- Welcome bonus: N/A;

- Rewards: 1%–1.5% cashback on eligible purchases.

- Terms apply.

Upgrade Triple Cash Rewards Visa®

- Credit Score: Fair – Excellent;

- Annual Fee: $0;

- Regular APR: 14.99% – 29.99% variable;

- Welcome bonus: $200 bonus when you open a rewards checking account and perform three debit card transactions;

- Rewards: 1%–3% cashback, depending on purchase categories.

- Terms apply.

If the Upgrade Triple Cash Rewards is the best option for you, read our post below to learn how to apply for it!

Applying for the Upgrade Triple Cash Rewards Visa®

Applying for an Upgrade Triple Cash Rewards Visa® is easy and fast, and you can do it even with an average credit score. This article will show you how it works.

Trending Topics

PREMIER Bankcard® Mastercard® Credit Card full review

Need to build credit and improve your score? PREMIER Bankcard® Mastercard® Card review can help! See how this simple option can save you!

Keep Reading

Top 6 best rewards cards in Canada: enjoy the benefits in 2022!

Looking for the best rewards cards in Canada? We've got you covered with top cash back, travel points, and sign-up bonus offers for 2022!

Keep Reading

Applying for the Truist Enjoy Travel Credit Card: learn how!

Want to apply for the Truist Enjoy Travel Credit Card but unsure how? Then read on and learn! Earn miles on every $1 spent!

Keep ReadingYou may also like

Citi Premier vs Chase Sapphire Preferred card: which is the best?

Which travel card is best for you? Is it the Citi Premier or the Chase Sapphire Preferred card? Read this article to learn more about them!

Keep Reading

Neo Financial credit card full review

Neo Financial credit card is changing the way online banking works. It has no annual fee and valuable rewards. Read on to learn about it.

Keep Reading

Applying for the Aspiration Spend & Save™ card: learn how!

Learn how to apply for the Aspiration Spend & Save™ card. A product that cares for your wallet and the environment just as much.

Keep Reading