Loans

OneMain Financial Personal Loans: how to apply now!

This step-by-step guide explains everything you need to know about applying and the requirements. Borrow up to $20,000 for multiple purposes!

Advertisement

Flexibility in payment and values to use for different purposes

Do you need extra cash or a larger purchase to handle life’s daily expenses? Then apply for the OneMain Financial Personal Loans today!

OneMain Financial provides a streamlined lending experience for those looking for financial flexibility. So read on and learn how to apply easily!

Apply online

Applying for a personal loan from OneMain Financial is easy.

Nevertheless, you must pre-qualify on their website by choosing the “Check for offers” button and entering your requested loan amount.

Second, you will be asked to provide your name, address, email, and income and answer questions about your employer and whether you have a paid-off vehicle.

Moreover, after entering your birth date and SSN or ITIN, they will offer previews of your potential loans.

So, the next step involves submitting an application.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Requirements

To apply for OneMain Financial Personal Loans, you must have a social security number or individual taxpayer identification number and be 18 years old.

While no minimum credit score is required for the application, individuals with no credit history may not qualify.

Additionally, applicants must have enough income to support their expenses plus the new loan’s monthly payment.

Finally, this income can come from any source, including but not limited to employment, partner income, alimony, retirement, child support, and more.

Apply on the app

Want to know how to apply for OneMain Financial Personal Loans? Then check out the topic above, as the official website makes the application exclusively.

OneMain Financial Personal Loans vs. Upstart Personal Loans: which one is the best for you?

Upstart Personal Loans may be a great option if you’re looking for an alternative to OneMain Financial Personal Loans.

While applying, Upstart takes a comprehensive look at your credit score and data finance.

Whether OneMain Financial or Upstart Personal Loans is the best option for you depends on your needs.

Consider things such as interest rates, repayment terms, and more. So, check out the comparison.

| OneMain Financial Personal Loans | Upstart Personal Loans | |

| APR | 18.00 to 35.99%; | 6.7% to 35.99%; |

| Loan Purpose | Debt consolidation, Auto purchase, repair, or refinance, Wedding or funeral expenses, Medical debts, Vacations, Recreational vehicles, and Home improvements; | Consolidating credit card and other debts, Paying for moving expenses, Funding home improvements, Covering medical costs, Financing a wedding, and Starting or expanding a business; |

| Loan Amounts | $1,500 to $20,000; | $1,000 – $50,000; |

| Credit Needed | All types of credit scores are accepted; | All types of credit scores are accepted; |

| Origination Fee | $25 to $500 or 1% to 10%; | Up to 8%; |

| Late Fee | $5 to $30 or 1.5% to 15% of the payment amount; | 5% of the unpaid amount or $15, whichever is greater; |

| Early Payoff Penalty | N/A. | N/A. |

Upstart Personal Loans is an interesting alternative that releases up to $50,000.

Furthermore, you can use that money for several things. So, want to find out how to apply? So, check out the post below.

Upstart Personal Loans: how to apply now!

Find out how to apply for Upstart Personal Loans and access the money you need! Borrow up to $50K with quick funding.

Trending Topics

Ovation Credit Repair review: repair your credit with confidence

Want to improve your credit score? Then check out this Ovation Credit Repair review and find out if this might be your needed service.

Keep Reading

Tier 1 Credit 101: building a strong financial foundation

What is Tier 1 Credit? You can find out here, including how to achieve it to improve your finances. So, read on!

Keep Reading

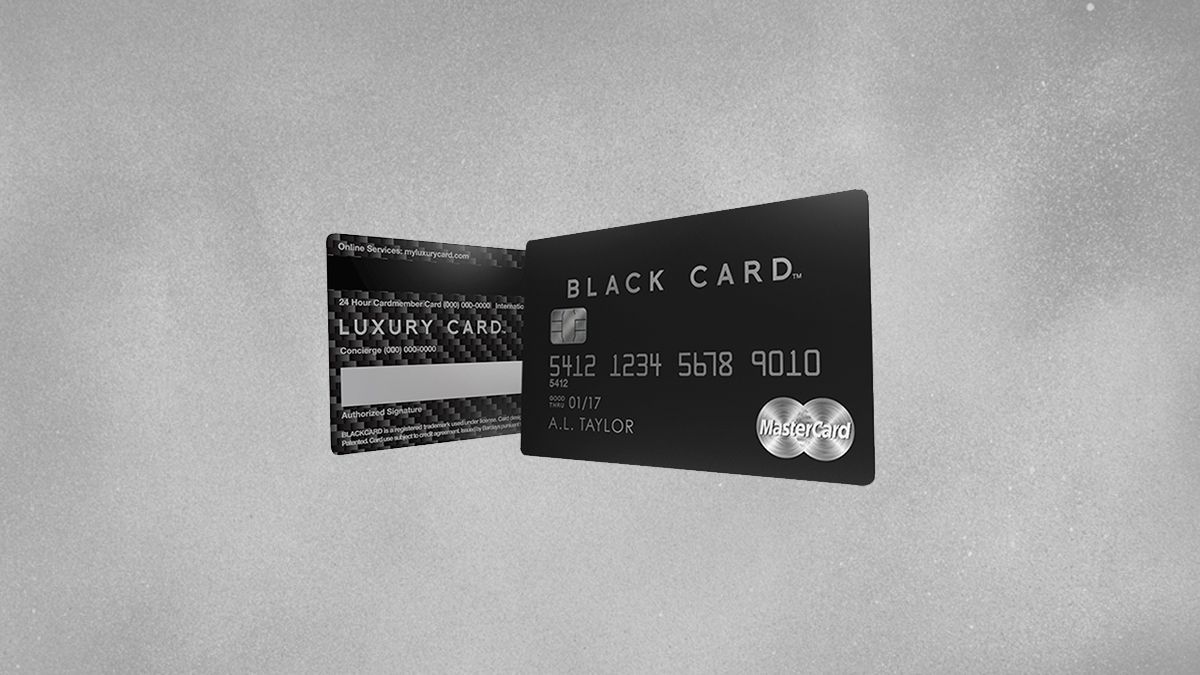

Luxury Black credit card full review

Check out our Luxury Black credit card full review to learn all about its exclusive travel rewards and high-end experiences.

Keep ReadingYou may also like

Prosper Loans review: is it worth it?

Check our Prosper Loans review to see if it’s the right fit for your financial needs. We’ll look over rates and terms to help you decide.

Keep Reading

Juno Debit Card full review

Need a good debit card to make your money work? Check out this Juno Debit Card review and find out if it might be what you're looking for.

Keep Reading

First savings credit card full review

First Savings credit card is the card for people who needs some help with their credit score. Get this Mastercard card to use everywhere.

Keep Reading