Finances

Tier 1 Credit 101: building a strong financial foundation

What is Tier 1 Credit? It is a common question among borrowers seeking the best credit opportunities. Keep reading to learn more!

Advertisement

A score that can open your financial doors

If you’ve ever applied for a loan or a credit card, you may have heard the term “Tier 1 credit.” But what exactly does it mean? In this article, we’ll break down what Tier 1 credit is, how it’s determined, and why it’s important.

650 credit score: is it a good score?

A 650 credit score may be enough to get approved for some loans, but it's not great. Learn the details on what institutions consider good credit!

Understanding Tier 1 credit can help you make better financial decisions and improve your chances of getting approved for loans and credit cards with favorable terms.

What does Tier 1 Credit mean?

Tier 1 Credit is a term used to describe the highest level of creditworthiness that a borrower can have. It is typically assigned to individuals who have a credit score in the range of 720 or higher.

Having Tier 1 Credit means that lenders consider you a low-risk borrower. Moreover, it means that they are more likely to offer you favorable loan terms.

Achieving Tier 1 Credit can be a valuable financial goal and can help you access better credit opportunities and achieve your financial goals.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Benefits of Tier 1 Credit

Having good credit is crucial when it comes to making major financial decisions. It can affect your ability to get approved for loans, credit cards, and even job opportunities.

One term that you might have heard in relation to credit is “Tier-One Credit”. So, check out why it’s important to maintain a high credit score.

Lower interest rates

One advantage of having Tier-One Credit is being able to access lower interest rates on loans and credit cards.

This means that you will pay less in interest over time and can save thousands of dollars on significant purchases such as a car or a house.

A lower interest rate translates into lower monthly payments. And this makes it easier for you to manage your finances and keep up with your payments.

When you have good credit, lenders view you as a low-risk borrower. Also, they are more willing to lend you money at lower interest rates.

Higher credit limits

Another advantage of having Tier-One Credit is that you will have access to higher credit limits on your credit cards. This can be helpful if you need to make a significant purchase or if you want to increase your credit utilization ratio to improve your credit score.

A higher credit limit means that you can borrow more money without maxing out your credit cards, which can help you avoid costly fees and penalties.

Easier loan approvals

Having Tier-One Credit can also make it easier to get approved for loans, including mortgages and car loans. Lenders are more likely to approve applicants with good credit. This is because they have a proven track record of making payments on time and managing their debts responsibly.

This means that you will have more options when it comes to choosing a lender. Also, you may be able to negotiate better terms and interest rates.

Better job opportunities

Your credit score can also affect your job prospects, as some employers may check your credit as part of the hiring process, particularly if the job requires handling financial transactions or sensitive information.

Having Tier-One Credit can demonstrate that you are responsible and trustworthy, which can make you a more desirable candidate for these types of positions.

Access to premium credit cards and perks

Finally, having Tier-One Credit can give you access to premium credit cards and perks, such as exclusive travel rewards, cashback offers, and concierge services.

These cards often come with high annual fees. But, the rewards and benefits can more than make up for the cost if used strategically.

How to Get Tier 1 Credit?

Achieving Tier-One Credit is an important financial goal for many people. It can open up access to lower interest rates, higher credit limits, and other benefits. So, check out how to get tier 1 credit below.

1. Know your current credit score

The first step in obtaining Tier-One Credit is to know your current credit score. You can check your credit score for free once a year through the three major credit bureaus: Equifax, Experian, and TransUnion.

Moreover, you can also use online credit monitoring services to keep track of your credit score. Furthermore, you can receive alerts when it changes.

2. Make timely payments

Making timely payments on your bills and credit cards is crucial to building good credit. Late payments can hurt your credit score and make it harder to achieve Tier-One Credit.

Establish automatic payments or set up reminders to guarantee that you always meet payment deadlines without fail.

How to do a balance transfer in 10 simple steps

Are you wondering how balance transfers works? Wonder no longer! Keep reading and learn everything you need! Let's go!

3. Keep your credit utilization

Credit utilization is the percentage of your available credit that you are using. Keeping your credit utilization low can improve your credit score and make it easier to achieve Tier-One Credit.

Ideally, you should aim to keep your credit utilization below 30%.

4. Manage your debts

Managing your debts effectively is another key to achieving Tier-One Credit. Avoid taking on too much debt, and try to pay off your debts as quickly as possible.

Therefore, this can help you maintain a healthy debt-to-income ratio, which is an important factor in determining your creditworthiness.

5. Maintain a good credit history

A good credit history can demonstrate your ability to manage your debts responsibly and make timely payments. Avoid opening too many new credit accounts at once, as this can lower your credit score.

Instead, focus on building a solid credit history over time.

6. Monitor your credit report

Consistently keeping an eye on your credit report can enable you to identify any errors or inaccuracies that might be impacting your credit score.

Also, if you notice any errors or discrepancies, contact the credit bureau to dispute them and have them removed from your report.

7. Seek professional help if needed

If you are struggling to improve your credit score or manage your debts, seek professional help.

Moreover, credit counseling services and financial advisors can provide guidance and support to help you achieve your financial goals and achieve Tier-One Credit.

If you want to learn about credit cards to use and improve your score, you can read about the different types of credit cards you can use. So, read on our post below!

10 different types of credit cards

From cash back to travel rewards, see the main different types of credit cards you can use to your benefit!

Trending Topics

Rocket Loans or LightStream Loans: pros and cons

Choosing the best loan for you can be quite a challenge. However, Rocket Loans or LightStream Loans can be good options. Check out!

Keep Reading

Here’s why you should keep investing in the stock market despite its current conditions

With the recent market crash, many investors are too nervous to get into the stock market. But here's why you should invest anyway.

Keep Reading

Ensure competitive rates: apply for Bank of America HELOC

Learn how to apply for a Bank of America HELOC and take advantage of its flexible loan options, low APR, and easy online application process.

Keep ReadingYou may also like

SoFi Private Student Loan review: is it worth it?

Looking for a student loan? This SoFi Private Student Loan review will point you in the right direction. Enjoy flexible terms and more!

Keep Reading

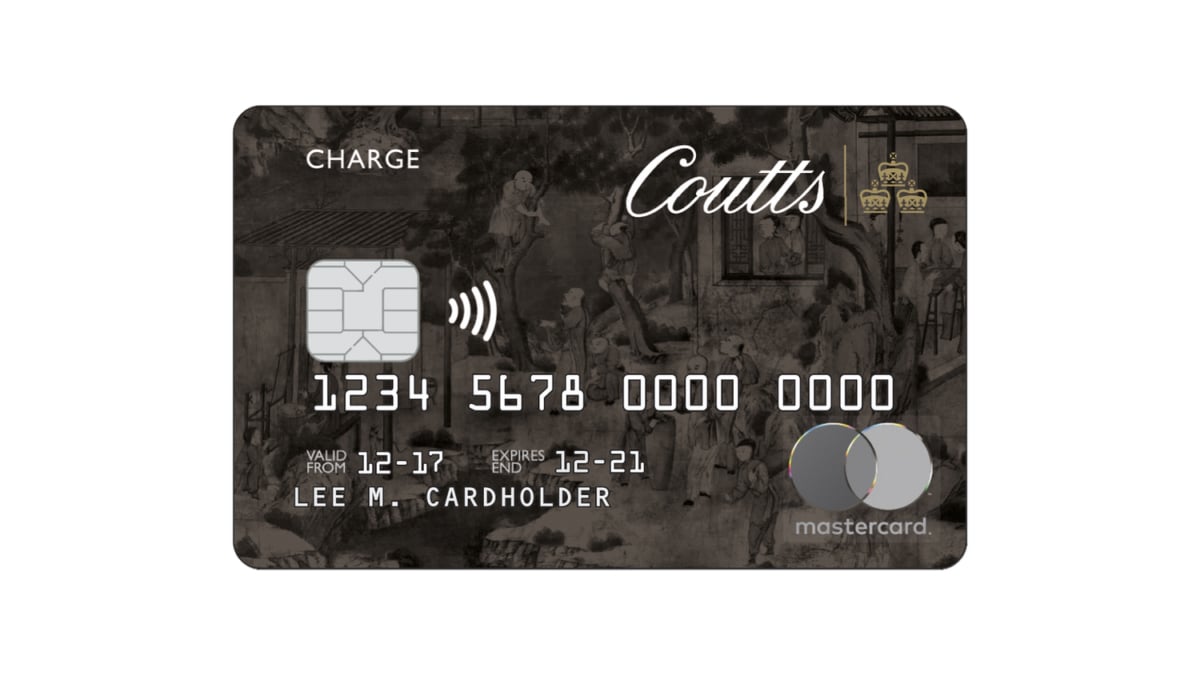

Coutts World Silk credit card full review

Discover everything you need to know about the Coutts World Silk credit card, including its features and benefits. Keep reading to see more!

Keep Reading

Seeking New Talent: How to apply for a Job at AutoZone Today!

AutoZone job openings: Apply online now – Learn the requirements and what to expect after submission. Read on!

Keep Reading