Credit Cards

Applying for the U.S. Bank Visa Platinum® Card: Learn How!

If you're interested in learning how to apply for the U.S. Bank Visa Platinum® Card, and getting a long low intro APR, read on and learn everything you need!

Advertisement

Simple and quick application

The U.S. Bank Visa Platinum® Card is one of the most popular credit cards on the market. It offers many benefits, including a 0% intro APR on purchases and balance transfers for 21 billing cycles.

In this blog post, we’ll walk you through everything you need to know to apply for the U.S Bank Visa Platinum®. We’ll cover eligibility requirements and how to fill out the form.

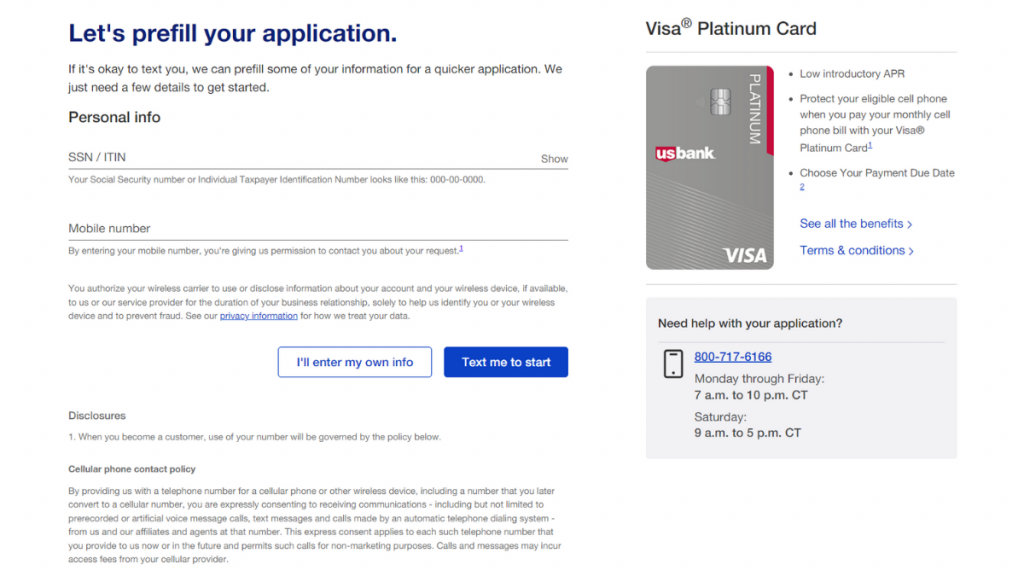

Apply online

Applying for the U.S. Bank Visa Platinum® Card is easy and convenient, with everything being done online through the website.

All you need is your financial information, personal data, and Social Security number. The process is straightforward! As a result, you can be approved in as little as 60 seconds.

There’s no need to worry about complex applications or hidden fees. Just apply online, and you’re on your way to enjoying all the benefits of the U.S. Bank Visa® Platinum.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

To apply for the U.S. Bank Visa Platinum® Card, you must use either a website or an app. Unfortunately, it cannot be done exclusively via the app itself.

You must provide your financial, personal, and security information when applying. As well as ensure that you are older than 18 years of age and currently residing in the U.S.

Once your account has been successfully opened, you can easily download and install the app via the respective store on your device and keep track of your finances.

U.S. Bank Visa Platinum® Card vs. Aspire® Credit Card

If you’re looking for a good credit card with no annual fee, the U.S. Bank Visa Platinum® is a great option.

With a 0% introductory APR for 21 months on both purchases and balance transfers, it’s a great way to save on interest.

The Aspire® Credit Card also has no annual fee. You can earn 3% cash back rewards on qualifying gas, grocery, and utility purchases and some payments.

Moreover, plus 1% cash back on any other eligible purchase if you enroll in the cash-back rewards program.

U.S. Bank Visa Platinum® Card

- Credit Score: Good/Excellent;

- Annual Fee: $0;

- Regular APR: 0% introductory APR for the first 21 months for purchases and balance transfers. After that, 18.74% – 29.74% (Variable);

- Welcome bonus: N/A;

- Rewards: Coverage against damage or theft of cell phones up to US$ 600.

Aspire® Credit Card

- Credit Score: 300 to 850;

- Annual Fee: $49 to $175. Then, $0 to $49 annually;

- Regular APR: 29.99% or 36% variable APR for purchases;

- Welcome bonus: None;

- Rewards: 3% cash back rewards on qualifying gas, grocery, and utility purchases and some payments. Also, you can earn a 1% cash-back reward on any other eligible purchase (valid if you enroll in the cash-back rewards program);

- Terms apply.

The Aspire® Credit Card is an excellent alternative. Want to know how to apply? Then check out the post we separated.

How to apply for the Aspire® Credit Card

The Aspire® Credit Card can help you rebuild your credit score. However, here's how to apply to be approved and start using your card.

Trending Topics

Neo Financial credit card full review

Neo Financial credit card is changing the way online banking works. It has no annual fee and valuable rewards. Read on to learn about it.

Keep Reading

Build credit with PREMIER Bankcard® Mastercard®: apply now!

Apply for the PREMIER Bankcard® Mastercard® today and achieve your full credit potential! Qualify with poor credit! Read on and learn more!

Keep Reading

5 best cards that offer welcome bonuses: choose and enjoy!

Wondering what are the cards that offer welcome bonuses? Check out the best sign-up rewards products and start earning points today!

Keep ReadingYou may also like

Start budgeting: 5 simple steps on how to start!

Want to get your finances under control? This article will show you how to start budgeting in 5 easy steps. Find out more about it here!

Keep Reading

Earnest Private student loan review: is it worth it?

Do you need to finish your studies and have no money? Find out how the Earnest Private student loan can help you out!

Keep Reading

Upgrade Rewards Checking Account review: read before applying

Want to have the best checking account in town? Don't miss out on our Upgrade Rewards Checking Account review to learn more!

Keep Reading