Credit Cards

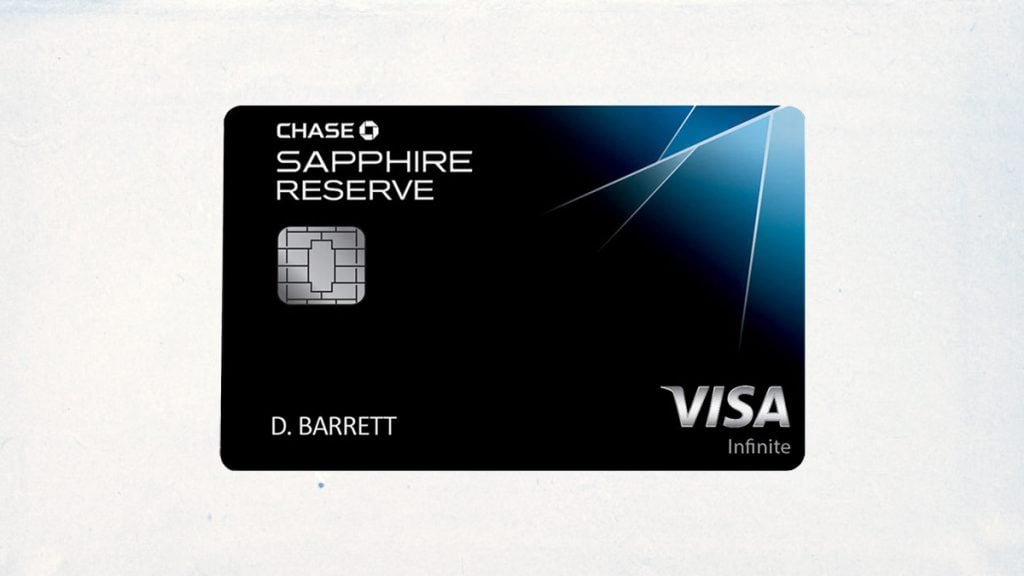

Applying for the Chase Sapphire Reserve card: learn how!

Learn how to apply for the Chase Sapphire Reserve and get 50,000 bonus points after spending $4,000 in the first 3 months. Plus, enjoy 3x points on travel and dining purchases worldwide!

Advertisement

Chase Sapphire Reserve Card: Double your points with Chase’s loyalty programs!

There are many different options to choose from when it comes to travel-related bonus credit cards. But if you want the ultimate in flexibility and convenience, then the Chase Sapphire Reserve card is hard to beat.

With the Chase Ultimate Rewards, you can earn points and redeem them for travel, cash back, and more. Plus, you can use your points to book travel through the Chase website, which offers fantastic deals on flights and hotels.

This card comes with a sturdy annual fee, but it also provides some great perks, like a $300 annual travel credit and access to over 1,300 airport lounges worldwide. And, you’ll earn 3 points per dollar spent on travel and dining purchases! So, keep reading if you want to learn how to apply for it!

Apply online

Requesting the Chase Sapphire Reserve card online is fairly easy, and it only takes a couple of minutes. First, you’ll need to access Chase’s official website and select the “explore products” option at the top menu.

Then, click on “credit cards” and find the Sapphire Reserve option. You can either create a Chase account or apply to it as a guest. Whichever option you choose will lead you to a form you’ll need to fill out with your personal information before sending in the request.

As a way for Chase to confirm you’ve read their Terms and Conditions, you will need to sign them electronically. The answer to your application should come shortly via e-mail or a phone call.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

Chase is one of the few card companies that allows its customers to apply for their credit cards through the bank’s mobile app. To do so, you’ll need to download the application and follow the step-by-step guide provided by it. The process is very intuitive and similar to the online application.

Chase Sapphire Reserve credit card vs. Discover It Miles credit card

If you’re not sure whether the Chase Sapphire is the best choice for you, or maybe you don’t think the $500 annual fee is worth all the perks, we’ve got you covered. Meet the Discover It Miles credit card! With it, you don’t have to worry about annual fees, and you get 1.5x miles for every dollar spent!

Check out its main features below and follow the related content link if you want to learn how to apply for it!

| Chase Sapphire Reserve | Discover It Miles | |

| Credit Score | Excellent | Good – Excellent |

| Annual Fee | $550 | $0 |

| Regular APR | 16.99% – 23.99% (variable) | 11,99% – 22,99% (variable) |

| Welcome bonus | 50.000 bonus points after spending $4.000 on purchases in the first three months of account opening | Miles-for-miles match at the end of your first-year |

| Rewards | $300 annual travel credit reimbursements; Generous welcome bonus; Dining benefits; | 1.5x Miles on every dollar spent; No annual fee; Rewards don’t expire as long as the account is open. |

Discover it® Miles Card Review: $0 annual fee

If you're looking for a credit card that offers great travel rewards, the Discover it® Miles card is definitely one to consider. Check our review.

Trending Topics

Applying for the Discover Bank account: learn how!

Discover Bank is a great option to open your account. Want to know how to do it? Then find out here how to apply.

Keep Reading

Fortiva® Mastercard® Credit Card Review

Explore our Fortiva® Mastercard® Credit Card review for insights on earning cash back on everyday purchases and building credit easily.

Keep Reading

ELFI Student Loan: how to apply now!

Applying for an ELFI Student Loan is easy! Enjoy low rates and several benefits. Keep reading and learn more!

Keep ReadingYou may also like

Applying for the SavorOne Rewards for Good Credit card: learn how!

Learn how to apply for a SavorOne Rewards for Good Credit card and get 3% cash back on all of your favorite everyday categories!

Keep Reading

Make up to $15 per hour working at TGI Friday’s: see job vacancies

Looking for a job in customer service? TGI Friday's has job vacancies that don't require experience. Enjoy healthcare, 401(K) plan and more!

Keep Reading

How to get a loan with bad credit: 5 easy tips

Are you trying to get a loan with bad credit? It is not easy but will get easier if you follow the tips we give you in this article.

Keep Reading