Credit Cards

Applying for the Citi Premier® Card: learn how!

The Citi Premier® Card is an amazing rewards credit card that offers fantastic benefits to its users. If you are interested in applying for it, then you have come to the right place!

Advertisement

Citi Premier® Card: the travel reward credit card that values your money

The Citi Premier® Card has a marvelous performance in the reward points program.

If you love to travel, you know that using the right credit card can make all the difference. This card will optimize almost every purchase by giving you 1x to 3x points for each dollar you spend.

These points are very flexible. You can choose between various airlines to transfer your points, or you can turn them into cashback.

This article will show you how to apply for the Citi Premier® Card, so keep reading to learn all about the process!

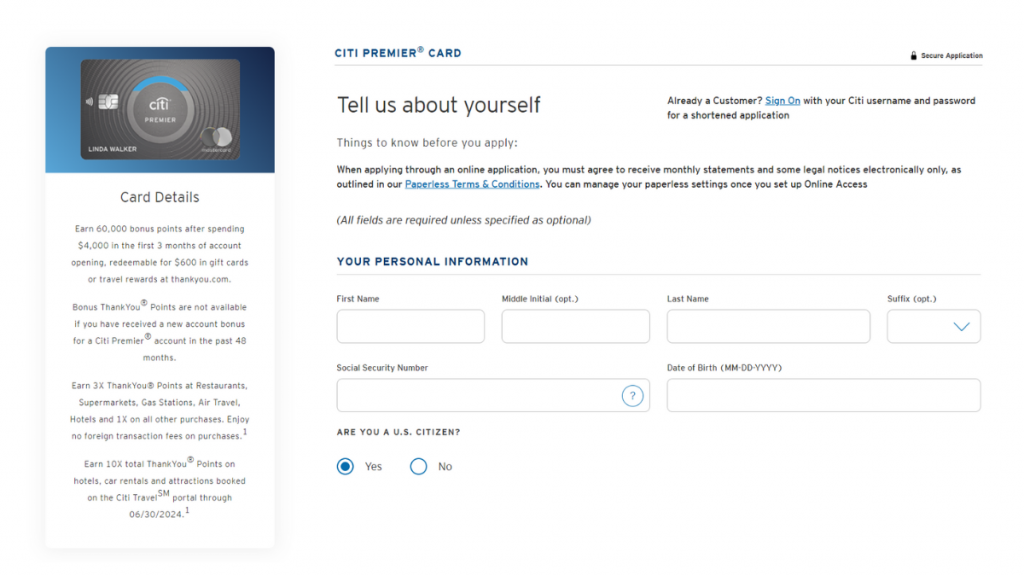

Apply online

Go to the Citi Bank website and look for the Citi Premier® Card option. There you’ll find an “apply now” button, right next to the image of the card.

The site will redirect you to a form. It is a bit long, so pay attention to answering all the questions correctly.

The questions are not different than the usual for a credit card application. You’ll have to inform some personal information, address and contact info like e-mail and phone number.

Finally, you’ll tell a bit about your financial life. You need to inform your annual income and monthly payments, such as mortgage and rent.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

We found no information about applying using the app. Citi Bank provides an app only for users to administer their accounts.

The only option besides the website is to apply by phone.

Citi Premier® Card vs. Chase Sapphire Preferred® Credit Card

To compare with Citi Premier, we brought you the Chase Sapphire Preferred credit card. They both have the same annual fee, so check the difference between their benefits:

| Citi Premier® Card | Chase Sapphire Preferred® | |

| Credit Score | Good to Excellent. | 690 or higher |

| Annual Fee | $95. | $95. |

| Regular APR | 21.24% – 29.24% variable. | 21.49%–28.49% variable. |

| Welcome bonus | 60,000 points after $4,000 spent in the first three months. | 60,000 bonus points after $4,000 spent in the first 3 months. |

| Rewards | 3x Points in air tickets, hotels, gas stations, supermarkets, and restaurants; 1X points on all other purchases. | 5x points on travel purchased through Chase Ultimate Rewards; 3x points on dining; 3x points on select streaming services and online grocery purchases; 1 point per $1 spent on all other purchases. |

Have you considered applying for the Chase Sapphire Preferred? No worries, we have an article about it too.

Just check the content below and learn how to apply for it.

How to apply for the Chase Sapphire Preferred®

The Chase Sapphire Preferred® Credit Card will give you a lot of rewards to travel the world. Learn everything you need to know to apply for it.

Trending Topics

Top 10 Free Movie and Series Streaming Apps You Need to Try

Unplug your cable box! Access free movies and series with these must-have apps to watch your favorite content for free. Read on!

Keep Reading

Applying for the Upgrade Rewards Checking Account: learn how

Learn everything you need to know about applying for the Upgrade Rewards Checking Account, including what information you'll need to start.

Keep Reading

What are the real advantages of cashback?

The advantages of cashback are powerful in the long term, and in this article you will learn how this works. Read on to find out more!

Keep ReadingYou may also like

Study Abroad in Canada: A Guide for International Students

Check out these exclusive scholarships and Canadian government grants for international students to study abroad in Canada. Dive in now!

Keep Reading

How to get a loan with bad credit: 5 easy tips

Are you trying to get a loan with bad credit? It is not easy but will get easier if you follow the tips we give you in this article.

Keep Reading

What is a hard fork: learn how it affects the crypto market

Ever wondered: What is a hard fork? This term belongs to the world of cryptocurrencies, and today we are going to explain it to you.

Keep Reading