Credit Cards

Applying for the Discover it® Miles card: learn how!

The Discover it® Miles credit card is a great way to earn rewards on your everyday spending. You can earn unlimited 1.5 miles per dollar spent on purchases and redeem them for travel benefits. Learn how to apply for the Discover it® Miles credit card and start earning rewards today!

Advertisement

Discover it® Miles Card: Redeem your rewards in cash or travel credit!

The Discover it® Miles card is an excellent option for frequent travelers. Especially if you are looking to get bonus rewards without worrying about annual fees.

With an attractive feature for new clients, you can obtain 1.5x miles per dollar spent, and Discover will match the amount by the end of your first year.

There is no minimum spending required, and you can choose how to redeem your reward to use it any way you want. So, keep reading if you’re interested in applying for it.

Apply online

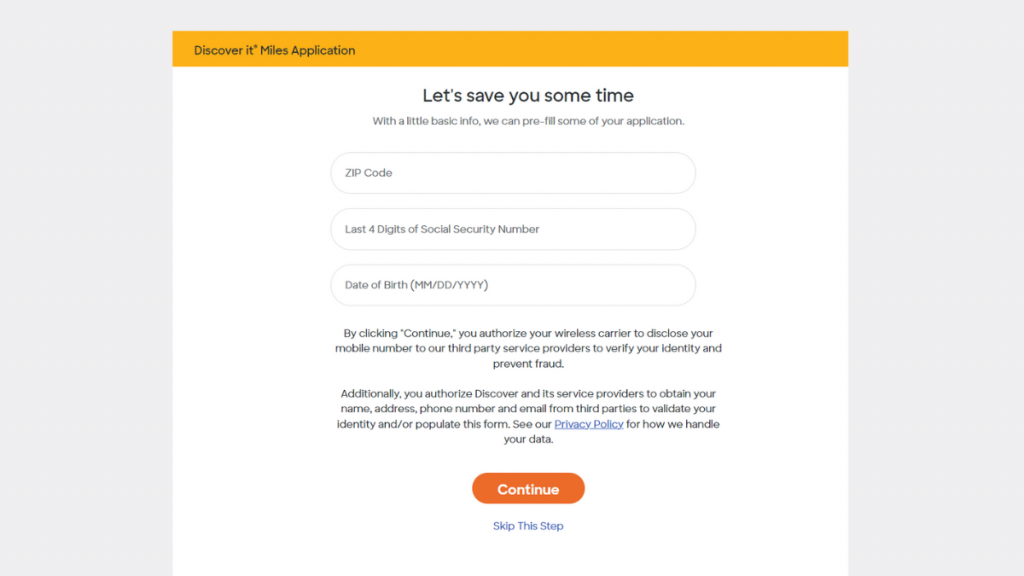

You can apply for your own card in a few easy steps, and it will only take a couple of minutes to do so.

First, you need to access the Discover official website and click on “all products.” Then, select the “credit cards” option and look for the “travel card” alternative.

By clicking on Apply Now, the website will redirect you to a security form that you will need to fill out with your personal information.

Once you’re done providing all of your info, read the terms and conditions carefully to avoid any confusion about any fees and payment conditions in the future.

If you agree to those terms, tap the box next to it and send in your request. If your application is approved, you should receive a call or an e-mail in the next couple of days.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Discover has a fantastic app that helps Discover it® Miles card clients manage their accounts and stay on top of their finances.

However, you can’t apply for any of their products on it. You must visit their website for new credit card requests or call 1-800-DISCOVER.

Discover it® Miles credit card vs. American Express® Gold Card

After learning all the benefits the Discover it® Miles card has to offer, you’re still unsure if it’s the right choice for you? No worries!

To help you decide, we brought a similar product in the same category. The American Express Gold card offers excellent travel bonuses and a unique Rewards Program.

| Discover it® Miles Credit Card | American Express® Gold Card | |

| Credit Score | Good – Excellent. | 670 or higher. |

| Annual Fee | $0. | $250. |

| Regular APR | Zero interest for the first 15 months; then a variable, between 17.24% and 28.24%. | Variable, between 21.24% to 29.24% on eligible purchases. |

| Welcome bonus | Miles-for-match for every point earned after the first year as a new cardholder. | Up to 90,000 Membership Rewards® Points with minimum spending of $6,000 in the first 6 months. |

| Rewards | 1.5 miles for every dollar spent using the card. | 4x bonus points on dining and groceries shopping; 3x on flights booked through Amex Travel; 1x on all other eligible buys. |

How to apply for the American Express® Gold Card

An excellent card for travel and dining enthusiasts who are looking for profitable rewards! Learn how to apply for the American Express® Gold Card!

Trending Topics

The Quick Way To Apply For A Job At TGI Friday’s

Build your career from the ground up with the entry-level training programs for a job at TGI Friday's - Learn to apply here!

Keep Reading

Applying for the Luxury Black credit card: learn how!

Want to know what it takes to get your hands on a Luxury Black card? We'll show you how easy it is to apply so you can start earning rewards!

Keep Reading

One Finance hybrid account review: read before applying

Check our One Finance Hybrid Account review to learn about the unique benefits and features this account has to offer! Read more now.

Keep ReadingYou may also like

Luxury Titanium credit card full review

Want to travel in style and earn cash back? Check out our Luxury Titanium card review and see how its features can benefit you.

Keep Reading

Alliant Credit Union HELOC review: Your Home Equity Solution!

Looking for a flexible and affordable way to finance your home improvements? Check out our Alliant Credit Union HELOC review!

Keep Reading

OnPoint Community Credit Union HELOC: apply now

Get rate discount and fast funding. Apply for the OnPoint Community Credit Union HELOC and achieve your full potential! Read on and learn!

Keep Reading