Finances

9 retirement planning mistakes to avoid

To have a peaceful retirement, it is essential to start thinking about how to do it. Learn about the main planning mistakes and learn how to avoid them.

Advertisement

Find out what are the biggest mistakes people make when preparing for retirement

Planning for retirement is a common concern for all workers who have been in the job market for a long. However, many mistakes can be made by people when planning for retirement.

What are Medical Loans?

If you need to pay for medical expenses but don't have the money to do it, you should read on to learn about medical loans!

Fortunately, it’s never too late to start the retirement planning process. But before that, people must avoid many common mistakes when planning to reap the rewards of a lifetime of work. Check out!

Planning your retirement? These are the 9 mistakes to avoid!

Planning for retirement is not easy, and there are many challenges. After all, you must consider several factors for your retirement to be smooth.

However, many people make several mistakes when planning for retirement, which can have serious consequences. So, check out the separate tips to help you in this mission.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

1. Not planning for retirement in advance

The sooner you think about saving, the less trouble you will have maintaining your financial standard when you retire. If you start saving after years of work, more money will need to be spent monthly.

Therefore, you must start thinking about your retirement as early as possible. That way, you can have enough money to guarantee a comfortable life in the future.

2. Not being flexible

Many people wait only for the social benefit to retire, which is perhaps one of the biggest mistakes. Other people make some investments, such as bonds, pensions, and real estate, to live on income, etc.

However, most do not diversify their investments, choosing only the more traditional options.

This is another mistake, as many confuse trivial with security. Being too conservative can prevent you from being safe when you don’t work anymore.

Some variable-income investments, such as stocks, can yield better than fixed-income ones. In this case, it is possible that the retiree even uses the profits acquired in this type of investment.

Thus, he makes his money with income from diversified investments. Of course, this process has more risk, so it’s worth identifying your investor profile.

Safe investments: learn the best low-risk

In this article you are going to find out about three of the best low risk investments you can have in times of economic uncertainty.

3. Not saving enough

Saving for retirement or living your retirement today? This is one of the most common questions among adults and young people when considering retirement.

You will make a choice that will have profound implications for the last 30 years of your life. Saving for retirement is about priorities and alternatives.

That is, you need to make some choices. Maybe think about taking less luxurious trips, or even stop buying such an expensive car. Thus, you can ensure greater comfort during retirement.

4. Not having a financial plan

One of the main mistakes when thinking about retirement is the lack of financial planning. After all, you need to take stock of some points to know how much you need to save to have a healthy old age.

In this sense, creating a plan that considers life expectancy, where you want to be, and your health status is necessary. In addition, you need to consider the planned age and the desired lifestyle.

You can plan well on the total amount to save from these points. In this way, the future will be safer and with a very peaceful retirement.

5. Not reflecting on the impact of changing jobs

The 401(k) plan, one of the most common retirement plans in the United States, considers job switching.

Therefore, many people forget about this factor and change jobs without reflecting on this impact on retirement.

Generally speaking, a worker in the United States changes jobs around 12 times in a lifetime. In this way, he leaves a significant amount of money behind without even realizing it.

Therefore, you must choose a job well before joining a company. Also, you should always remember the impact a job change will have on your retirement. So you can choose the best value for money.

6. Not paying debts

If you don’t have proper control of your debts, this can become a big problem. After all, you will be dragging the payment of debts into the future, which can reflect a headache in retirement.

So, try to use your debit card more or make cash payments, avoiding loans and credit. Also, build your emergency fund so that you don’t have to resort to these means that get into debt.

Also, try to save on superfluous things and think that old age requires good money saved. Have a financial plan to control your monthly expenses.

7. Not thinking about health and the costs of it

According to official data, every 65-year-old retiree may need $300,000 to cover old-age health care costs. This money needs to be saved, and planning is the way to do that.

However, a golden tip is to take care of your health now so that this cost goes down. That is, practice some exercise, not be sedentary, and eat well. Also, take care of mental health, our most precious asset.

8. Not Planning for Tax Implications and ignoring inflation

In addition to considering all the other factors already mentioned, many people forget to calculate retirement taxes. And this can take the elderly by surprise, with major associated tax implications.

Also, disregarding inflation is another mistake, as the economy is cyclical, and the inflation rate can take some of your money. After all, macroenvironmental factors directly influence these values.

One way to avoid this is to plan for tax amounts and stimulate inflation. Discuss how your retirement will be taxed and discuss with a tax advisor to find out more.

9. Not Leveraging Employer Correspondence for 401(k)

Many people do not take advantage of what companies offer 401(k). This is another big mistake regarding retirement. After all, if you apply, you can enjoy the full value of employer correspondence.

Normally this match equals a percentage of your salary. So, if you contribute an amount of your salary, the company can cover half of that percentage, which is great.

Also, some companies may cover this amount completely. It is worth talking to the hiring department to determine your company’s conditions.

And if you want to learn about the best retirement accounts alternative to a 401(k) plan, we can help! Check out our post below to learn all about it!

Retirement accounts alternative to a 401(k) plan

With all the talk about 401(k) plans, you might be missing out on some better retirement account options. Here's an overview of two lesser known accounts and their bene

Trending Topics

Apply for Lexington Law: how to get your approval fast

Lexington Law can help you rebuild credit. Check out how to apply for Lexington Law and succeed with this credit repair company!

Keep Reading

What is an NFT: understand how this digital asset works

Ever wondered what is an NFT? This digital asset works as a new fully digital currency. Learn more about this new technology.

Keep Reading

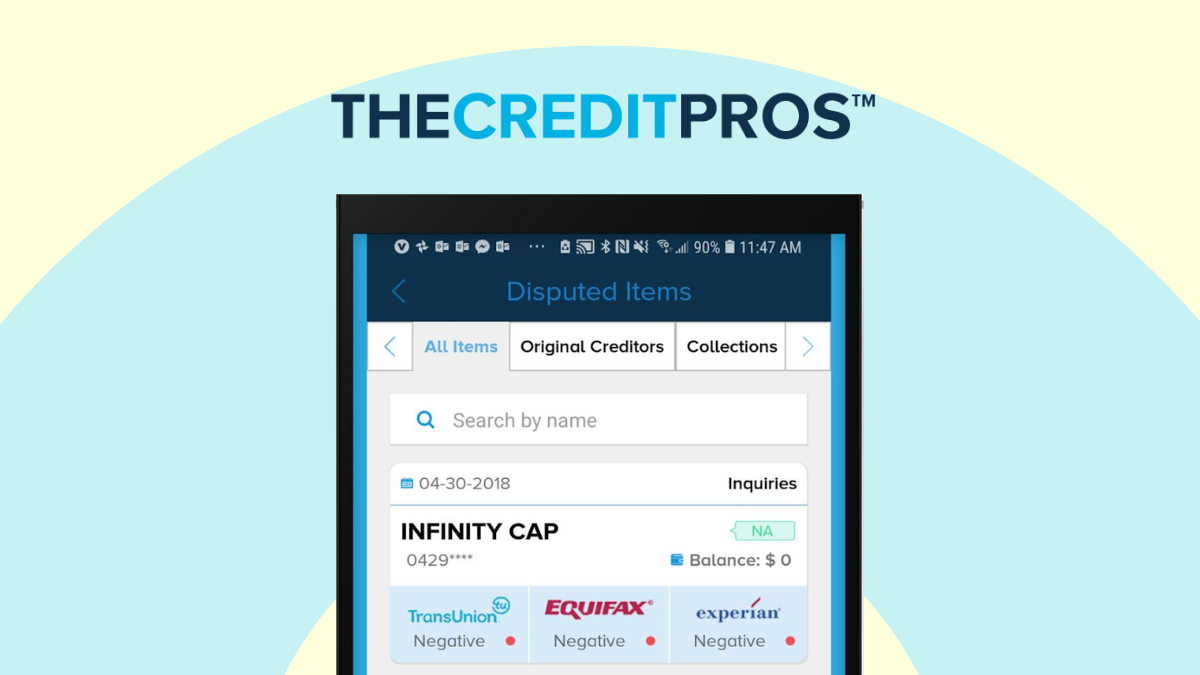

The Credit Pros review: become debt-free!

The Credit Pros deserves this review because it is one of the best credit repair companies in the US. Read to learn how it works.

Keep ReadingYou may also like

Get the Funds You Need with Ease: Republic Bank Loans review

Need a personal loan? Republic Bank offers unsecured loans with terms up to 180 months. Discover the benefits and drawbacks before you apply.

Keep Reading

OakStone Gold Secured Mastercard credit card full review

In this review, find out the benefits of the OakStone Gold Secured Mastercard, such as no credit checks, low APR, and more!

Keep Reading

Earned Income Tax Credit (EITC): eligibility and benefits

The Earned Income Tax Credit is a refundable tax credit for low or moderate-income workers. Learn more!

Keep Reading