Credit Cards

Amex Blue Cash Everyday® Card Review: Earn more!

Learn all about the American Express Blue Cash Everyday® Credit Card in our detailed review. Pay $0 annual fee and enjoy exclusive perks.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

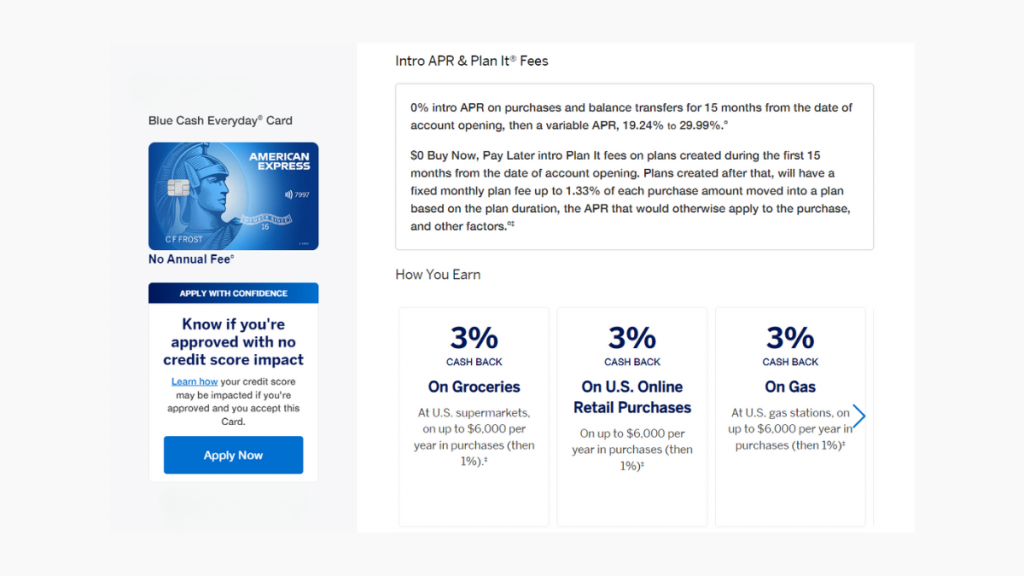

Blue Cash Everyday® Card: Earn up to 3% cash back on purchases

Learn more about this credit card at our Blue Cash Everyday® Credit Card review. Earn cash back on purchases and enjoy several perks.

This credit card has an introductory interest rate and bonus rewards that can be redeemed at supermarkets, gas stations, and online retailers. So read on for more!

- Credit Score: Good to excellent;

- Annual Fee: $0 (rates & fees);

- Regular APR: 0% intro APR for 15 months from account opening; 18.24% to 29.24% on purchases and balance transfers after (rates & fees);

- Welcome bonus: Earn up to $250 back after spending $2,000 on purchases in the 1st 6 months of card Membership (terms apply);

- Rewards: 3% cash back on groceries, U.S. Online retail purchases, and gas stations; 1% cash back on other purchases (terms apply).

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the Blue Cash Everyday® Credit Card work?

The Blue Cash Everyday® Credit Card is perfect for those who want to maximize their finances.

For example, cardholders can count on an introductory APR for 15 months from the account opening with this credit card. Also, it charges no annual or monthly fees.

Also, they can earn up to 3% cash back on purchases received as Reward Dollars. The earned points can be redeemed as a statement credit.

You can also receive a $7 statement credit monthly after spending $12.99 or more with The Disney Bundle. It gives you access to Disney Plus, Hulu, and ESPN Plus.

Lastly, cardholders can enjoy Car Rental Loss, Damage Insurance, and Global Assist Hotline. This can help you travel safely to several destinations.

Blue Cash Everyday® Credit Card will help you save a lot on purchases. Its reward program won’t let us lie.

However, if you’re unsure if this card is the right option, don’t worry! Therefore, we’ve brought the main details of this product to help you decide.

So compare below the pros and cons of the Blue Cash Everyday® Credit Card!

Pros

- It charges no annual fee;

- 0% intro APR on purchases and balance transfers for 15 months;

- Up to 3% cash back on purchases;

- Earn $250 back after spending $2K in purchases (terms apply).

Cons

- This card has limits for the cashback;

- This card charges a $40 late fee;

- It charges 2.7% per foreign transaction.

Are you interested in this credit card option? To make an informed decision, read our instructions on how simple it is to apply for it!

This credit card offers several benefits to its clients. Therefore, a good credit history is required for membership based on the above information.

As a result, you’ll need a FICO score of at least 670 to grant a Blue Cash Everyday® Credit Card.

Requirements

Age and Residency:

- You must be at least 18 years old (or the age of majority in your state).

- Must be a legal resident of the United States with a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

Income Verification:

- Applicants need to demonstrate a steady source of income to ensure the ability to repay the credit card balance. This information is typically provided during the application process.

Existing Debts:

- Your debt-to-income ratio is considered during the application review. A lower ratio increases your likelihood of approval.

Credit History:

- A solid credit history with timely payments, low credit utilization, and few or no recent negative marks can improve your approval chances.

Application Information:

- Personal information such as name, address, employment details, and contact information must be provided during the application process.

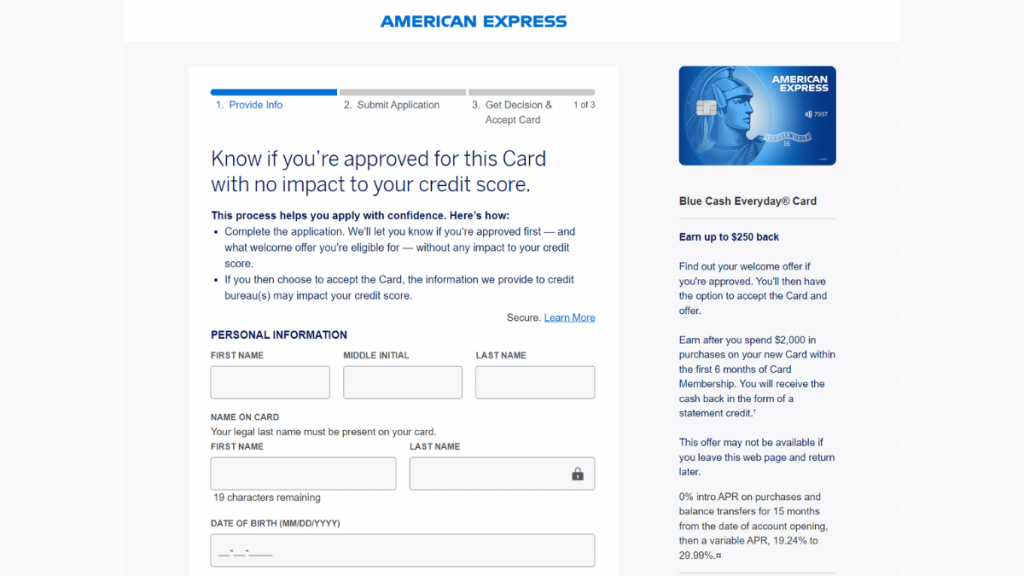

Apply online

First, you’ll need to access the website we’ve provided above! There, select the “Apply Now” option to get started.

Further, you must fill out a form with your personal information, including full name, email address, date of birth, phone number, and home address.

After checking all the information you’ve provided, follow the steps to complete your application.

You’ll only need to wait for the result to see whether you’re approved! Simple, isn’t it?

Apply using the app

American Express provides an excellent mobile app to its customers. However, you cannot apply for this card through it!

To do so, you’ll need to access their official website. Still, you can easily manage your account from anywhere.

Track spending and rewards, find offers, check your balance, and pay your bill with the Amex app.

So, touch ID and Face ID are fast, safe, and secure on compatible devices. Fast, secure, and convenient: Amex® Mobile App.

If you have doubts whether the Blue Cash Everyday® Credit Card is the best option for you, how about checking the comparison table below?

Both require same-level credit scores. In addition, both annual fees cost a total of $0. So continue looking to analyze the bonuses and rewards.

Blue Cash Everyday® Credit Card

- Credit Score: Good to excellent;

- Annual Fee: $0 (rates & fees);

- Regular APR: 0% intro APR for 15 months from account opening; 18.24% to 29.24% on purchases and balance transfers after (rates & fees);

- Welcome bonus: Earn up to $250 back after spending $2,000 on purchases in the 1st 6 months of card Membership (terms apply);

- Rewards: 3% cash back on groceries, U.S. Online retail purchases, and gas stations; 1% cash back on other purchases (terms apply).

PenFed Platinum Rewards Visa Signature® Card

- Credit Score: Good/excellent;

- Annual Fee: $0;

- Regular APR: 17.99% variable on purchases; 0% intro APR for 12 months on balance transfers made in the 1st 90 days from account opening, 17.99% after;

- Welcome bonus: 15,000 points after $1,500 on purchases during the first three months;

- Rewards: 5x points on the gas you pay at the pump and EV charging; 3x points at the supermarket, restaurants, and TV, radio, cable, and streaming services; and 1x points on any other purchase;

- Terms apply.

Has the PenFed Platinum Rewards Visa Signature® Card gotten your attention? Great! Read our following article and learn how to apply for it.

PenFed Platinum Rewards Visa Signature® Card

Do you need an incredible rewards card with points on every purchase? If so, read our PenFed Platinum Rewards Visa Signature® Card review to learn more!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The information provided was accurate at publication, though certain offers may no longer be applicable.

Trending Topics

Best Egg Personal Loan review: is it worth it?

Check out the Best Egg Personal Loan review. Enjoy approval and borrow up to $50,000 for multiple purposes. Keep reading to learn more.

Keep Reading

The current mortgage rates and how they are changing

Do you know why mortgage rates are rising again? Several reasons are given for the increase. Read on to learn more!

Keep Reading

United℠ Business Card Review: Amazing Rewards

Find out how the United℠ Business Card can help you earn rewards and bonuses on your business expenses in this review!

Keep ReadingYou may also like

First Access Visa® Card full review

If you have a low score and need a credit card, read our First Access Visa® Card review and find out how this credit card option can help!

Keep Reading

Supplemental Nutrition Assistance Program (SNAP)

The Supplemental Nutrition Assistance Program (SNAP) was designed to lift families from food insecurity. Learn all about this!

Keep Reading

No fees and no hassle: Sesame Cash Debit Card review

You just found a game changer debit card! Read our Sesame Cash Debit Card review and learn how to build credit and pay no fees! Let's go!

Keep Reading