Loans

Unlock your power: OnPoint Community Credit Union HELOC review

The key to unlocking your financial goals is here: OnPoint Community Credit Union HELOC! Ensure rate discount and much more! Read on!

Advertisement

A smart financial solution for homeowners!

In this OnPoint Community Credit Union HELOC review, you’ll discover a great financial solution to help you tap into your home’s equity and get the money you need!

OnPoint Community Credit Union HELOC: apply now

Get rate discount and fast funding. Apply for the OnPoint Community Credit Union HELOC and achieve your full potential! Read on and learn!

This credit union provides several HELOC options to build the life you’ve dreamed about for so long. So without further ado, let’s get started!

| APR | 6.25% – 11% APR – you can get fixed or variable APR depending on the HELOC options; |

| Loan Purpose | Home renovations, debt pay-off, large or unexpected expenses, vacations, weddings, and more; |

| Loan Amounts | Up to $150,000; |

| Credit Needed | Fair – Good; |

| Terms | 5 – 30 years; |

| Origination Fee | Not disclosed. |

OnPoint Community Credit Union HELOC overview

OnPoint Community Credit Union brings several HELOC options to those needing extra cash! All this with flexible and affordable solutions.

Among its HELOC options, you can find interest only, fixed-portion, fixed portion in 1st alien positions, new-owner occupied, and new-owner occupied fixed portion HELOCs!

With repayment terms ranging from 5 to 30 years, borrowers can choose between fixed or variable APR, which is a great way to find the perfect HELOC for your needs.

In addition, customers will find discounted rates in some HELOC options. In some cases, they can enjoy up to 0.25% off on the APR, which is an excellent way to save.

The HELOC amount can be used for various purposes, such as debt consolidation, home improvement, large purchases, vacations, and more! This will help you achieve your goals!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Is it worth it to apply for OnPoint Community Credit Union HELOC?

OnPoint Community Credit Union HELOC undoubtedly offers flexible solutions regarding its lines of credit! After all, with so many options, you’ll find the perfect product!

As a result, improving your cash flow was never there easy! But before applying, you need to be sure of your decision! So what about checking the pros and cons of it?

Further, we’ve compared the benefits and drawbacks of the OnPoint Community Credit Union HELOC. Check it out!

Benefits

- Enjoy a wide range of HELOC options;

- Flexible lending conditions;

- Use the HELOC amount for several purposes;

- Flexible and fixed APR options;

- No prepayment fees;

- Pay in up to 30 years.

Disadvantages

- Lack of information about fees, to learn more you must contact them.

What credit score is required for the application?

You must have at least a fair credit to get an OnPoint Community Credit Union HELOC. They will consider other requirements on your application.

Still, having a higher credit score will help you qualify for better overall conditions and lower rates!

How does the application process work?

Are you wondering how to apply for the OnPoint Community Credit Union HELOC? Then you don’t need to wonder any longer!

Further, keep reading and discover how simple and fast it is to apply for this lender! Are you ready to unlock your financial potential? Then let’s get started!

OnPoint Community Credit Union HELOC: apply now

Get rate discount and fast funding. Apply for the OnPoint Community Credit Union HELOC and achieve your full potential! Read on and learn!

Trending Topics

Up to $25,000: U.S. Bank Personal Line of Credit review

Read our in-depth review of the U.S. Bank Personal Line of Credit to discover if it's ideal. Get affordable conditions and low rates!

Keep Reading

Citrus Loans: how to apply now!

Citrus Loan can lend you up to $2,500 with a bad credit score. Learn how to apply for Citrus Loan and get your money today!

Keep Reading

Applying for the X1 Credit Card: learn how!

Searching for an easy way to apply for the X1 Credit Card? Look no further! This card has no annual fee and a reward program! Read on!

Keep ReadingYou may also like

Best student credit cards of 2022: 7 great options

Choosing among the best student credit cards is not easy. Discover the best options for 2022 and decide which one will be yours.

Keep Reading

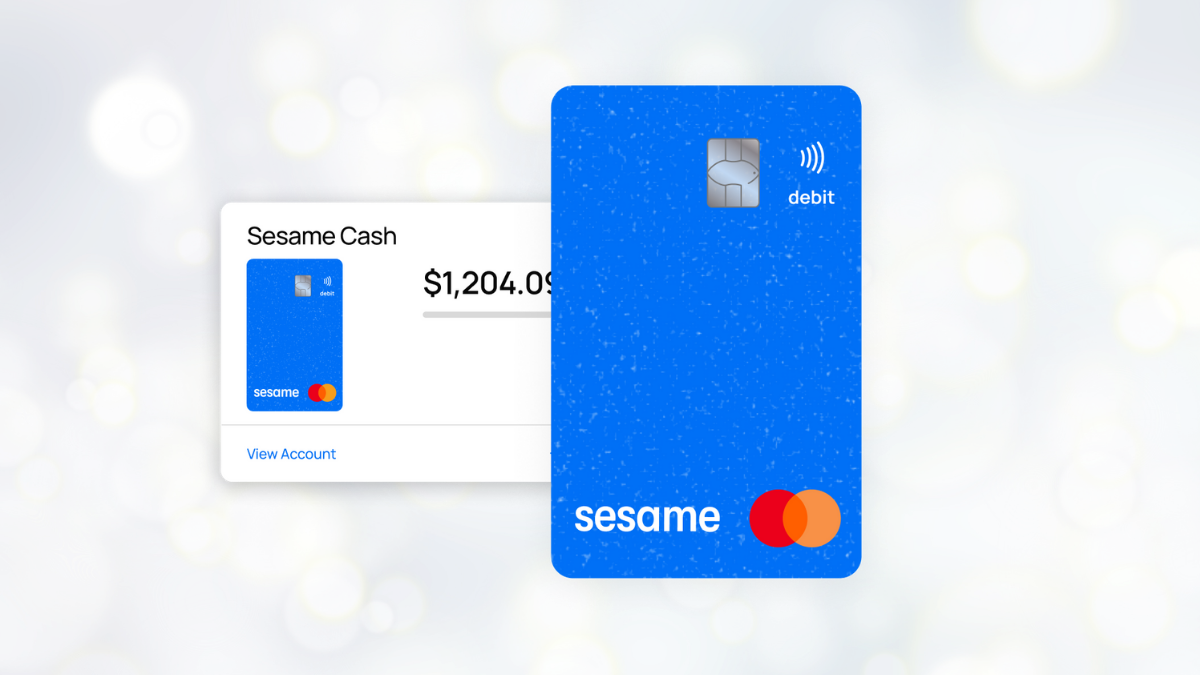

Elevate your finances: Apply for the Sesame Cash Debit Card today

Upgrade your online banking experience! Apply today for the Sesame Cash Debit Card and earn cash back on select brands! Read on!

Keep Reading

100 Lenders Personal Loan review: is it worth it?

Get an in-depth review at how the 100 Lenders Personal Loan can help customers find the best loan for their needs! Up to $40K! Read on!

Keep Reading