Credit Cards

BMO CashBack Mastercard card or Capital One Venture Rewards card: find the best choice!

Choosing a new credit card can be difficult. Do you go with a no-annual-fee option like the BMO CashBack Mastercard, or do you spring for a card that offers travel rewards like the Capital One Venture Rewards? Check this comparison to help you decide!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

BMO CashBack Mastercard credit card or Capital One Venture Rewards card: get tailor-made rewards!

If you’re looking for a high-value rewards credit card and are torn between the BMO CashBack Mastercard or Capital One Venture Rewards card, we can help you. When it comes to choosing a rewards product, there are many options to consider. Do you want cash back or travel rewards? How important is the annual fee? And what kind of bonus opportunities are available?

In this post, we’ll compare the two popular rewards products. We’ll take a look at the benefits and features of each card to see which one is the better option. Keep reading to find out more!

How to apply for a BMO CashBack Mastercard Card?

See how to apply for a BMO CashBack Mastercard Credit Card and start earning rewards on everyday purchases!

Capital One Venture Rewards Credit Card Review

Do you love to travel but don't want to spend a fortune on flights and hotels? If so, check out the Capital One Venture Rewards Credit Card.

| BMO CashBack Mastercard credit card | Capital One Venture Rewards credit card | |

| Sign-up bonus | 5% cash back in your first 3 months, plus a $50 cash back bonus by spending $6,000 in your first year | 60,000 bonus miles after spending $3,000 within the first 90 days of account opening |

| Annual fee | $0 | $95 |

| Rewards | 3% cash back on groceries; 1% cash back on bills; 0,5% cash back on all other purchases. | 2 miles per dollar on every purchase; 5 miles per dollar on car rentals and hotels booked through Capital One Travel |

| Other perks | Flexible Redemption options | No foreign transaction fees |

| APR | 19.99% – 22.99% | 15.99% – 20.99% – 23.99%, based on creditworthiness |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

BMO CashBack Mastercard credit card

Issued by the Bank of Montreal, this card has Mastercard coverage and nationwide acceptance. It charges no annual fee, and new cardholders get a welcoming bonus of 5% cash back in their first 90 days, plus a $50 cash back bonus by spending $6,000 after their first year.

Customers carrying a balance can take advantage of its 1.99% intro APR for 9 months with a 1% transfer fee. After that period, the card has a constant interest rate that varies between 19.99% and 22.99%. The BMO CashBack Mastercard credit card offers a stand-out 3% return rate on groceries with a $500 spending cap per statement period.

Other benefits include 1% cash back on bills and a flat 0,5% unlimited rate on all other purchases. You can redeem all earned points any time, starting at $1. Your credit score must range from good to excellent to request this credit card. Plus, you’ll need an annual income of at least $15,000.

You can apply through BMO’s official website or via their mobile app, and the process is simple with step-by-step guidance by the bank. If you’re interested in getting this card, check below for its main pros and cons before deciding.

Benefits

- Excellent cash back rates on groceries;

- Reasonable welcome bonus;

- No minimum redemption;

- No annual fee.

Cons

- Spending caps on high rate categories;

- No 0% intro APR;

- Flat 0,5% rate is not suitable for big spenders.

Capital One Venture Rewards credit card

Known as one of the most popular credit cards on the market, the Capital One Venture Rewards Credit Card is a travel-related product that pays high rates on every purchase. It charges a $95 annual fee, and there is no promotional introductory APR. Its interest rates depend on your creditworthiness, varying between 15.99%, 20.99%, or 23.99%.

This card offers an exciting welcome bonus of 60,000 miles once new cardholders spend $3000 on purchases within the first 90 days. You can get 5x miles by booking your next trip through Capital One Travel and 2x miles on every other purchase. All earned miles don’t expire as long as the account is active. There’s also no foreign transaction fee, making this card the ideal companion overseas.

However, this card provides no domestic transfer partner for bonuses, and earned points decrease in value when redeeming them for cash back. To apply for this card, you’ll need an excellent rating on your FICO score. Applications are available through Capital One’s website or mobile app.

If you think the Capital One Venture Rewards Credit Card is the best choice for your financial needs, check its pros and cons below before sending in your application. That way, you can make an informed decision.

Benefits

- High rewards rates on travel purchases;

- No foreign transaction fees;

- Miles don’t expire so long as the account is open;

- Flexible redemption options;

- Travel insurance.

Cons

- Require good/excellent credit score;

- Cash back redemptions decrease miles value;

- No choice to redeem travel miles domestically;

- High annual fee.

BMO CashBack Mastercard or Capital One Venture Rewards: still not sure which is the best card option for you?

So, which card is better? The BMO CashBack Mastercard or Capital One Venture Rewards card? That’s a tough question to answer! Both the BMO CashBack Mastercard and the Capital One Venture Rewards card have their own unique benefits.

Ultimately, it depends on what you’re looking for in a credit card. If you want a card that gives you cash back on your purchases, the BMO CashBack Mastercard is a great choice. If you’re looking for a card that lets you earn travel miles, the Capital One Venture Rewards card is a good option.

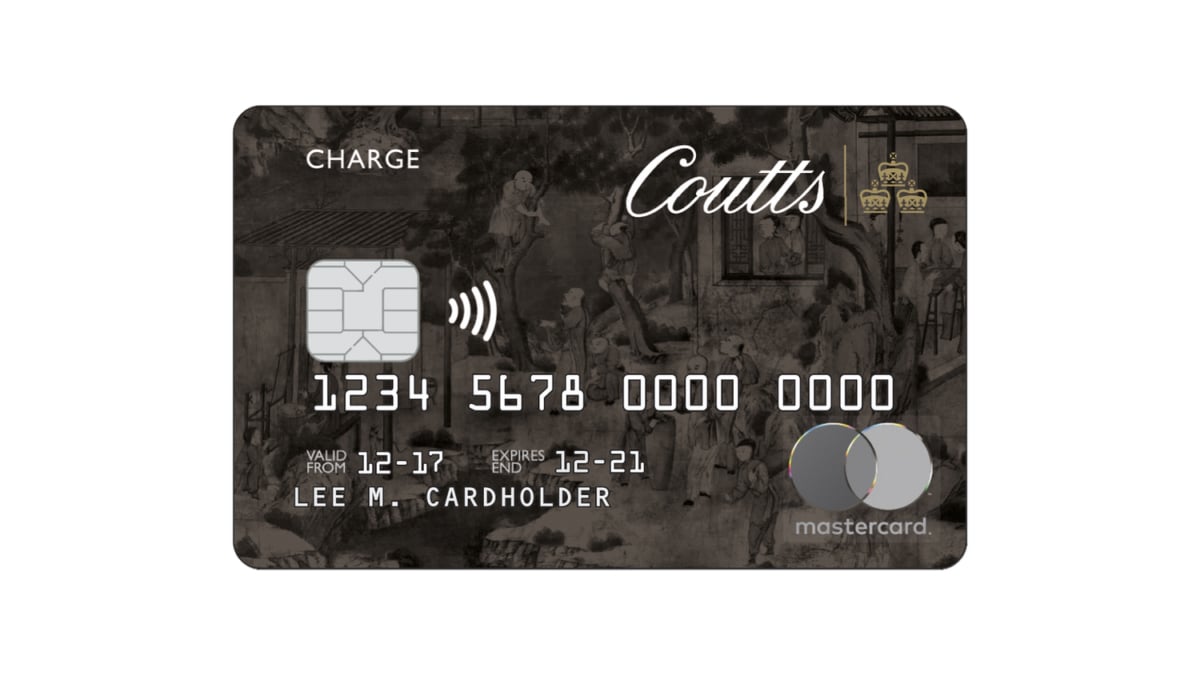

At the end of the day, it’s essential to choose a credit card that fits your needs. Do some research and compare different cards to find the right one for you! To help you with that process, we brought a third option with the Coutts World Silk credit card.

Known as the Queen’s card, this is one of the most exclusive products in the world. It comes with many benefits, a low APR rating, and no annual fee! Check the link below for its full review and learn more about the Coutts alternative.

Coutts World Silk credit card full review

Check our full review for the Coutts World Silk credit card, one of the most exclusive products in the world!

Trending Topics

Home Depot Consumer Credit Card full review

Looking for a comprehensive review of how the Home Depot consumer credit card works? Read on to find out! No annual fee!

Keep Reading

5 best cards that offer welcome bonuses: choose and enjoy!

Wondering what are the cards that offer welcome bonuses? Check out the best sign-up rewards products and start earning points today!

Keep Reading

Different types of loans available: which one is right for you?

Need a loan but don't know which one to choose? Don't worry. We'll help you. Check out the different types of loans.

Keep ReadingYou may also like

Custom Choice Student Loan Review: is it worth it?

Do you need money to complete your studies? The Custom Choice student loan may be what you are looking for. Learn more!

Keep Reading

Upgrade Personal Loan Review: Up to $50,000 with Low Rates

Are you looking for a good personal loan? Check out this Upgrade Personal Loan review and find out if it could be your solution!

Keep Reading

Would a rise in corporate taxes help curb inflation?

Could a rise in corporate taxes help curb inflation? Learn more about how corporate taxes could impact prices and the economy as a whole.

Keep Reading