Credit Cards

Chase Sapphire Preferred® Credit Card Review

This is a full review of the Chase Sapphire Preferred®, one of the best travel credit cards in the matter of rewarding. Read this article to learn more about it!

Advertisement

The travel card that gives you amazing rewards

If you’re looking for a travel credit card that gives you a lot of reward points, the Chase Sapphire Preferred® Credit Card is perfect for you.

It is one of the favorite cards among travelers that want to take the best advantage of their credit cards. Do you want to know how to explore all of its benefits? Read On!

| Credit Score | 690 or higher. |

| Annual Fee | $95. |

| Regular APR | 19.99% – 28.24% variable. |

| Welcome bonus | 60K bonus points after $5,000 spent in the first 3 months. |

| Rewards | 5x points on travel purchased through Chase Ultimate Rewards; 3x points on dining; 3x points on select streaming services and online grocery purchases; 2x points on other travel purchases; 1 point per $1 spent on all other purchases. |

How does the Chase Sapphire Preferred® Credit Card works?

The Chase Sapphire Preferred® is a travel credit card. You’ll get many reward points if you use it to buy your tickets and book hotels.

But it is also an excellent card for daily use. You receive points for every purchase you make with the card.

If you pay attention to calculating the points and how they work, you can get hundreds of dollars worth in rewards. That justifies the $95 annual fee.

The welcome bonus is really attractive. The 60,000 points can value $750 if you redeem them through Chase Ultimate Rewards.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Chase Sapphire Preferred® Credit Card pros and cons

Want to make sure this card is the right fit for you? Take a closer look at its key advantages and possible drawbacks to make an informed decision.

We’ve listed the main pros and cons below, so you can weigh the benefits and understand any limitations before applying!

Pros

- Excellent welcome bonus, with high potential value;

- One of the best Reward Points programs among travel credit cards;

- The rewards, credits, and discounts can pay off the annual fee;

- No foreign transaction fees.

Cons

- It doesn’t give cashback, as it has its own reward points program;

- The annual fee of $95 is worth it only if you use the card often to get enough points to redeem;

- If you have already received the welcome bonus on any other Sapphire-branded Chase credit card, you can’t receive a new one within 48 months. And the welcome bonus is one of the best benefits of this card.

What credit score do you need to have?

You’ll need an excellent credit score. This is not an easy card to be approved, and the recommended is that you have a credit score of 690 or higher.

If you’re not there yet, you can learn how to build your credit score to get your travel credit card. You can start with lower-range credit cards that are usually easier to get approved.

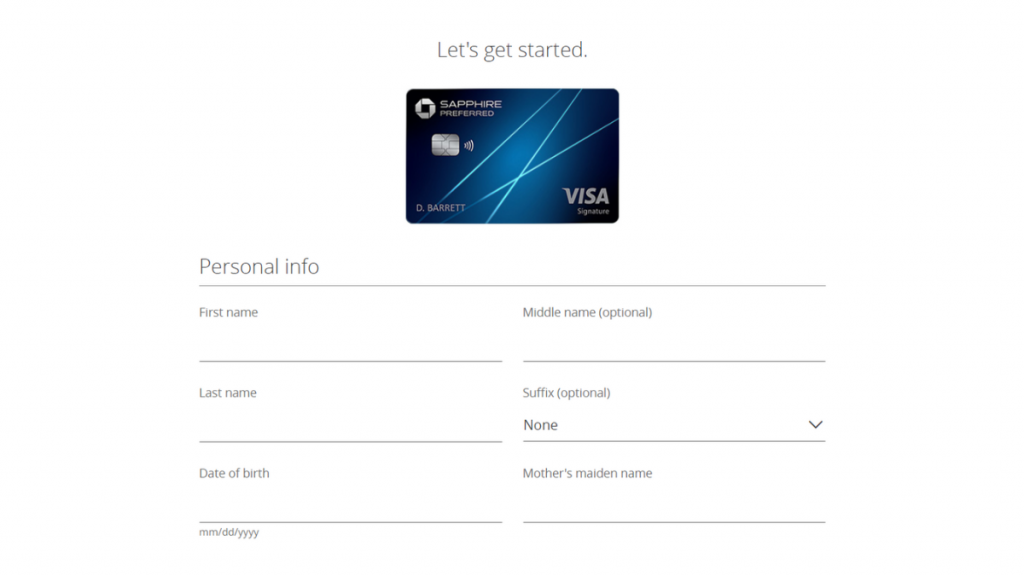

How to apply for the Chase Sapphire Preferred® Credit Card?

If you’re looking for a travel rewards credit card with high benefits and low annual fees, the Chase Sapphire Preferred® Credit Card is definitely worth considering.

With this card, you’ll earn points that can be redeemed for travel expenses, merchandise, or gift cards.

So if you’re ready to start enjoying all the fantastic benefits a Chase Sapphire Preferred® Credit Card has to offer, read on to find out more!

Apply online

The application for the Chase Sapphire Preferred® can be done online. All you have to do is go to the official Chase website and look for the page of the card.

After you hit the button to apply, you’ll be redirected to a form. It is relatively long, where you’ll have to inform your contact and personal information, like full name, e-mail, address, and so on.

Also, you’ll have to inform your Social Security Number and your income.

Remember to check the eligibility requirements before doing it.

- Credit score great or excellent.

- Open less than five credit accounts in the last 24 months.

Apply using the app

Chase Bank has an app for its users to administrate their bank and credit accounts. However, if you’d like to apply for a credit card, you’ll have to go to their website.

Chase Sapphire Preferred® Credit Card vs. The Platinum Card® from American Express

Another option for a travel credit card is The Platinum Card® from American Express. This is a way more luxurious and expensive card.

So, check out the comparison chart below to learn more about it and choose the best option for your financial needs!

| Chase Sapphire Preferred® Credit Card | The Platinum Card® from American Express | |

| Credit Score | Good to Excellent. | Excellent. |

| Annual Fee | $95 | $695 |

| Regular APR | 19.99% – 28.24% variable. | 21.24% to 29.24% variable on eligible charges. |

| Welcome bonus | 60K bonus points after $4,000 spent in the first 3 months. | Earn up to 125,000 Membership Rewards® Points after spending $8,000 within the first 6 months. |

| Rewards | 5x points on travel purchased through Chase Ultimate Rewards; 3x points on dining; 3x points on select streaming services and online grocery purchases; 2x points on other travel purchases; 1 point per $1 spent on all other purchases. | 1x to 5x Reward Points for each dollar spent (according to the category of each purchase). |

If you’d like to get your Platinum membership and get your travel credit card, we have an article about it here at the Stealth Capitalist. Read the content below and apply for your card.

American Express Platinum review

Learn how to apply for The Platinum Card® from American Express and check out the benefits you'll get with the best travel card in the market!

Trending Topics

Upgrade Cash Rewards Visa® credit card full review

Want a card with good cashback and fixed monthly fees? Then, read on to learn about the Upgrade Cash Rewards Visa® credit card.

Keep Reading

Pay $0 annual fee: Assent Platinum Secured Credit Card review

You just found the card that works for you! Read our Assent Platinum Secured Credit Card review and learn how! Build credit quickly!

Keep Reading

Upgrade Triple Cash Rewards Visa® Credit Card Review

The Upgrade Triple Cash Rewards Visa® Credit Card has an excellent performance, with good cashback rates. It will optimize your money.

Keep ReadingYou may also like

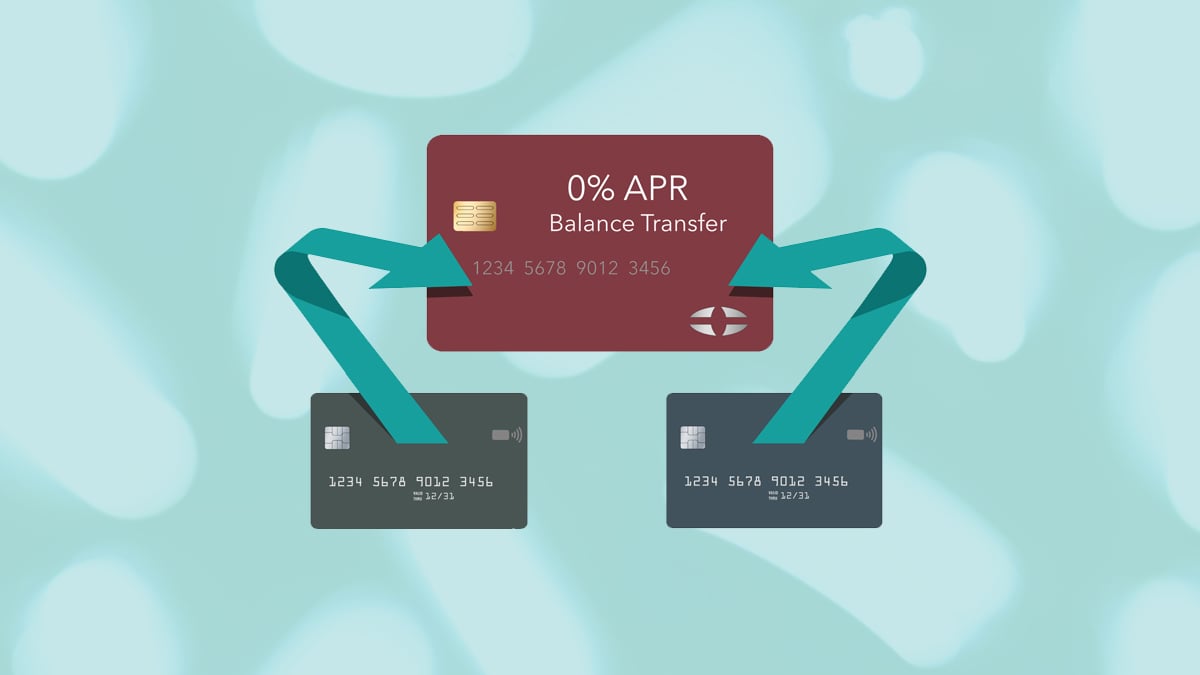

Balance transfer credit card: what is it?

Read this article to learn what is a balance transfer credit card and how it can help you save a lot of money on interest rates!

Keep Reading

700 credit score: is it good enough?

Wondering if a 700 credit score is good enough to get you the best interest rates and terms on loans? Find out now.

Keep Reading

The Credit People review: repair your credit with confidence

A good credit score opens doors for negotiations. Check out this review from The Credit People, a great option to improve your finances!

Keep Reading