Credit Cards

Citi Strata Premier℠ Card Review: Earn Much More!

The Citi Strata Premier℠ Card has everything a smart traveler could ask for. It gives you reward points with everyday purchases to turn into air tickets or cashback. Read more about it.

Advertisement

Citi Strata Premier℠ Card: Turn your points into cash on your pocket

In this Citi Strata Premier℠ Card review, you’ll learn exactly why this card is one of a kind. Experts in the credit card points area admire its strong reward program.

If you like to have the flexibility to choose how to redeem your points, this card is for you. You can even turn your points into cash on your account.

Disclaimer: This credit card has been revamped as Citi Strata Premier℠ Card, previously Citi Premier® Card.

| Credit Score | Good to Excellent. |

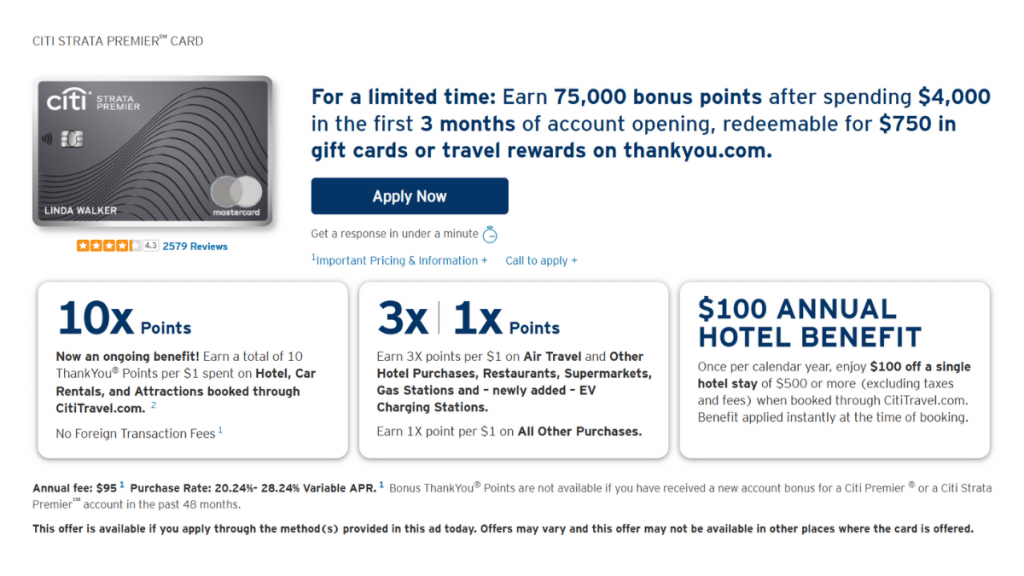

| Annual Fee | $95. |

| Regular APR | 20.24% – 28.24% variable. |

| Welcome bonus | 75,000 points after $4,000 spent in the first three months. |

| Rewards | 10x points per $1 spent on Hotel, Car Rentals, and Attractions booked through CitiTravel.com; 3x Points for air tickets, hotels, gas stations, supermarkets, and restaurants; 1X points on all other purchases. |

How does the Citi Strata Premier℠ Card work?

If you’re looking for your first travel rewards credit card, consider the Citi Strata Premier℠ Card.

This card doesn’t offer a long variety of discounts or perks. However, the reward points program is spectacular for a travel credit card with a low annual fee.

The best advantage is the possibility of making points for everyday purchases. You’ll make 3 points for each dollar spent on the following purchases:

- air tickets

- hotel

- gas station

- supermarkets

- restaurants

- delivery and take out

Each point can value up to 1,7CPP. So, the welcome bonus alone can be worth more than $1,300. If you redeem your ThankYou points as cashback, they’ll be valued at 1 CPP.

Citi ThankYou Rewards Program has various airline partners to transfer bonus points, which gives you more autonomy to choose what’s best for you.

Also, you’ll have access to the World Elite Mastercard benefits, including damage and theft protection and extended warranties.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

CCiti Strata Premier℠ Card pros and cons

Check some highlights of the pros and cons of the Citi Strata Premier℠ Card in our review:

Pros

- Excellent welcome bonus.

- Competitive CCP rate.

- Reward points in almost all of the everyday expenses.

- An extensive list of partners to transfer your ThanYou points.

Cons

- There is a low variety of perks, credit, and discounts.

- Has a $95 annual fee.

- You won’t be eligible for the bonus points if you have received them on any other Citi credit card in the last 24 months.

Want to apply for the Citi Strata Premier℠ Card?

The Citi Strata Premier℠ Card has a marvelous performance in the reward points program.

If you love to travel, you know that using the right credit card can make all the difference. This card will optimize almost every purchase by giving you 1x to 3x points for each dollar you spend.

These points are very flexible. You can choose between various airlines to transfer your points or turn them into cashback.

Below, we’ll show you how to apply for the Citi Strata Premier℠ Card , so keep reading to learn all about the process!

Does my credit score needs to be good?

To request the Citi Strata Premier℠ Card, your credit score needs to fall between the good and excellent range. Citi also considers other financial factors for approval.

Requirements

Age and Residency:

- Must be at least 18 years old.

- Must be a legal resident of the United States with a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

Income: While Citi does not specify a minimum income requirement, applicants should have a steady source of income to demonstrate the ability to manage credit obligations.

Application Frequency: Citi has specific rules regarding the frequency of credit card applications:

- You can apply for one Citi card every eight days.

- You can apply for no more than two Citi cards within 65 days.

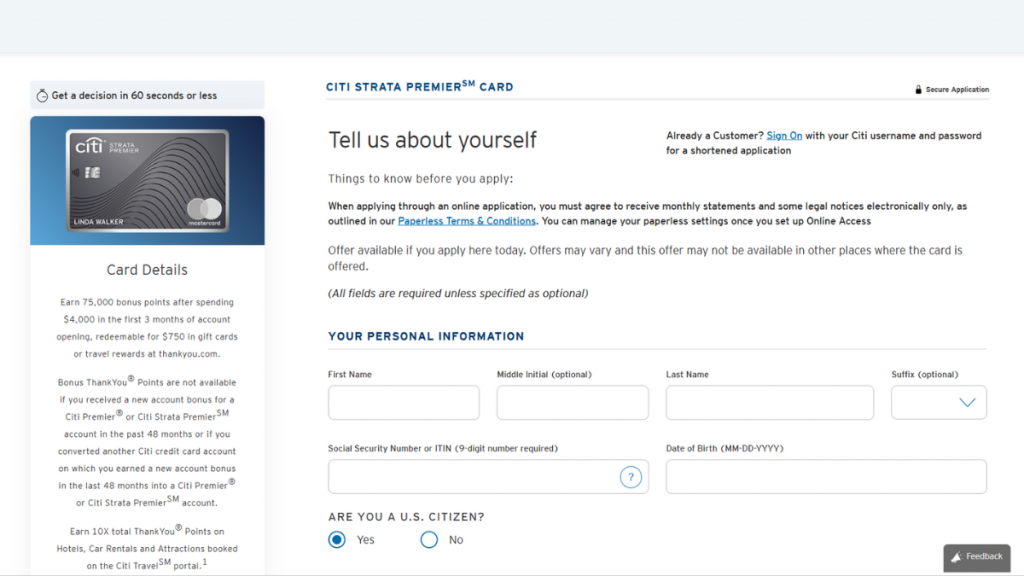

Apply online

Head to Citi’s website and locate the Citi Strata Premier℠ Card page. Click “Apply Now” to begin your secure online application process quickly.

Enter your name, address, date of birth, and Social Security number. Citi uses this data to verify your identity and assess your application for approval.

Provide your employment status, annual income, and monthly housing payment. This helps Citi determine your eligibility and creditworthiness for the Citi Strata Premier℠ Card.

Double-check all details for accuracy before submitting. Citi may offer instant approval, or you might receive a decision via email or mail within days.

Once approved, expect your card within 7-10 business days. Activate it online or through the Citi mobile app to start earning rewards immediately!

Apply using the app

We found no information about applying for the app. Citi Bank provides an app only for users to administer their accounts.

The only option besides the website is to apply by phone.

Citi Strata Premier℠ Card vs. Chase Sapphire Preferred® Credit Card

We brought you the Chase Sapphire Preferred credit card to compare with Citi Strata Premier℠ Card. They both have the same annual fee, so check the difference between their benefits:

| Citi Strata Premier℠ Card | Chase Sapphire Preferred® | |

| Credit Score | Good to Excellent. | 690 or higher |

| Annual Fee | $95. | $95. |

| Regular APR | 20.24% – 28.24% variable. | 20.49%–27.49% variable. |

| Welcome bonus | 75,000 points after $4,000 spent in the first three months. | 60,000 bonus points after $4,000 spent in the first 3 months. |

| Rewards | 10x points per $1 spent on Hotel, Car Rentals, and Attractions booked through CitiTravel.com; 3x Points for air tickets, hotels, gas stations, supermarkets, and restaurants; 1X points on all other purchases. | 5x points on travel purchased through Chase Ultimate Rewards; 3x points on dining; 3x points on select streaming services and online grocery purchases; 1 point per $1 spent on all other purchases. |

Have you considered applying for the Chase Sapphire Preferred? No worries, we have an article about it too. Just check the content below and learn how to apply for it.

Chase Sapphire Preferred® Review

The Chase Sapphire Preferred® Credit Card will give you a lot of rewards to travel the world. Learn everything you need to know to apply for it.

Trending Topics

The Vatican will launch an NFT gallery

The Vatican is developing a NFT art gallery to allow people from all over the world to access thousands of art works, manuscripts and more.

Keep Reading

Sable Review: read before applying

Need a Sable account review you can rely on? We got you! In this review we cover fees, perks, benefits, its pros and its cons.

Keep Reading

No fees and no hassle: Sesame Cash Debit Card review

You just found a game changer debit card! Read our Sesame Cash Debit Card review and learn how to build credit and pay no fees! Let's go!

Keep ReadingYou may also like

Credit card rewards: does it make you spend more money?

Do credit card rewards make you spend more? Learn if it is true, and how to use your card to your benefit without overspending it.

Keep Reading

Cash Management Account: how does it work?

If you care about your finances and investments, you should learn what is cash management account by reading this article.

Keep Reading

College Ave student loan review: is it worth it?

If you are looking for a perfect student loan with flexible terms and no origination fees, read our College Ave student loan review!

Keep Reading