Loans

College Ave student loan review: is it worth it?

Completing the studies is the dream of many people, but sometimes there is a lack of money. Check out how the College Ave student loan can save you.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

College Ave student loan review and benefits: no origination fees and flexible terms!

Studies are essential for achieving a good professional career. And to top it off, you might need some extra cash. The College Ave Student Loan may be the solution you are looking for.

The College Ave Student Loan is a great option because it makes borrowing easy.

It brings low rates for those who pay on time and those who opt for autopay. It also allows for co-signer participation, which helps to lower the APR rate even further.

And you can select a category your studies fall under to reduce the rate further. See more details about this option.

| APR* | Undergraduate Student Loans: Variable APR ranges from 1.79% to 13.85% Fixed APR ranging from 3.22% to 13.95% Graduate Student Loans: Variable APR ranges from 1.76% to 10.97% Fixed APR ranging from 3.99% to 11.98% *Terms apply |

| Loan Purpose | Undergraduate, Graduate (including MBA, law, dental, medical, and other health professions), Parent loans, Career programs, and Student loan refinancing |

| Loan Amounts | It depends on the loan type |

| Credit Needed | Not disclosed |

| Origination Fee | None |

| Late Fee* | There are late fees, but they depend on the loan type *Terms apply |

| Early Payoff Penalty | None |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

College Ave student loan: how does it work?

The College Ave Student Loan is a great option to earn credit and complete your studies. It has different loan modalities like an undergraduate, graduate, parent, and refinancing.

APR fees vary by category, but you have no origination fees and no early payoff penalty fees. In addition, you can finance your entire course, just apply in the right way.

Is it worth it to apply for the College Ave student loan?

To answer this question, it is important to analyze some factors. College Ave Student Loan has low APR rates that may vary by category. However, it also has late fees and other disadvantages. Check out the pros and cons below!

Benefits

- Possibility of pre-qualification with a smooth credit check;

- Speed in the process, being able to approve the loan in up to 3 minutes if everything is right;

- Flexible repayment options;

- No origination fees;

- Allows co-signer release for private loans, which can reduce fees.

Disadvantages

- Refinancing can only be requested if you have already completed your studies;

- Half of the refund period must have passed to release the co-signer.

What credit scores are required for the application?

To apply for a College Ave student loan, you do not need excellent credit. The average of those who succeed is a credit score of 600.

However, it is critical that you and your co-signer have a good prior credit history. Thus, your chances of approval faster are greatly increased.

College Ave student loan: applying for this loan today

The College Ave student loan is one of the best in its class. However, you need to know the College Ave student loan application so you don’t make a mistake when applying.

This loan has low fees and allows for co-signer association. In addition to flexible payment and a zero origination fee, the application process is simple and fast.

Apply online

To apply online, you need access to a computer or notebook. So get started with your online prequalification. So you already know what the fees will be.

Then just fill in your details and wait for the decision, which can be out in minutes.

Requirements

Certain requirements must be fulfilled in order for you to apply. First, you must be a US citizen and be over 18 years of age.

As it is a student loan, it is essential to be regularly enrolled in a university. Also, it is critical to have your social security number and a co-signer for eligibility.

Apply on the app

If you like to solve everything from your smartphone, you can do the process through it.

Download the app, which is available for Android and iOS. Then, you can pre-qualify and register with your personal and financial data.

College Ave student loan vs. Sallie Mae student loan: which is the best for you?

Deciding on the best loan can be quite a challenge. In addition, the minimum credit score is 600 on average.

On the other hand, you can opt for the Sallie Mae Student Loan. While it has higher APR rates, it doesn’t have any kind of extra fees and allows for customized rates depending on the course. Check the comparison!

| College Ave student loan | Sallie Mae student loan | |

| APR* | Undergraduate Student Loans: Variable APR ranges from 1.79% to 13.85% Fixed APR ranging from 3.22% to 13.95% Graduate Student Loans: Variable APR ranges from 1.76% to 10.97% Fixed APR ranging from 3.99% to 11.98% *Terms apply | Career Training Student Loans: 3.25% to 13.97% variable APR 3.75% to 14.08% fixed APR For undergraduate students: 3.25% to 13.59% variable APR 3.75% to 13.72% fixed APR Rates for graduate student loans vary |

| Loan Purpose | Undergraduate, Graduate (including MBA, law, dental, medical, and other health professions), Parent loans, Career programs, and Student loan refinancing | Undergraduate, graduate, or technical career courses |

| Loan Amounts | It depends on the loan type | $1,000 minimum and up to 100% of the school-certified cost of attendance |

| Credit Needed | Not disclosed | N/A |

| Origination Fee | None | None |

| Late Fee* | There are late fees, but they depend on the loan type *Terms apply | N/A |

| Early Payoff Penalty | None | N/A |

And if you are interested in the perks offered by the Sallie Mae student lending platform, be sure to read our post below to learn all about the application process!

Sallie Mae student loan application

Completing your studies is not an easy task, is it? But with the Sallie Mae student loan you can have peace of mind. Read to learn how to apply for a Sallie Mae loan!

Trending Topics

Alliant Credit Union HELOC review: Up to $250K

Looking for a flexible and affordable way to finance your home improvements? Check out our Alliant Credit Union HELOC review!

Keep Reading

Chase Ink Business Cash® Credit Card full review

Read our Chase Ink Business Cash® Credit Card review and learn more about this card. Enjoy up to 5% cash back and more!

Keep Reading

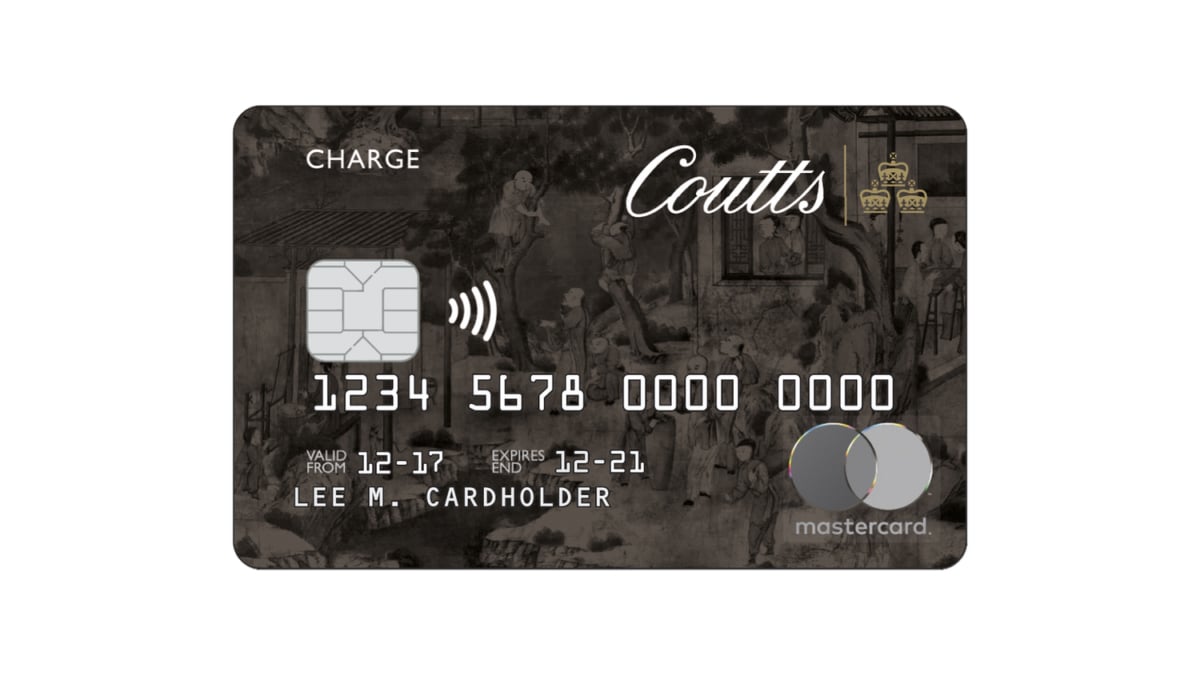

Coutts World Silk credit card full review

Discover everything you need to know about the Coutts World Silk credit card, including its features and benefits. Keep reading to see more!

Keep ReadingYou may also like

Total Visa® Card Review

Need to rebuild credit and some extra cash? Then check out the Total Visa® Card full review and find out how interesting this option can be.

Keep Reading

100 Lenders Personal Loan review: is it worth it?

Get an in-depth review at how the 100 Lenders Personal Loan can help customers find the best loan for their needs! Up to $40K! Read on!

Keep Reading

Earnest Private Student Loan review: is it worth it?

Do you need to finish your studies and have no money? Find out how the Earnest Private student loan can help you out!

Keep Reading