Credit Cards

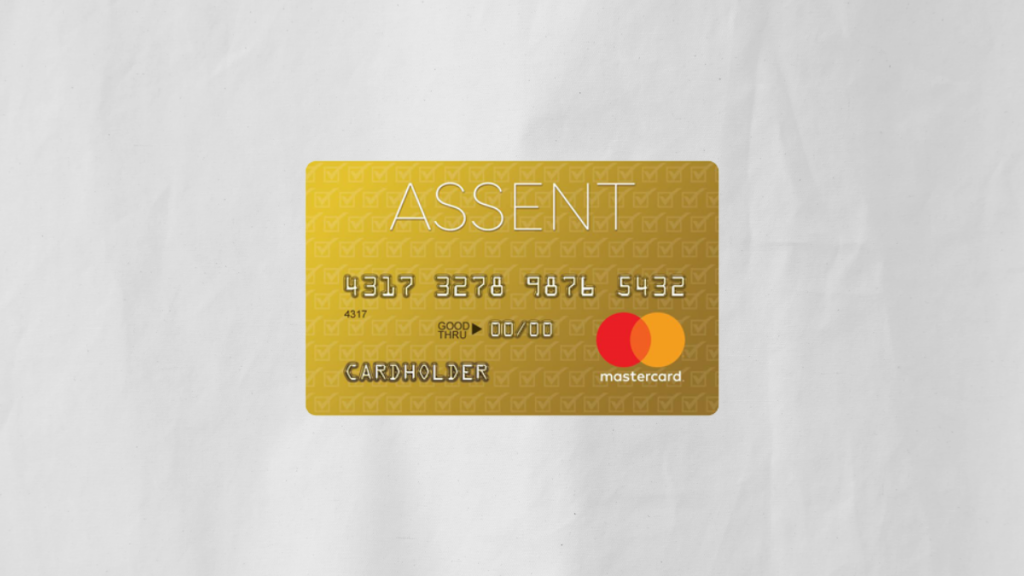

Pay $0 annual fee: Assent Platinum Secured Credit Card review

The secure way to rebuild your credit is here! Assent Platinum Secured Credit Card provides an easy solution for that! Read on and learn how!

Advertisement

Say goodbye to bad credit with this card!

Are you seeking a comprehensive review of the Assent Platinum Secured Credit Card? Then we’ve got your back! Today we’ll bring all details about this product!

Apply for the Assent Platinum Secured Card

Looking for a card with a hassle-free process? Read on a learn how to apply for the Assent Platinum Secured Credit Card! $0 annual fee!

So stay tuned in our full article to learn everything you need, including some disadvantages of getting this card! Are you ready? Then let’s get started!

- Credit Score: All types of credit are accepted;

- Annual Fee: $0;

- Purchase APR: 28.74%;

- Cash Advance APR: 28.74%;

- Welcome Bonus: No welcome bonuses;

- Rewards: No reward program.

How does the Assent Platinum Secured Credit Card work?

Rebuilding your credit doesn’t have to be difficult. And the Assent Platinum Secured Credit Card is here to prove that while providing some exclusive perks.

For example, cardholders will enjoy a $0 annual fee with this card, which is a great way to save on interest!

In addition, to get this card, you can make a fully-refundable security deposit ranging from $200 to $2,000! Thus, the deposit amount will be your credit limit.

As a credit builder card, the Assent Platinum Secured Credit Card will monthly report your payments and transactions to all 3 major credit bureaus!

Plus, you can easily access your account online 24/7! Which is a great way no better manage your money and spending! Yes, this card brings some great features!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Other charges

Besides its annual Fee of $0, there are other charges you must be aware of before applying for this credit card:

- Foreign transaction fee: $10 or 3% of the amount, whichever is higher;

- Cash advance fee: $10 or 3% of the amount, whichever is higher;

- Late payment fee: $41;

- Returned payment fee: $30.

Assent Platinum Secured Credit Card pros and cons

Finding a secured credit card offering with some good benefits is not common! And that is why the Assent Platinum Secured Credit Card stands out from the competition!

Indeed, this easy-to-get credit card will help you build your credit history fast while helping you save your hard-earned money! But is it the right option for your needs?

To help you answer that question, we’ve compiled the Assent Platinum Secured Credit Card pros and cons! So let’s check it out!

Pros

- Enjoy $0 annual fee;

- Your security deposit can be as low as $200;

- The security deposit is fully-refundable;

- It reports monthly to the 3 major credit bureaus;

- 24/7 access to your account online.

Cons

- This card has no reward program or welcome bonus;

- It is not available in NY, IA, AR, or WI;

- It charges an annual fee.

Does my credit score need to be good?

As a secured credit builder card, the Assent Platinum Secured Credit Card won’t have a credit score requirement. Thus, all types of credit are welcome to apply.

Still, you’ll need a security deposit ranging from $200 to $2,000 to get this credit card.

Want to apply for the Assent Platinum Secured Credit Card?

As you can note in our review, the Assent Platinum Secured Credit Card is an excellent tool for building credit quickly. And applying for it is simple and fast!

So read our following article and find out how the application process works!

Apply for the Assent Platinum Secured Card

Looking for a card with a hassle-free process? Read on a learn how to apply for the Assent Platinum Secured Credit Card! $0 annual fee!

Trending Topics

Applying for the Chime® Debit Card: learn how!

Need a debit card to help you save money and pay no monthly fees? Then the Chime® Debit Card can help you! Learn how to apply to be approved!

Keep Reading

Upgrade Rewards Checking Account review: read before applying

Want to have the best checking account in town? Don't miss out on our Upgrade Rewards Checking Account review to learn more!

Keep Reading

Sable account review: read before applying

Need a Sable account review you can rely on? We got you! In this review we cover fees, perks, benefits, its pros and its cons.

Keep ReadingYou may also like

Home Depot Consumer Credit Card full review

Looking for a comprehensive review of how the Home Depot consumer credit card works? Read on to find out! No annual fee!

Keep Reading

Applying for the American Express Platinum card: learn how!

Check here how to apply for the American Express Platinum card, and enjoy its benefits at airline companies and hotels around the world!

Keep Reading

Capital One SavorOne Rewards for Students Credit Card Review

Discover the incredible advantages and cashback of the Capital One SavorOne Rewards for Students credit card. Check all about it here!

Keep Reading