Reviews

Lending Tree Personal Loan review: is it worth it?

Keep reading and learn what Lending Tree Personal Loan is all about! This marketplace allows you to find the perfect lender for your need. Stick aroung and find out how.

Advertisement

Lending Tree Personal Loan: Find the best lender for your needs

Wondering if this service is the right option for you? Wonder no longer. Read our LendingTree Personal Loans review and find out. This service offers multiple possibilities and fast access to funds.

Lending Tree Personal Loan: how to apply now!

If you want to apply for the Lending Tree Personal Loan, you're in the right place. Enjoy fast funding. Qualify with lower credit. Read on!

You can qualify for a loan of up to $50K. So what are you waiting for? Keep reading and learn how it works, compare its pros and cons, and more. Let’s get started.

| APR | Varies depending on the lender; |

| Loan Purpose | Debt consolidation, home improvement, wedding expenses, car repair, medical expenses, and more; |

| Loan Amounts | Varies depending on the lender; |

| Credit Needed | 580 or higher; |

| Origination Fee | Varies depending on the lender; |

| Late Fee | Varies depending on the lender; |

| Early Payoff Penalty | Varies depending on the lender. |

Lending Tree Personal Loan: how does it work?

LendingTree Personal Loans is a marketplace designed to help you find the best lender for your particular needs. It allows you to shop around and compare multiple loan offers at once.

Borrowers can check personal loan offers without hurting their credit scores. Plus, they can use the requested loan amount for multiple purposes, such as debt consolidation, medical expenses, and large purchases.

When it comes to interest rates, will vary from lender to lender. The same applies to origination, late payment, and prepayment fees. So make sure to check the specificities of the lender you choose.

Not only does it offers speedy access to funds, with some applications processed in as little as one business day*. Also, through LendingTree, you can even find loan amounts of $100,000, depending on your eligibility.

Additionally, this website provides free credit score monitoring, budget tracking, and other useful services. LendingTree Personal Loan might be worth considering if you’re looking for flexibility and several lender options.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Is it worth it to apply for Lending Tree Personal Loan?

Lending Tree Personal Loan has very attractive benefits. For example, you connect with multiple lenders and quickly release the money you need. Also, you don’t need to have an excellent credit score.

However, this option also has its drawbacks. Check out the comparison of benefits and disadvantages and draw your conclusions.

Benefits

- Transparent about credit score, income, and geographical areas served;

- Enjoy multiple tools on their website;

- Get free credit score monitoring, budget tracking, and more;

- Compare multiple lenders in one place;

- Flexible loan purposes.

Disadvantages

- You might have to pay for origination fees, prepayment fee, or other fees depending on the lender;

- Potentially high rates.

What credit scores are required for the application?

The Lending Tree Personal Loan review offers an interesting option to catch up on your finances. And you don’t need to have a high credit score to apply and get fascinating values.

Moreover, the higher your score, the better your chances of qualifying for the lower interest rates and fees.

Lending Tree Personal Loan: applying for this loan today

The Lending Tree Personal Loan is an excellent option for those looking for the perfect lender since you can connect with multiple options and compare offers.

However, you need to meet some requirements and perform the application process correctly. But we’re here to help! Check out the post below and learn more!

Lending Tree Personal Loan: how to apply now!

If you want to apply for the Lending Tree Personal Loan, you're in the right place. Enjoy fast funding. Qualify with lower credit. Read on!

Trending Topics

Aspiration Spend & Save™ debit card full review

If you want to have a positive social and environmental impact, the Aspiration Spend & Save™ debit card should be on your watchlist.

Keep Reading

Maximize Rewards with Every Swipe: Pelican Points Visa Review

Looking for a reliable rewards credit card? Discover what the Pelican Points Visa has to offer in our review. Enjoy a special bonus offer!

Keep Reading

WhatsApp will let users leave group chats quietly

WhatsApp is currently in the process of rolling out an experimental feature that will allow users to anonymously leave groups chats.

Keep ReadingYou may also like

Wells Fargo Autograph℠ Card full review

Looking for a new credit card? Then read out the Wells Fargo Autograph℠ Card review and find out! Enjoy intro APR and multiple benefits!

Keep Reading

Deleted Your Photos? Use These Amazing Apps to Recover Them

Get back your lost memories! Explore these top-rated apps to recover deleted photos effortlessly right from your device. Read on!

Keep Reading

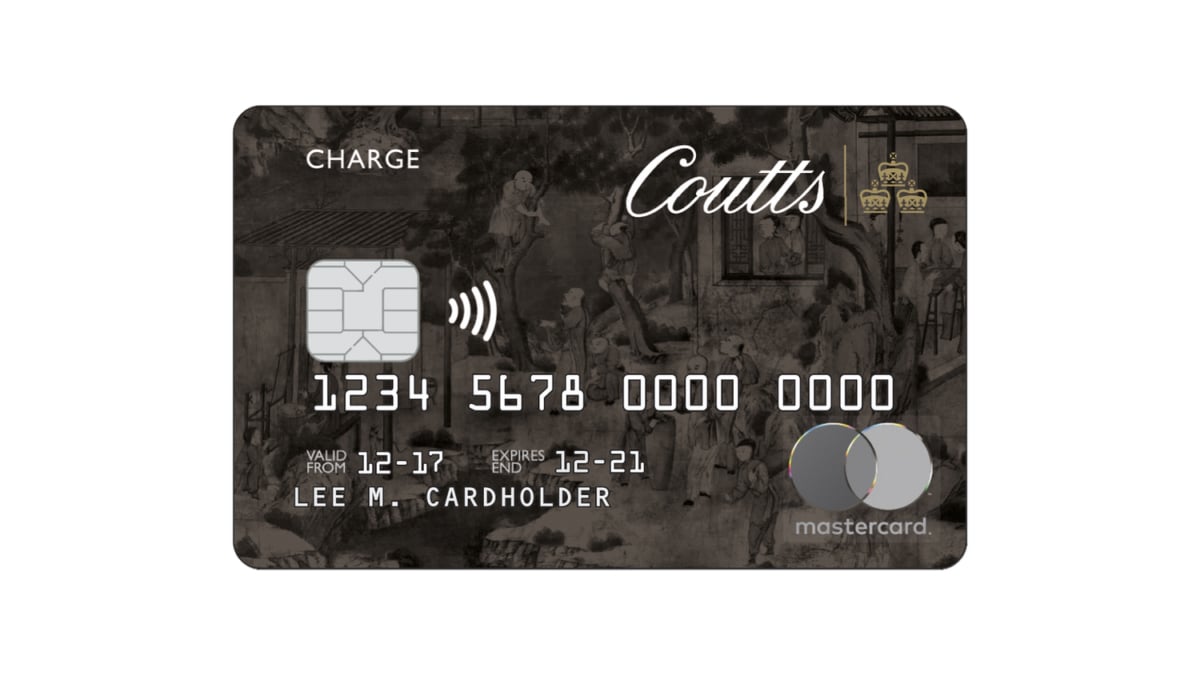

Coutts World Silk credit card full review

Discover everything you need to know about the Coutts World Silk credit card, including its features and benefits. Keep reading to see more!

Keep Reading