Credit Cards

Fortiva® Mastercard® Credit Card Review

Discover the pros and cons in our Fortiva® Mastercard® Credit Card review. Ideal for credit building and earning cash back on utilities and groceries, it's tailored for those rebuilding their credit history.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Available for all credit scores with no security deposit!

Getting a good reward credit card is everyone’s wish. In this review of the Fortiva® Mastercard® Credit Card, you’ll discover whether this option meets your needs.

Here’s the solution if you don’t have a good credit score but still want a rewards card. After all, the Fortiva® Mastercard® offers credit even to those with less-than-perfect credit.

- Credit Score: Good/ Fair/ Poor;

- Annual Fee: $85-$175 first year, $229 thereafter;

- Regular APR: 29.99% or 36% Fixed;

- Welcome bonus: None;

- Rewards: Up to 3% cash back on eligible purchases.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the Fortiva® Mastercard® Credit Card work?

This review presents the Fortiva® Mastercard® Credit Card, a card for those who like cashback and one of the few cash back options for people with bad credit scores.

If eligible, you could be approved for the Fortiva Credit Card or the Fortiva Cash Back Rewards Card. The cash-back version offers up to 3% cash back in select categories and 1% on other purchases.

However, the Fortiva Cash Back Rewards Card comes with significant fees and a high APR, making it important to evaluate the benefits against the costs carefully.

The card offers a 3% cash back on gas, groceries, and utility purchases. In addition, it also offers 1% cash back on other purchases.

With this credit card, your initial limit can go up to $2,000, even with a bad credit score. In addition, the application allows you to pre-qualify without changing your score.

And even if you’re not approved for the cash-back version, you might still qualify for the basic version of the card, which can help you rebuild your credit score while providing access to essential credit services.

Fortiva® Mastercard® Credit Card pros and cons

The Fortiva® Mastercard® is an interesting option. After all, it offers cashback between 1 and 3% and can still be requested by those with bad credit scores.

However, you must pay a relatively high APR and initial membership fees to qualify for this option. So, weighing the pros and cons is important to see if the alternative is worth it.

Pros

- Possibility of pre-qualification without affecting the credit score;

- Limit up to $2,000 even with a bad credit score, subject to prior assessment;

- Free access to TransUnion’s VantageScore 4.0 credit score inquiries;

- No initial deposit is required for use or account opening;

- Cards can be used for payment on major digital platforms.

- Attractive cashback between 1 and 3%;

- Contributes to credit score reconstruction;

- Bonuses are divided according to card usage category.

Cons

- High initial enrollment fees;

- Relatively high APR rates;

- Associated fee for foreign transactions;

- Might not be approved for the cash-back version card.

Want to apply for the Fortiva® Mastercard® Credit Card?

It can be great for those who don’t have a good credit score. After all, you can earn up to a $2,000 starting limit and earn interesting rewards.

The Fortiva® Mastercard® Credit Card is attractive for all credit scores. However, you need to know how to apply correctly to be approved.

Does my credit score need to be good?

As presented in this Fortiva® Mastercard® Credit Card review, this credit card does not require a good credit score. People with all types of credit scores can apply for the card.

However, interest rates and APR are subject to credit analysis and may be higher with a bad credit score. However, you can pre-qualify on the website and determine which plan is right for you.

Requirements

To apply for the Fortiva® Mastercard® Credit Card, you should meet the following criteria:

- Age Requirement: Applicants must be at least 18 years old (or the legal age of majority in your state).

- Residency: You must have a valid U.S. physical address.

- Identification: A valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is required for identity verification.

- Income Verification: Proof of a steady income is necessary to demonstrate your ability to repay the credit extended. This may involve providing access to your bank account information for income verification.

- Credit History: While the Fortiva® Mastercard® is designed for individuals with less-than-perfect credit, your credit history will be reviewed to assess your creditworthiness.

Meeting these requirements does not guarantee approval but enhances your eligibility for the Fortiva® Mastercard® Credit Card.

It’s advisable to review the specific terms and conditions provided during the application process for detailed information.

Apply online

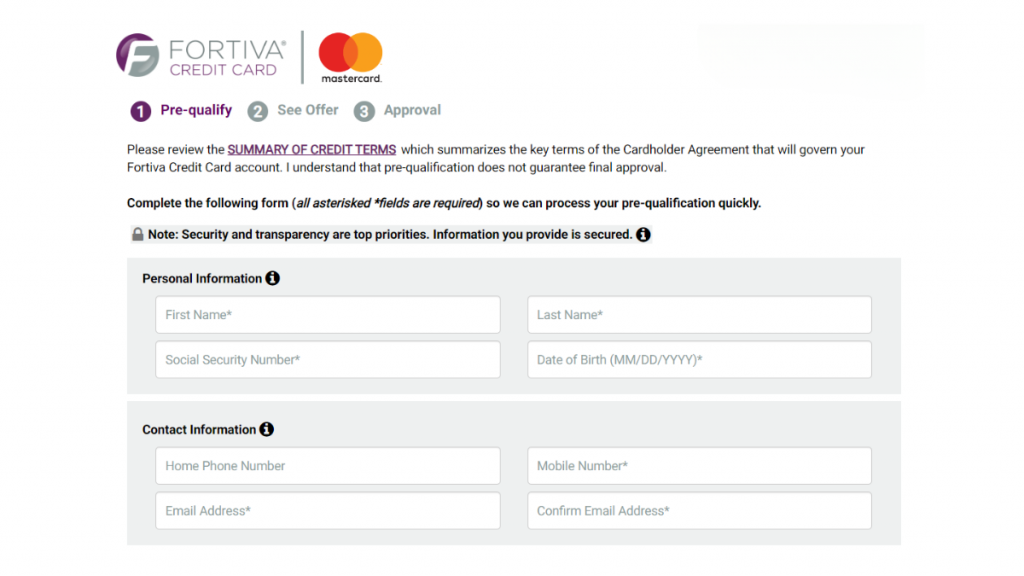

Applying for the Fortiva® Mastercard® Credit Card is straightforward and convenient. You can complete the process from anywhere, whether using your mobile device or computer.

Before starting your application, you need to meet certain requirements. Specifically, you must be a U.S. citizen at least 18 years old and have a physical address.

If you meet these requirements, you can begin your application online.

Simply access the website from any internet-enabled device, fill in the necessary details, and submit your information. You’ll need to agree to the terms and conditions during this process.

The first step is to go through the prequalification process, which will not impact your credit score. After completing this step, you’ll receive an offer tailored to your profile.

Based on your qualifications, you might be offered the Fortiva Credit Card or the Fortiva Cash Back Rewards Card, with varying annual fees and APR based on the credit analysis.

Apply using the app

As mentioned earlier, you can only apply for this card and complete the prequalification process online.

The mobile app is exclusively for managing your credit card account. Through the app, you can monitor transactions, make payments, receive alerts, and keep track of account activity.

Fortiva® Mastercard® Credit Card vs. Petal® 1 Visa® Credit Card

The Fortiva® Credit Card is among the few reward cards for bad credit scores. In this sense, it has a cashback of 1 and 3% on purchases and an initial limit of up to $2000.

However, you can also consider some alternatives. The Petal® 1 Visa® Credit Card can be very attractive. It has no annual fee and offers 10% cashback on multiple purchases.

However, it is important to know which option best fits your needs. So, check the comparison and determine which one to choose to improve your financial life.

Fortiva® Mastercard® Credit Card

- Credit Score: Good/ Fair/ Poor;

- Annual Fee: $85-$175 first year, $229 thereafter;

- Regular APR: 29.99% or 36% Fixed;

- Welcome bonus: None;

- Rewards: Up to 3% cash back on eligible purchases.

Petal® 1 Visa® Credit Card

- Credit Score: All credit scores are welcome;

- Annual Fee: $0;

- Regular APR: 25.24% – 34.74% (variable);

- Welcome bonus: N/A;

- Rewards: Up to 10% cash back on select merchants.

If the Petal® 1 Visa® Credit Card is the best choice, check out our post below to learn about the application process!

Petal 1 Visa credit card: complete review

Looking for a credit card that will accept applicants with limited or poor credit? The Petal 1 Visa credit card might be worth looking into. Check it out!

Trending Topics

What type of account is a cash management: the same as a bank account?

What type of account is a cash management account? In this article we cover the basics of this type of account, and whether it is for you.

Keep Reading

Juno Debit Card Review

Need a good debit card to make your money work? Check out this Juno Debit Card review and find out if it might be what you're looking for.

Keep Reading

What credit score do you need to lease a car?

Do you know your credit score to lease a car? Look no further than this article, which covers everything you need to know.

Keep ReadingYou may also like

Amex Blue Cash Everyday® Card Review: Earn more!

Looking for a cash back credit card? Check out our in-depth review of the Blue Cash Everyday® Credit Card from American Express.

Keep Reading

Auto Loans: all you need to know before financing your new car

Do you know how you can buy your new car? With auto loans. Check out how you can buy your dream car quickly.

Keep Reading

FTX exchange might acquire Robinhood Investing soon

Learn more details about the potential acquisition of Robinhood by cryptocurrency exchange FTX and what it could mean for the market.

Keep Reading