Credit Cards

Group One Platinum Card full review

Many people are looking for a credit limit but have a bad credit score, making things difficult. Check out how the Group One Platinum Card works and how it helps you.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Group One Platinum Card: Up to $750 starting limit on all credit scores

If you’re a big fan of Horizon Outlet, you’ll enjoy following along with this Group One Platinum Card review. After all, this credit card is perfect to use there and does not require a good credit score.

That is, anyone with a good credit score can apply for and have the approval of up to a $750 limit.

Without having associated APR fees, all of this is a great differentiator of this option. Learn more and see if it’s right for you.

- Credit Score: Poor;

- Annual Fee: $177.24 ($14.77 per month);

- Regular APR: None;

- Welcome bonus: None;

- Rewards: None.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the Group One Platinum Card work?

The Group One Platinum Card, presented in this review, is a card for all credit scores. It releases up to a maximum initial $750 and has no associated APR fee, making it very different from the rest.

However, you may have some attached fees like annual and monthly fees. However, it is an excellent card that meets the needs of people regardless of their credit score.

Furthermore, the limit offered by the Group One Platinum Card is reasonable and very good for those who still need a credit score. However, you only have a few associated benefits.

Group One Platinum Card pros and cons

The Group One Platinum Card, from this review, is great for anyone who likes to use the Horizon Outlet. After all, it allows all credit score types to apply for this card and still has an APR of 0%.

However, this option has limitations and some cons. For example, high monthly and annual fees and a reduction in the possibility of use. Check out the comparison below.

Pros

- The reasonable credit limit for use at Horizon Outlet;

- My Roadside Protect is included with membership;

- APR is potentially lower than other similar credit cards;

- Allows all types of credit scores to apply.

Cons

- Limitation of Credit Card Use for Horizon Outlet;

- The monthly associated fee of $14.77 to each and every cardholder;

- A high annual fee amounting to $177.24;

- No sign-up bonuses, rewards, or cash back;

- No reporting to major credit agencies to improve your credit score;

- No benefits like a regular credit card.

Does my credit score need to be good?

As mentioned earlier, all types of credit are accepted in this Group One Platinum Card review. You can apply online or through the app, regardless of your credit score.

However, a great benefit is that the APR is 0%; you will pay the other fees, but the APR does not change.

So, regardless of your credit score, you will enjoy a good limit offered.

Want to apply for the Group One Platinum Card?

Group One Platinum is the perfect choice for those who don’t have a credit score but need some extra cash. However, knowing how to apply Group One Platinum Card is essential for success and fast approval.

The application is a simple and quick process as long as the data is filled in correctly. However, the application can be made online or through an app. Check out the step-by-step to get a quick result.

Apply online

Applying for the Group One Platinum Card is a simple process that can be done with internet access. However, before starting the procedures, you must check that you meet all the requirements.

You must be over 18 years old and have a US citizen record to apply. It is also important to provide supporting documents. Thus, the result of the analysis is obtained more quickly.

To apply online, you need a device with internet access. Therefore, you can access the official website and fill in your information in the form. Finally, wait for the result.

Apply using the app

Unfortunately, you can only apply for this credit card through the official website. This way, you can check out our tips on the topic above!

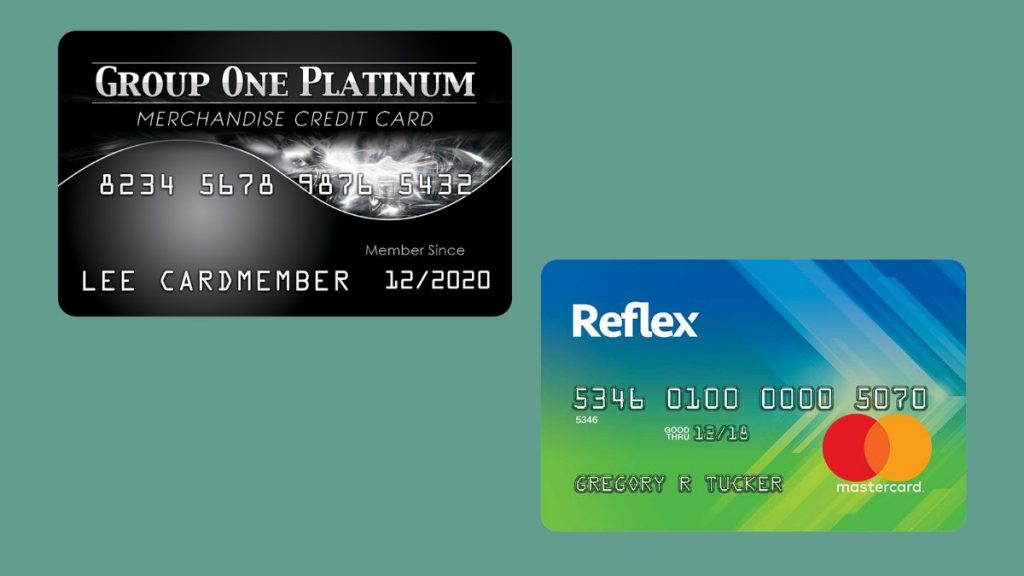

Group One Platinum Card vs. Reflex Mastercard®

The Group One Platinum Card is an excellent option for people without a good credit score. However, spending up to $750 is only allowed for Horizon Outlet, which limits card usage.

Also, you have no associated APR, although annual and monthly fees exist. This way, it has this great differential from other card options for all credit scores.

However, you may also have other alternatives for those with bad credit scores.

In this sense, the Reflex® Platinum Mastercard® can be an excellent alternative. After all, he has a monthly report of good use to the credit agencies.

In addition, it has a reduced annual fee but a relatively high APR associated with it. Check out the comparison of options and find out which is best for you.

Group One Platinum Card

- Credit Score: Poor;

- Annual Fee: $177.24 ($14.77 per month);

- Regular APR: None;

- Welcome bonus: None;

- Rewards: None.

Reflex® Platinum Mastercard®

- Credit Score: Fair/Bad;

- Annual Fee: read terms;

- Regular APR: 24.99% to 29.99%;

- Welcome bonus: N/A;

- Rewards: monthly reports to the country’s three major credit bureaus to help build credit.

Do you want to make purchases outside the Horizon Outlet and think that the Reflex® Platinum Mastercard® is the best choice for you? If so, read our post below to learn how to apply!

Reflex® Platinum Mastercard® Review

Need some help with your credit score? Reflex Mastercard® can help. See how to apply and be approved.

Trending Topics

Being rich or wealthy: what’s the difference between them?

What is the difference between being wealthy and being rich? Which should you be aiming for? We’ll help you answer that question.

Keep Reading

Capital One SavorOne Rewards for Students Credit Card Review

Discover the incredible advantages and cashback of the Capital One SavorOne Rewards for Students credit card. Check all about it here!

Keep Reading

Get the Perfect Loan: Fast, Easy, and Affordable

Need extra funds? Learn how to find the best loan with low rates, flexible terms, and quick approval. Make smarter financial moves today!

Keep ReadingYou may also like

Curadebt review: pay off your debts

You'll certainly find the solution for your debt in this Curadebt review. They helped more than 300,000 people, and they can help you too.

Keep Reading

Home Depot Consumer Credit Card full review

Looking for a comprehensive review of how the Home Depot consumer credit card works? Read on to find out! No annual fee!

Keep Reading

What is a personal loan: an uncomplicated guide

A personal loan can be of help in times of financial difficulty. But what is a personal loan? You can find out today in our post. So, read on!

Keep Reading