Financial Education

How Long Does It Take to Get a HELOC? Speed Up the Process!

Get the money you need quickly! Keep reading and discover 5 tips to make your HELOC process faster and hassle-free! Read on and learn!

Advertisement

Access your HELOC funds efficiently!

Have you ever wondered how long does it take to get a HELOC? Well, time is of the essence when it comes to getting a HELOC and accessing the money.

Types of personal loans

When it comes to types of personal loans, there are a few different options to choose from. Read on an learn for essential types of personal loans.

In this article, we’ll explore the factors influencing the timeline for getting your HELOC and provide key tips to expedite the process! So keep reading and learn more!

How much time does it usually take to get a HELOC?

The time to get a Home Equity Line of Credit (HELOC) can vary depending on several factors. Generally, the process can take between 60 to 75 days.

However, it is important to note that this is just an estimate, and the actual timeframe may differ depending on several specific factors.

For example, the timeline can be influenced by the lender’s efficiency, the complexity of your financial situation, and the required documentation to go through it.

Additionally, delays in accurately providing the necessary information can prolong the process! Thus, the more accurate estimate, the faster it goes.

As such, it is rightly recommended that you consult with a specific lender and inquire about their average processing times before applying for a new HELOC.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Efficiency boost: 5 steps to quicken your approval

If you dream of transforming your home or embarking on a once-in-a-lifetime adventure, a HELOC might make these aspirations a reality.

And if you’re keen to get started with it, you’ll be pleased to know that you can proactively speed up the process. And you can do this through simple steps.

You can quickly access the funds you need by following a few key tips! And we’re going to tell you how today!

So without further ado, let’s get to the best things you can do to speed up your Home Equity Line of Credit process! Let’s go!

1. Gather all necessary documentation

If you want to go through a smooth application process, you must promptly provide the right documentation! So before any step, check what those are.

The requested documents might vary from lender to lender, but overall, they’ll request the following:

- Driver’s license or ID;

- Social Security Card

- Mortgage statements;

- Proof of income – pay stubs, W-2s/1099s, and tax returns;

- Current property tax information;

- Banking and investment statements;

- Homeowners Association dues.

And more! So once you find a lender, don’t hesitate to take a closer look at the necessary documentation!

Providing it accurately and quickly will help guarantee you’ll have a hassle-free process and get the money you need fast!

2. Do some research

Don’t go for the first HELOC lender you find! Take your time to ask around and find the best conditions for your personal and financial needs.

In addition, don’t hesitate to call around and ask for time estimates. Some lenders might have a lot of people waiting to get their services.

Some might face long wait times to process their application! Therefore, always ask the lender about it before closing the deal with them.

If possible, try to get a lender that allows you to start your application immediately! This will save you time and mental health.

Figure Home Equity Line of Credit: how to apply

Applying for the Figure Home Equity Line of Credit is quick and easy, and you can complete the process entirely online. Check out!

3. Try lenders that won’t require an appraisal

Not all lender offers HELOCs without an appraisal. But if you find one, try to go for it! Those typically have stricter requirements, such as a higher score or lower LTV ratio.

Still, those can offer several advantages. For example, saving you time since home appraisals can take weeks to be completed and add to your closing costs.

In addition, those can provide cost reductions, simplify your process and help you avoid value limitations, for example.

Before deciding to pursue a HELOC without an appraisal, it’s crucial to carefully consider your specific financial situation, goals, and the terms and conditions offered.

Consulting multiple lenders and exploring their specific requirements and terms will ensure you choose the best option for your needs.

4. Check for local credit unions

Compared to national banks, local credit unions bring a faster and closer approach to HELOCs. This is because they’re a community focussed.

Additionally, you’ll enjoy personalized service and often qualify for competitive interest rates and fees! As such, telling your officer you need the money fast will speed it up!

As member-owned institutions, local credit unions prioritize the well-being and satisfaction of their member and clients, providing several benefits to help you!

So go for it and check the different credit unions and their offering in your area. Look for their HELOC products, terms, and rates! As well as average processing time.

Therefore, take your time and choose wisely. This allows you to make an informed decision based on the best available options for your circumstances.

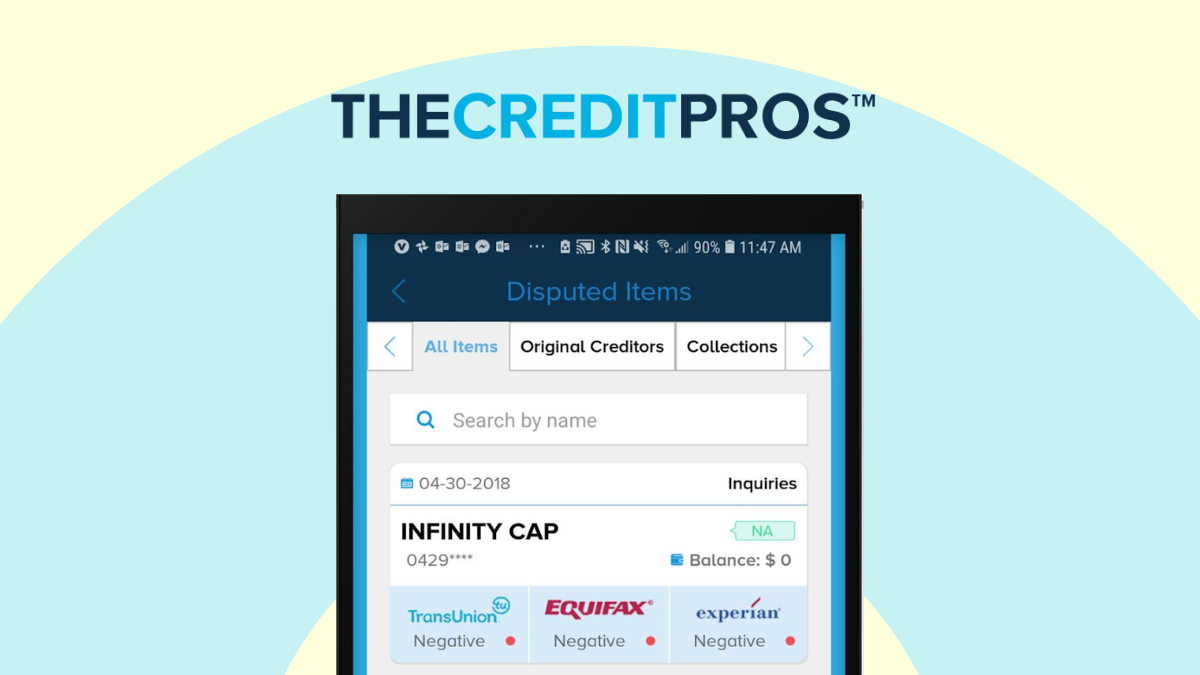

5. Work on your credit before applying

We all know that a credit score is among the most important numbers in our financial lives. This three-digit number provides your creditworthiness.

In other words, it shows lenders, banks, and other financial institutions, how likely you are to pay your debt. And when it comes to HELOCs, they’re very important.

Therefore, having a higher credit score can increase your chances of quick approval and higher amounts and lower rates and fees!

Take steps to improve your credit by paying bills on time, reducing debt, and correcting any errors on your credit report.

Plus, you can monitor your credit score for free at the major credit bureaus – Equifax, Experian, and TransUnion! So don’t hesitate to go for it!

Bottom line

Now that you know 5 key steps to quicken your approval and how long it takes to get a HELOC, it is up to you! Do your homework, and rest assured you’ll save money and time!

You’re one step closer to getting the money you need!

Up next, choose a credit repair company to help you improve your finances! Keep reading and learn more!

Choose the perfect credit repair company

Choosing a company to repair your credit is not an easy decision. Check out the tips we brought to help you on this mission.

Trending Topics

Destiny Mastercard® Review: Reach Better Credit!

In our Destiny Mastercard® review, you’ll learn about this product that can help you repair your credit and build a strong financial future.

Keep Reading

The Credit Pros review: become debt-free!

The Credit Pros deserves this review because it is one of the best credit repair companies in the US. Read to learn how it works.

Keep Reading

What is a personal loan: an uncomplicated guide

A personal loan can be of help in times of financial difficulty. But what is a personal loan? You can find out today in our post. So, read on!

Keep ReadingYou may also like

How to do a balance transfer in 10 simple steps

Learn how to do a balance transfer in 10 simple steps and save money on high-interest credit card debt. Keep reading and learn more!

Keep Reading

Regions Cash Rewards Visa® Credit Card full review

Looking for a cash back credit card? Check out our Regions Cash Rewards Visa® Credit Card review. 0% intro APR and $0 annual fee!

Keep Reading

PenFed Gold Visa® Card full review

Read our PenFed Gold Visa® Card full review and learn how this card works. Pay a $0 annual fee and enjoy Visa benefits! Stick with us!

Keep Reading