Finances

Lexington Law review: repair your credit with confidence

To rebuild your credit, nothing better than a law firm to help. Check out the services offered by Lexington Law!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Lexington Law: A law firm that recovers your credit!

Credit repair is a very important mission to open doors in the financial aspect. In that sense, this Lexington Law review will show you how you can greatly help restore your financial health.

Lexington Law is a service that aims to help you restore your credit score and win new business. The law firm claims it has helped over 80 million people out of the negative. Want to know more? Check out this review.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does Lexington Law work?

Lexington Law is a credit repair service offered by a law firm. Like other credit recovery operators, they question records and possible negative reports.

That way, the negative record is voided, and you have greater trading possibilities.

This service offers 3 main plans: Premier Plus, Concord Premier, and Concord Standard.

All plans offer inquiries about registrations. However, higher-value plans like Concord Standard offer more personalized options.

Lexington Law: learn the advantages and disadvantages

As a law firm, Lexington Law, featured in this review, is a very interesting service. After all, the team of professionals is highly prepared to respond to negative reports.

However, like other credit recovery services, Lexington Law has some positives and negatives. Check out the pros and cons of this option to see if it’s right for you.

Pros

- Free Credit Score Verification;

- Free Credit Report Summary;

- Free Credit Repair Recommendation;

- Varied plan options that meet different needs;

- Hiring a law firm for your credit claims;

- Many associated educational tools;

- Contribution to credit score improvement by contesting negative reports.

Cons

- ‘C-‘ rating with BBB;

- Business ethics are questionable by some users;

- High-cost consulting plans;

- Pending government lawsuit;

- No debt exclusion, just compensation.

Who is it suitable for?

Lexington Law, featured in this review, is one of the best tools for credit recovery. In this sense, the team of professionals acts to contest negative reports of credit usage.

In addition, the company offers this service through lawyers who are specialized in this type of dispute. That way, your chances of credit recovery are better.

Therefore, this service is ideal for those who need to recover their credit score. After all, the credit score will define the best interest rates and financing options or cards. Therefore, credit recovery can be ideal.

Want to apply for Lexington Law? We help you affiliate

Lexington Law is an excellent option for credit recovery, being one of the most sought-after in the market. However, knowing how to apply for Lexington Law is critical for approval.

The application process doesn’t require much of a headache; just filling out the information in a form. This application can be carried out online or through an application. Check out how to apply.

Apply online

Find out now if you want to know how to apply for Lexington Law. There are two main ways to use it: online or through the service’s official app for mobile devices.

However, before starting your application, it is important to remember that you must fulfill certain requirements. First and foremost, you must be a US citizen over 18 to apply.

In addition, you must have an address registered in your name to fill out the form. The online application can be made through a computer or notebook, where you fill in your information in a preform.

This form does not affect your credit score, as in the case of a prequalification. On the contrary, you apply your information so that the company knows your interest.

You will then receive an email to continue the process.

Apply using the app

There is not much information about Lexington Law offering a mobile app to its customers. However, follow the tips above to apply for this credit repair company and build credit!

Another recommendation: The Credit Pros

Now that you know how to apply to Lexington Law, you need to know that this is not your only option. After all, if you need to rebuild credit, several options are available with the variation of this service.

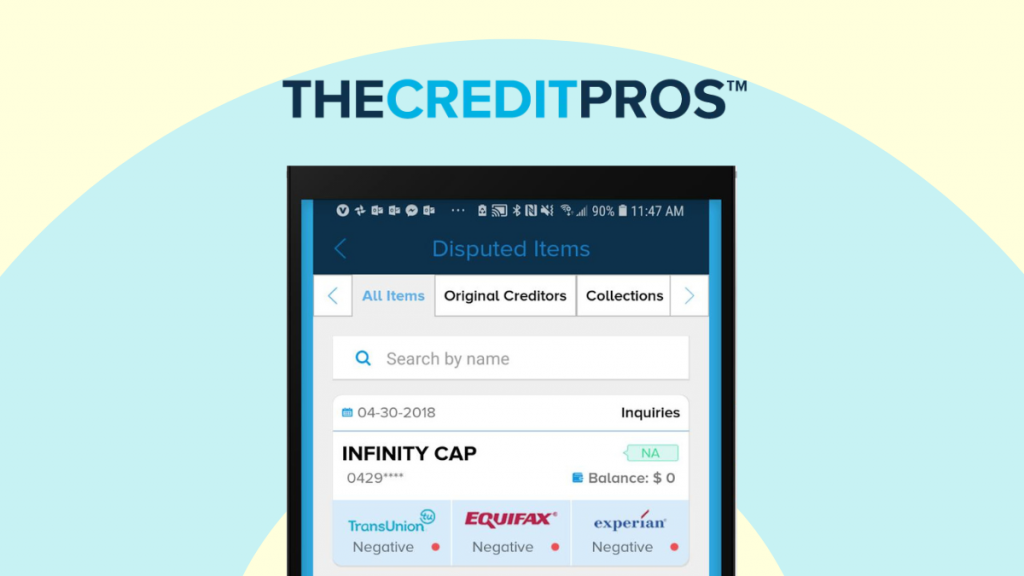

Another option we recommend is The Credit Pros, a similar credit rebuilding service. As with the previous option, The Credit Pros offers credit reconstruction and refund if there is no result within 90 days.

In addition, this option allows the construction of credit associated with this recovery. That is, you can have a credit line of up to $5,000. So, you can recover your credit score and have a significant and fast increase.

This alternative offers great customer support and has excellent reviews. In addition, it brings credit monitoring and fraud protection completely free, which makes you safer.

However, to enjoy these benefits, know that the monthly fee is one of the most expensive on the market. Additionally, line of credit tools may be limited on lower-value plans.

If you are interested in this alternative, it is important to know how to apply for a faster return. In this sense, check out the post we prepared to help you apply and succeed with the request.

How to apply for The Credit Pros

This post will give you the step-by-step to join The Credit Pros and fix your credit history once and for all.

Trending Topics

Chase Sapphire Preferred® Credit Card Review

The Chase Sapphire Preferred® Credit Card has everything you need to travel and get a lot of rewards for using it. Keep reading to learn how!

Keep Reading

Disney® Visa® Debit Card Review

Are you a fan of Disney parks? Then you'll need to get the Disney® Visa® Debit Card. It has exclusive advantages in the park. Check out!

Keep Reading

Great news! Based on your selection, we’ve listed the best cards for you below

Explore the top credit cards tailored to your score! Navigate your choices and pick the right card for your financial health and lifestyle!

Keep ReadingYou may also like

Credit Saint review: repair your credit with confidence

Credit Saint review helps you rebuild your credit score. Learn what the pros and cons of this option are and how it works.

Keep Reading

What is a personal loan: an uncomplicated guide

A personal loan can be of help in times of financial difficulty. But what is a personal loan? You can find out today in our post. So, read on!

Keep Reading

Credit Strong review: repair your credit with confidence

Don't let bad credit hold you back anymore. Read our review of Credit Strong to learn how to improve your finances. No hard pull!

Keep Reading