Credit Cards

Neo Financial credit card full review

Are you looking for a better credit card to use in Canada? Look no further. You found the Neo Financial credit card. Read this review to see which benefits it has to offer.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Neo Financial credit card: the best card to get cash back – rates go up to 15%

The Neo Financial credit card has everything Canadians wish for when they apply for a credit card. It is considered by many the best cash back credit card to get.

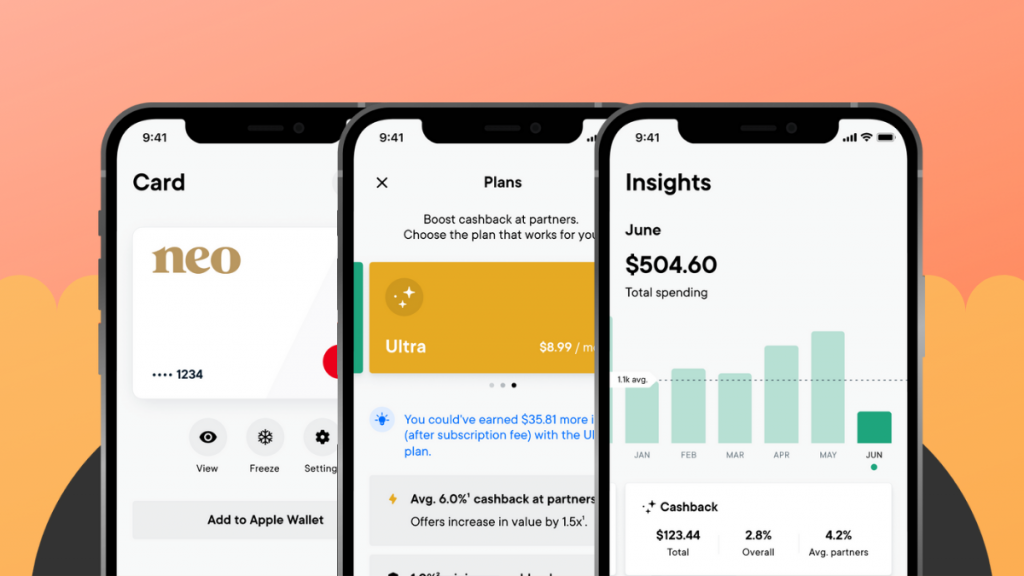

With fair prices, you can get a lot of rewards. Neo Financial is not a bank but provides high-quality financial services. The credit card gives you rewards and helps you save money. The mobile app has features to manage your expenses, with insights about how you’re using your money and how you could manage it better and save more.

To learn more about its features, keep reading this review. We bet you’ll like what this card has to offer.

- Credit Score: You don’t need a credit score to get the secured version, and you can get the unsecured one with at least 600.

- Annual Fee: You can opt for the free version or upgrade to the premium version with a monthly fee.

- Regular APR: 19.99% to 24.99% for purchases

- Welcome bonus: Up to 15% cash back on your first purchases at selected stores

- Rewards: Up to 5% cash back. Terms apply

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does Neo Financial credit card work?

Neo Financial will cut off the bureaucracy and put you in charge of your own finances. The modern app has features that will help you control every penny, and understand your expenses. Also, you can track your rewards, and redeem them whenever you want to.

The credit card has more than one version. There is a free version in which you pay a $0 annual fee. With as little as $2.99 per month, you can upgrade and get up to 5% cash back.

And if you still need to build some credit history, opt for the secured credit card. You can get one with a security deposit of as little as $50.

Neo Financial Credit card pros and cons

Neo Financial customers have wonderful things to say about it. Especially about the high rate of rewards. You can get a lot of cash back and save some money. Read some pros and cons of Neo Financial credit cards.

Pros

- No annual fee and you can opt to pay a monthly fee to improve your rewards rate.

- Apply via an app and pre-qualify before checking your score.

- The mobile app is very handy, and you can solve everything related to your account over there.

- Up to 15% cash back welcome bonus for select purchases

- Virtual card to use on your phone everywhere.

Cons

- Not available for some provinces.

- Has a monthly cap for earning cash back.

- Has no insurance coverage for phone, car, or extended warranty.

Does my credit score need to be good?

To apply for the unsecured version you can try to get one with a 600 credit score. However, if you’re still not there, apply for the secured one with a deposit starting at $50.

Want to apply for Neo Financial card?

Neo Financial card will change the way you think about credit cards. Cut down all the unnecessary bureaucracy, and add much more ease and benefits.

As it is not a bank, you don’t have to worry about expensive fees. The credit card is free to use unless you’re willing to upgrade to a premium version. With a monthly fee, you will get more rewards. But you can cancel it anytime you want through your app. Simple as that.

Neo Financial has many partners that offer discounts and cash back to cardmembers. Some will give you 15% cash back as a discount on your first purchase.

The mobile app will give you financial insights to help you save more money. A credit card that helps you to save instead of waste more money is worth giving a chance.

Apply online

Access the Neo Financial website to learn everything about this credit card. You can open your account for free to enjoy all the benefits it has to offer.

Neo Financial is not a bank and works even better than one. It has a modern approach, and it’s very simple to apply and use.

Once you open your account, download the app to conclude the application process.

Apply using the app

You can apply through the website, but you’ll need the app to manage your account anyway.

Download the app for free at Apple Store or Google Play Store. Open your account or log in if you already have one.

Select your financial product to apply for. You can get the Neo Financial credit card with a credit score starting at 600. Or you can get the secured one with a $50 security deposit or more.

You’ll have to inform some personal and financial information for Neo Financial to verify your identity. This is a pre-qualification, so if you don’t like the offer, you can decline and no hard inquiry will appear on your credit score.

Neo Financial credit card vs. BMO Cashback card

But as Neo Financial is not the only credit card available, let’s present you with another option. Is good to have something to compare to, and BMO Cashback is an excellent card too. Check Neo Financial features side-by-side with BMO Cashback.

Neo Financial credit card

- Credit Score: Recommended 600 to get the regular credit card, or no credit score at all to get the secured one.

- Annual Fee: No annual fee to use the standard version. You can choose to pay a monthly fee to get more rewards.

- Regular APR: 19.99% to 24.99% APR for purchases

- Welcome bonus: Up to 15% cash back on your first purchases at selected stores

- Rewards: Up to 5% cash back. Terms apply.

BMO Cashback

- Credit Score: Requires a good or excellent score.

- Annual Fee: Pay a $0 annual fee for this card.

- Regular APR: 19.99% to 29.99%

- Welcome bonus: Spend at least $6,000 on your first year to earn a $50 bonus, plus 5% cash back on every purchase for 3 months.

- Rewards: 0.5% to 3% cash back. Terms apply.

If you’d like to learn more about BMO Cashback benefits, read the full review and learn how to apply for it.

BMO CashBack Mastercard credit card full review

The BMO Cashback Mastercard is a unique credit card that provides users with cash back rewards on all their purchases. Let's see if it is the right choice for your wallet

Trending Topics

U.S. Bank Visa Platinum® Card Review

Looking for a great no-annual-fee credit card? Check out our U.S. Bank Visa Platinum® Card review to see if it's the right fit for you!

Keep Reading

Merrick Bank Double Your Line Secured Visa Review

With the Merrick Bank Double Your Line Secured Visa credit card you can double your credit limit within just a few months!

Keep Reading

Pyramid Credit Repair review: repair your credit with confidence

Looking for a reliable credit repair service? Look no further than Pyramid Credit Repair in this review. Apply for personalized plans!

Keep ReadingYou may also like

Cash Management Account: how does it work?

If you care about your finances and investments, you should learn what is cash management account by reading this article.

Keep Reading

Custom Choice Student Loan Review: is it worth it?

Do you need money to complete your studies? The Custom Choice student loan may be what you are looking for. Learn more!

Keep Reading

Net First Platinum Credit Card Review: $750 credit line

The Net First Platinum credit card is the perfect card for individuals who shop at the Horizon Outlet website. Check it out!

Keep Reading