Loans

Up to $25,000: U.S. Bank Personal Line of Credit review

Needing some extra money? Then don't miss our U.S. Bank Personal Line of Credit review - quick process and no collateral required!

Advertisement

Get the money you need quickly!

Looking for a reliable source of funding that can cater to various expenses? Then this U.S. Bank Personal Line of Credit review might be worth considering.

Apply for U.S. Bank Personal Line of Credit

Are you looking for a flexible and affordable line of credit? Then apply for U.S. Bank Personal Line of Credit – up to $25K!

Indeed, this product offers a flexible way to access funds for anything from home improvements to unexpected emergencies. So keep reading and learn more!

| APR | 12.50% to 22.50%; |

| Loan Purpose | Large purchases, home improvement, debt consolidation, and more; |

| Loan Amounts | $1,000 to $25,000; |

| Credit Needed | 680 minimum; |

| Terms | 12 to 60 months; |

| Origination Fee | None; |

| Late Fee | $40; |

| Early Payoff Penalty | Not Disclosed. |

U.S. Bank Personal Line of Credit overview

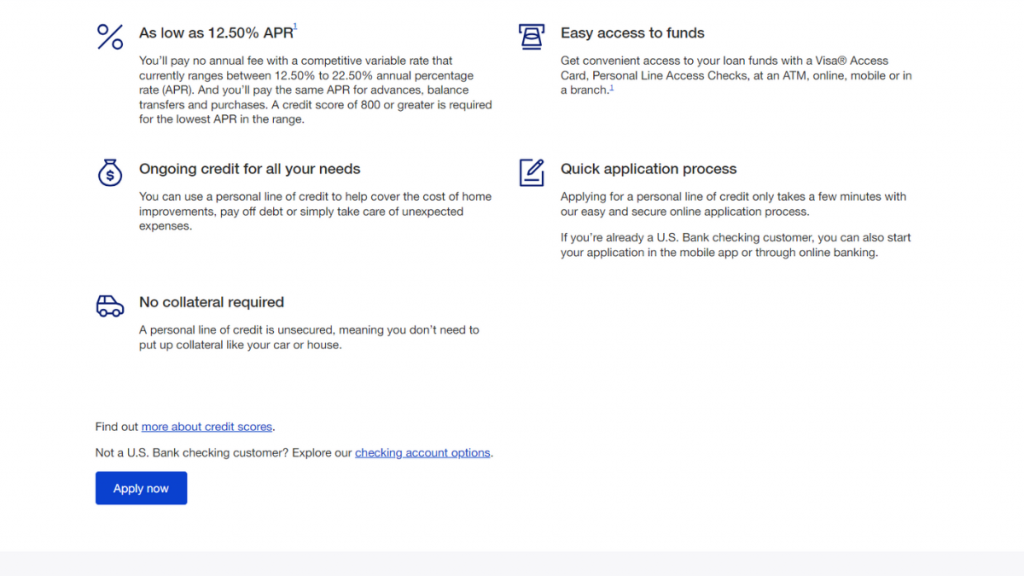

The U.S. Bank Personal Line of Credit is a revolving loan that allows you to borrow funds on an as-needed basis, up to your credit limit.

The line of credit has a fixed interest rate based on your creditworthiness, ranging from 12.50% to 22.50%.

Also, you can use the funds for various purposes, including home repairs, debt consolidation, or major purchases.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Is it worth it to apply for U.S. Bank Personal Line of Credit?

One of the benefits of the U.S. Bank Personal Line of Credit is that you only pay interest on the amount you borrow, thus making it cost-effective for short-term financing.

However, it’s important to remember that the interest rate can vary depending on your credit, and the rates can be relatively high if you have a lower credit score.

Also, you could risk a significant amount of debt if you’re not careful. So, check out the pros and cons.

Benefits

- Flexible borrowing: You can use the funds for a variety of purposes and borrow as much or as little as you need, up to your credit limit;

- Cost-effective: You only pay interest on the amount you borrow, making it a cost-effective option for short-term financing needs;

- No origination fees: The loan doesn’t come with any origination fees, so you can save money on upfront costs;

- Large loan amounts: If you’re a U.S. Bank customer, you can borrow up to $25,000, higher than the average personal line of credit limit.

Disadvantages

- High-interest rates: Depending on your credit score and creditworthiness, the interest rate can be relatively high;

- Risk of debt: It’s easy to keep borrowing from the line of credit, which could lead to significant debt if you’re not careful.

What credit score is required for the application?

Indeed, to be eligible for the U.S. Bank Personal Line of Credit, you’ll need a minimum credit score of 680.

However, remember that the interest rate you receive will be based on your creditworthiness.

So, having a higher credit score could help you get a lower rate.

How does the application process work?

Indeed, to apply for a U.S. Bank Personal Line of Credit, you’ll need to complete an application online or at a U.S. Bank branch.

You’ll need to provide personal and financial information, such as your income, employment history, and monthly expenses.

So, do you want more about the process application? So, keep reading the article below.

Apply for U.S. Bank Personal Line of Credit

Are you looking for a flexible and affordable line of credit? Then apply for U.S. Bank Personal Line of Credit – up to $25K!

Trending Topics

Reflex® Platinum Mastercard® Review

Rebuild your credit score with the confidence of a good spending limit! Read our Reflex® Platinum Mastercard® review to learn how.

Keep Reading

Great news! Based on your selection, we’ve listed the best cards for you below

Explore the top credit cards tailored to your score! Navigate your choices and pick the right card for your financial health and lifestyle!

Keep Reading

Applying for the Luxury Black credit card: learn how!

Want to know what it takes to get your hands on a Luxury Black card? We'll show you how easy it is to apply so you can start earning rewards!

Keep ReadingYou may also like

Apply for Raising Cane’s Job Vacancies: Life insurance

No experience? No problem! This guide shows how to apply for job vacancies at Raising Cane's. Keep reading!

Keep Reading

8 best credit cards for excellent credit

Credit card with rewards is all good! Discover the 8 best credit cards for excellent credit, and choose yours today!

Keep Reading

Indigo® Mastercard® with Fast Pre-qualification credit card full review

Check our Indigo® Mastercard® with Fast Pre-qualification card review and learn how to build a better financial future.

Keep Reading