Credit Cards

Credit limit of up to $35K: Pelican Prime Visa Review

Pelican Prime Visa is a straightforward and hassle-free way to boost your credit score! Do you want to learn why? Then keep reading and find out!

Advertisement

Improving credit is simple and affordable thanks to its low rates

In this review, we bring you a simple credit card perfect for those with fair credit who want to boost their score: The Pelican Prime Visa.

Apply for the Pelican Prime Visa

Stop wasting time on needlessly complicated credit card applications. Use our easy guide to apply for a Pelican Prime Visa today. Read on!

This card is straightforward, with no complicated rules or minimum spending requirements. Do you relate to it? Then stay with us to learn more about it!

- Credit Score: Average-Excellent;

- Annual Fee: $0;

- Purchase APR: 9.75% – 17.75%;

- Cash Advance APR: N/A;

- Welcome Bonus: N/A;

- Rewards: N/A.

How does the Pelican Prime Visa work?

The Pelican Prime Visa is a minimalistic credit card designed for consumers who want to make simple payments and build their credit score.

It offers low fees, such as a competitive APR based on creditworthiness. Also, it charges no annual fee, which makes it an affordable option for those on a tight budget.

However, it doesn’t offer any rewards or bonuses, so its main benefits are simple.

The Pelican credit cards provide credit limits of up to $35,000 based on the applicant’s credit score.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Free enrollment in ID Navigator by Norton LifeLock

Pelican cardholders get free ID Navigator Powered by Norton LifeLock, which helps them stay aware of identity threats and take action quickly.

Also, you can have access to Google, Samsung, or Apple Pay.

Building credit

One of the most significant reasons you might choose this card is that it reports your payments to the major credit bureaus in the country: TransUnion, Equifax, and Experia.

Thus, credit reports that show responsible credit use can increase a person’s credit score and help lenders see that they are trustworthy.

Zero Fraud Liability

Indeed, with the Pelican Prime Visa card, you won’t be responsible for unauthorized charges on your account.

Pelican Prime Visa pros and cons

If you want a basic credit card without fees or rewards, consider the Pelican Prime Visa. Further, look at the pros and cons to see if it fits you well.

Pros

- Zero fraud liability;

- No annual fee;

- Reports to major credit bureaus;

- Credit limit of up to $35K.

Cons

- No rewards;

- No welcome bonus;

- Foreign transaction fee.

Does my credit score need to be good?

The required credit score ranges from average to excellent. So make sure to meet the requirements before applying.

Want to apply for the Pelican Prime Visa?

Apply for the Pelican Prime Visa with ease – all online! So follow our simple steps outlined in the post below. Read on!

Apply for the Pelican Prime Visa

Stop wasting time on needlessly complicated credit card applications. Use our easy guide to apply for a Pelican Prime Visa today. Read on!

Trending Topics

Credit card rewards: does it make you spend more money?

Do credit card rewards make you spend more? Learn if it is true, and how to use your card to your benefit without overspending it.

Keep Reading

Learn the best Premium Credit Cards of 2022: enjoy their benefits!

You'll find everything you need to know about the best premium credit cards of 2022 in this article. Read and find out which one you like!

Keep Reading

Is $5000 enough to move out, and how to save money?

Are you considering moving out but not sure if your budget is enough? Find out if $5000 is enough to cover your moving expenses.

Keep ReadingYou may also like

Rocket Loans or LightStream Loans: pros and cons

Choosing the best loan for you can be quite a challenge. However, Rocket Loans or LightStream Loans can be good options. Check out!

Keep Reading

Pros and cons of refinancing a car: everything you need knows

Check out the pros and cons of refinancing a car. A detailed analysis will give you the necessary information to decide on this option.

Keep Reading

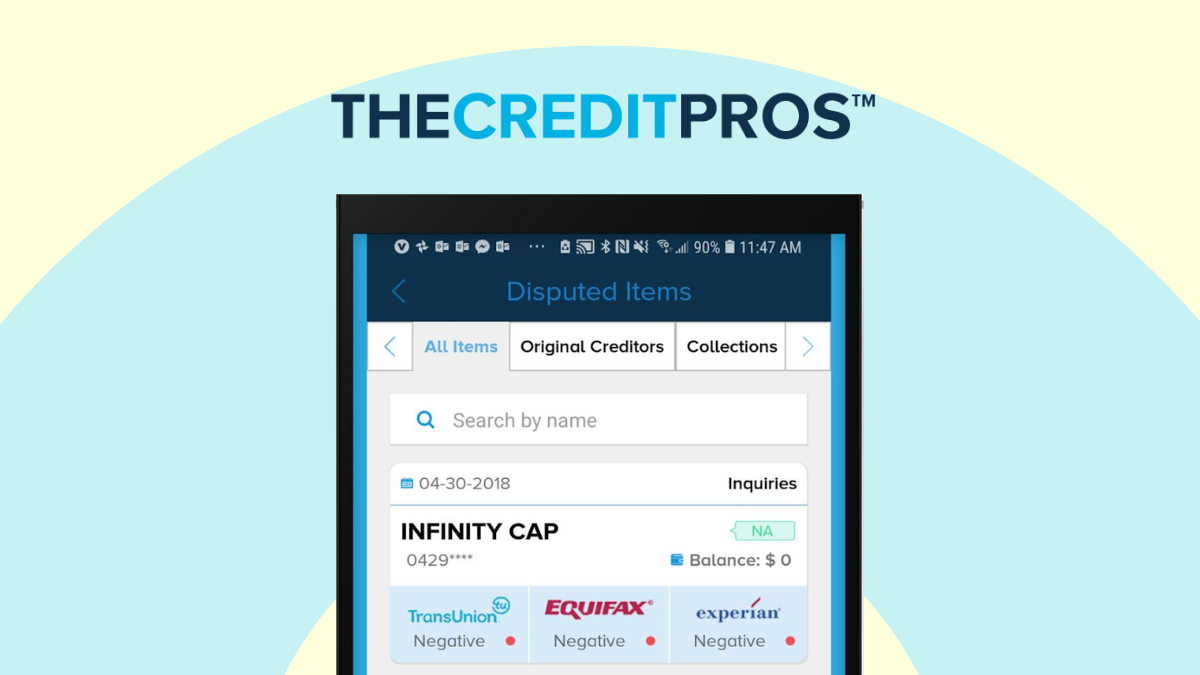

The Credit Pros review: become debt-free!

The Credit Pros deserves this review because it is one of the best credit repair companies in the US. Read to learn how it works.

Keep Reading