Credit Cards

PREMIER Bankcard® Mastercard® Credit Card full review

Not everyone has a good credit history. But, a lot of people need a credit card. See how the PREMIER Bankcard® Mastercard® Card can help!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

PREMIER Bankcard® Mastercard® Credit Card: ideal for building credit

Everyone needs a credit card, but the score may not help. That’s why there’s the PREMIER Bankcard® Mastercard® Credit Card review to show you how to get new credit.

With a relatively high APR, the PREMIER Bankcard® Mastercard® Card does not require a high credit score. With only 500, it is already possible to make a request.

And the rate varies depending on that score. Read more!

- Credit Score: Qualify with a low score (at least 500);

- Annual Fee: $50 to $125 based on creditworthiness;

- Regular APR: 36% variable APR;

- Welcome bonus: N/A;

- Rewards: N/A.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the PREMIER Bankcard® Mastercard® Credit Card work?

The PREMIER Bankcard® Mastercard® Credit Card is an option for those with not-so-good credit. Only 500 as a credit score qualifies you to apply for this option.

APR rates are determined based on your credit score; the higher the score, the lower the rates. And also, it informs the positive use of the card to agencies.

PREMIER Bankcard® Mastercard® Credit Card pros and cons

As with all card options, the PREMIER Bankcard® Mastercard® Credit Card has some pros and cons. Because it is used for building credit, it is normal for it to have higher APR rates.

However, the PREMIER Bankcard® Mastercard® Credit Card has other associated fees.

The sum of all these fees can be a little disadvantageous for anyone looking to increase their line of credit. Check out the main pros and cons.

Pros

- Allows other agencies such as Experian, Equifax, and TransUnion to be informed monthly of their positive credit usage updates;

- You can qualify with a not-so-good score.

Cons

- The initial fee for passing the program;

- Annual fee deducted from your credit limit, reducing your available initial credit;

- Monthly fee while the account is open;

- A fine fee for late payments;

- Additional user fee if you want to add a partner to your current account;

- Very high APR rate compared to other operators;

- Expensive credit limit increase rate, even after good card usage history.

Does my credit score need to be good?

If you have a minimum credit score of 500, you can apply for a credit card. The bank evaluates your credit score and will then determine the APR and annual rates based on your score.

Want to apply for the PREMIER Bankcard® Mastercard® Credit Card?

Getting a credit card with a bad credit score is a great difficulty for many. But the PREMIER Bankcard® Mastercard® Card is a solid option that can save you if that’s your situation.

However, it is not just the score that will be taken into account for approval. It is essential that your data is filled in correctly, as it increases the chances. So, check out how to apply correctly.

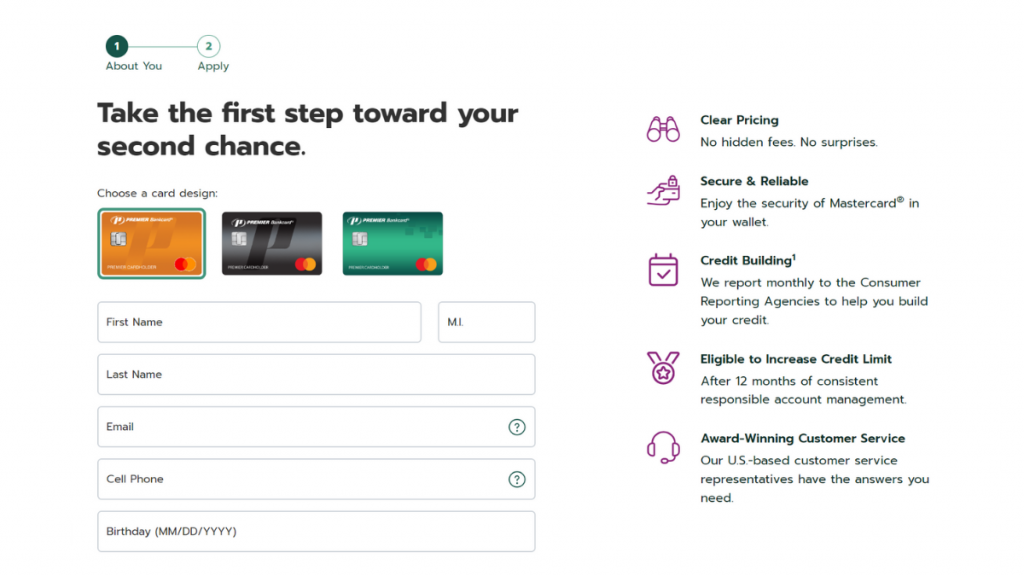

Apply online

Visit PREMIER Bankcard®’s official website. Then, on the homepage, look for the “Apply Now” option for the Mastercard® Card. Click on it to get started.

You’ll be prompted to enter your personal details. This typically includes your name, email, date of birth, and cell phone number. Ensure accuracy for smooth processing.

Next, take a few minutes to review the card’s fees, interest, and important disclosures. Then, check the box agreeing to the Communications Authorization and click on “continue”.

Then, provide employment details and income information. This helps determine your credit limit and approval. Always be honest and provide up-to-date details.

Once you’ve reviewed your application, click on the “submit” button. Wait for the system to process your information; this may take a few moments.

Most online applications offer instant decisions. If not, you’ll receive an email about your application results. Check your email regularly.

If approved, your new PREMIER Bankcard® Mastercard® Card should arrive at your address within a few business days.

Apply using the app

The PREMIER Bankcard® Mastercard® mobile app lets you effortlessly track balances and transactions. You can also make payments, and much more.

However, you cannot apply for the PREMIER Bankcard® Mastercard® Card through it.

Applying online ensures stronger security protocols, and the website’s designed to handle the rigorous checks, guaranteeing your data’s safety.

So while the website handles applications, the app’s tailored for current cardholders. It provides a clear and intuitive experience for account management only.

PREMIER Bankcard® Mastercard® Card vs. First Savings Card

The PREMIER Bankcard® Mastercard® can be a very good option for anyone looking to build credit.

It provides an unsecured credit line, and you can even waive the monthly fee depending on your creditworthiness.

However, a good alternative lies in the First Savings Credit Card. You can get fraud coverage, and there is no penalty APR! Check out the comparison below.

PREMIER Bankcard® Mastercard® Card

- Credit Score: A 500+ score is required;

- Annual Fee: $50 – $125 depending on your creditworthiness;

- Regular APR: 36%;

- Welcome bonus: N/A;

- Rewards: N/A.

First Savings Card

- Credit Score: N/A;

- Annual Fee: It depends on your card and credit score;

- Regular APR: N/A.;

- Welcome bonus: N/A;

- Rewards: N/A.

Do you want to learn more about the First Savings Card’s offerings? Then you can check out our post below to learn all about the application process for this card!

Applying for the First savings card: learn how!

Applying for the First Savings credit card is simple. But can you do it? This article will give you the answer.

Trending Topics

Applied Bank® Secured Visa® Gold Preferred® Card Review

Looking for a secured credit card that offers a low-interest rate? Check our Applied Bank® Secured Visa® Gold Preferred® card review!

Keep Reading

Discovery Platinum Card review: Earn up to 50% cashback

Check out our Discovery Platinum Card review! Learn the benefits this card offers and more! Enjoy discount on local flights and rewards.

Keep Reading

Best student credit cards of 2022: 7 great options

Choosing among the best student credit cards is not easy. Discover the best options for 2022 and decide which one will be yours.

Keep ReadingYou may also like

What Is the Lowest Credit Score Possible? (And How to Improve It)

Discover the lowest credit score possible, learn how it affects your finances, and how to improve it for better financial health. Read on!

Keep Reading

Up to $5K easily: CreditFresh Line of Credit review

Looking for a reliable line of credit option? Check out our CreditFresh Line of Credit review for all the details you need to know.

Keep Reading

Crypto with the most potential in 2022: great investment opportunities

Do you know which is the crypto with the most potential in 2022? Bitcoin has given way to other currencies like Ethereum. Read on!

Keep Reading