Reviews

PREMIER Bankcard® Secured Credit Card full review

If building a credit score is just what you're looking for, check out this PREMIER Bankcard® Secured Credit Card review to learn more!

Advertisement

PREMIER Bankcard® Secured Credit Card: ideal for those with low or no credit!

Starting to use credit can be a big challenge. However, this PREMIER Bankcard® Secured Credit Card review can help you choose this option to get started.

Apply for the PREMIER Bankcard® Secured Card!

Having a good credit-building card is crucial if you need to improve your finances. So, check out how to apply for the PREMIER Bankcard® Secured Credit Card!

This credit card was designed for people new to or needing a credit score. Therefore, they have a low associated APR rate and can reach up to a $5,000 limit. Know more!

- Credit Score: Under 500;

- Annual Fee: $50;

- Regular APR: 19.9%;

- Welcome bonus: N/A;

- Rewards: credit building for new card users.

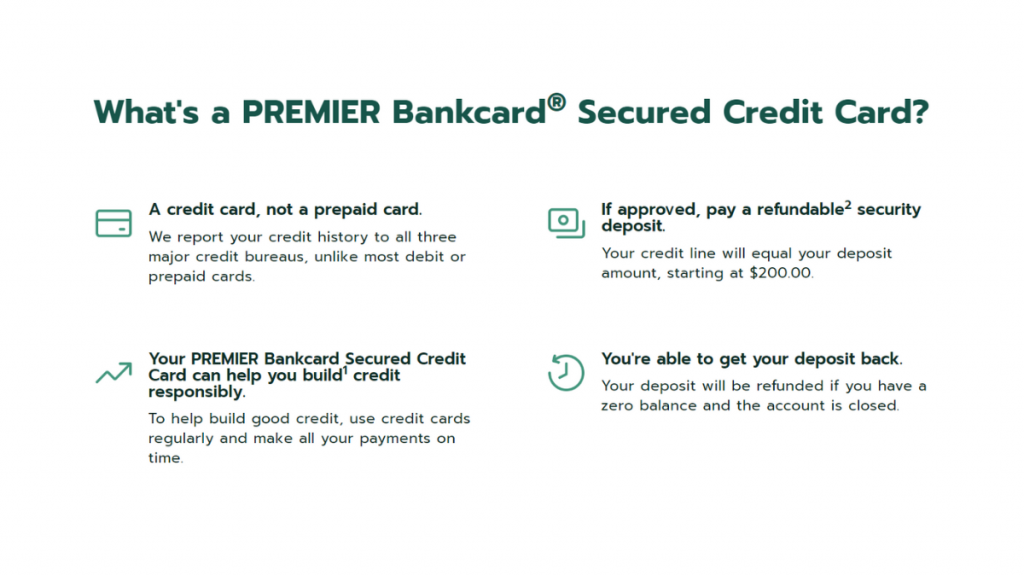

How does the PREMIER Bankcard® Secured Credit Card work?

As we said in this PREMIER Bankcard® Secured Credit Card review, this credit card is for building a good credit score.

Its APR rate tops out at 19.9%, with an associated annual fee of $50. It might be the first card you’ll ever have. Also, the application process is simple, and approval can come very quickly.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

PREMIER Bankcard® Secured Credit Card pros and cons

Every credit card option should be carefully evaluated before any decision is made. After all, some pros and cons may or may not bring pleasant surprises throughout the application.

Therefore, it is important to be prepared. The PREMIER Bankcard® Secured Credit Card review shows that this card has the advantages of a good limit, good application, and a low annual fee.

So, check out the pros and cons below!

Pros

- Helps in building a credit score;

- APR rate is low for this type of card;

- The limit is good and can go up to $5,000.

Cons

- It has an associated annual fee of up to $50;

- It doesn’t have many associated benefits, and there are no rewards.

Does my credit score need to be good?

This credit card option was designed especially for people who are new or who don’t have a credit score. Therefore, people with a score below 500 can apply and have the card approved.

So, you don’t need to have a good credit history. Also, this option can be ideal if you want or need to build a good credit score.

Moreover, the not very high APR rate favors the good use of credit, favoring your score.

Want to apply for the PREMIER Bankcard® Secured Credit Card?

You need more than just the minimum requirements to have a credit card. Therefore, you need to know how to apply correctly to have a better chance of being approved.

The PREMIER Bankcard® Secured Credit Card review shows that applications can be done online or through the app.

Want to know more about the process? Then check out our post below and we’ll show you the steps involved in applying for it.

Apply for the PREMIER Bankcard® Secured Card!

Having a good credit-building card is crucial if you need to improve your finances. So, check out how to apply for the PREMIER Bankcard® Secured Credit Card!

Trending Topics

Different types of loans available: which one is right for you?

Need a loan but don't know which one to choose? Don't worry. We'll help you. Check out the different types of loans.

Keep Reading

Regions Premium Visa® Signature Credit Card full review

Check this Regions Premium Visa® Signature Credit Card review. Earn a welcome bonus of 30,000 points in the 1st 90 days!

Keep Reading

Luxury Titanium credit card full review

Want to travel in style and earn cash back? Check out our Luxury Titanium card review and see how its features can benefit you.

Keep ReadingYou may also like

Choose the perfect loan for your finances: compare the options!

Need a new car, home repairs, money for a wedding, or just some extra cash? Compare options and choose a loan for you.

Keep Reading

Truist Enjoy Cash Credit Card full review

Want a card option with great rewards? Check out this Truist Enjoy Cash Credit Card review and find out if it's what you're looking for.

Keep Reading

Applying for the Upgrade Bitcoin Rewards Visa card: learn how!

Applying for the Upgrade Bitcoin Rewards Visa card is a simple process, and you get 1.5% cash back in crypto on every purchase.

Keep Reading