Get the most out of your home equity – up to $250K for multiple purposes!

Alliant Credit Union HELOC – Unlock the Power of Your Home Equity

Advertisement

Are you a homeowner looking to access funds for home improvements, debt consolidation, or other expenses? Alliant Credit Union HELOC could be the solution you’re looking for. With competitive rates, flexible terms, and a streamlined application process, Alliant Credit Union HELOC is an excellent choice for homeowners who want to tap into the equity in their homes.

Are you a homeowner looking to access funds for home improvements, debt consolidation, or other expenses? Alliant Credit Union HELOC could be the solution you’re looking for. With competitive rates, flexible terms, and a streamlined application process, Alliant Credit Union HELOC is an excellent choice for homeowners who want to tap into the equity in their homes.

You will remain in the same website

Don't miss out on the opportunity to access the funds you need from your home equity. Check out Alliant Credit Union HELOC today to learn more about the benefits of this flexible and affordable loan option.

A HELOC (home equity line of credit) is a revolving line of credit, similar to a credit card, that allows you to borrow money as needed and pay it back over time. In contrast, a traditional home equity loan is a lump-sum loan that is repaid in fixed monthly payments over a set period of time. With a HELOC, you can draw funds as needed, up to your credit limit, and only pay interest on the amount you borrow.

The maximum loan amount for an Alliant Credit Union HELOC is $250,000, subject to the equity you have in your home and other creditworthiness factors. However, Alliant Credit Union offers competitive rates and flexible terms to help you make the most of your HELOC.

You can use an Alliant Credit Union HELOC to pay off high-interest debt, such as credit card balances or personal loans. This can be a smart financial move, as HELOCs typically offer lower interest rates than other types of loans. Plus, the interest you pay on a HELOC may be tax-deductible, further reducing the cost of borrowing.

If you can’t make your Alliant Credit Union HELOC payments, it’s important to contact the credit union as soon as possible. Depending on your circumstances, Alliant Credit Union may be able to work with you to modify your payment plan or temporarily suspend your payments. However, if you fall significantly behind on your payments, Alliant Credit Union may have the right to foreclose your home.

Apply now for Alliant Credit Union HELOC

Learn how to apply for Alliant Credit Union HELOC and take advantage of the benefits offered by this financial institution – low rates!

As an alternative to Alliant Credit Union HELOC, we recommend checking out PenFed HELOC. Read our article on PenFed HELOC to see if it might be a better fit for your needs and learn how to apply.

Get up to $500K quickly: Apply for PenFed HELOC

Learn how to apply for a PenFed HELOC now – get the money you need quickly and use it for several purposes! Keep reading and learn more!

Trending Topics

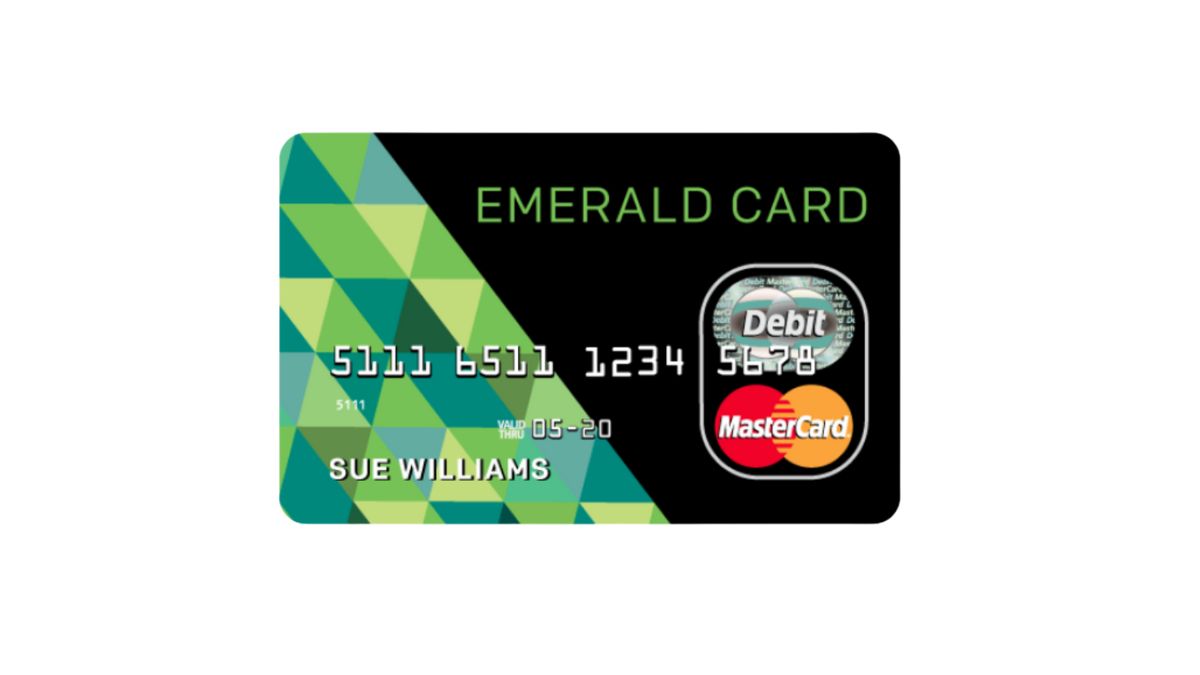

Applying for the H&R Block Emerald Prepaid Mastercard®: learn how!

The H&R Block Emerald Prepaid Mastercard® might be what you're looking for if you don't have a good credit score. Learn how to apply today!

Keep Reading

Bank of America® Unlimited Cash Rewards credit card full review

The Bank of Bank of America® Unlimited Cash Rewards credit card offers up to 2.62% cash back on, unlimited redemptions and zero fees

Keep Reading

Credit-builder loans: get the help you need to improve your credit score

Need to build credit or improve your credit score? Then you need to know about credit-builder loans. Check out!

Keep ReadingYou may also like

Medical loans: see how to finance your medical treatments

Medical loans are a great way to pay for medical treatments. See information on how they work and the pros and cons of taking them out!

Keep Reading

Truist Future Credit Card full review: 0% APR for the first 15 months

Read our comprehensive Truist Future Credit Card review. Pay $0 annual or foreign transaction fees! Keep reading and learn more!

Keep Reading

Destiny card or Indigo® Mastercard®: find the best choice!

Wondering if the Destiny or Indigo® Mastercard® with Fast Pre-qualification is right for you? Compare the features of both cards to find out.

Keep Reading