A prepaid card with debit card functionality and no fees

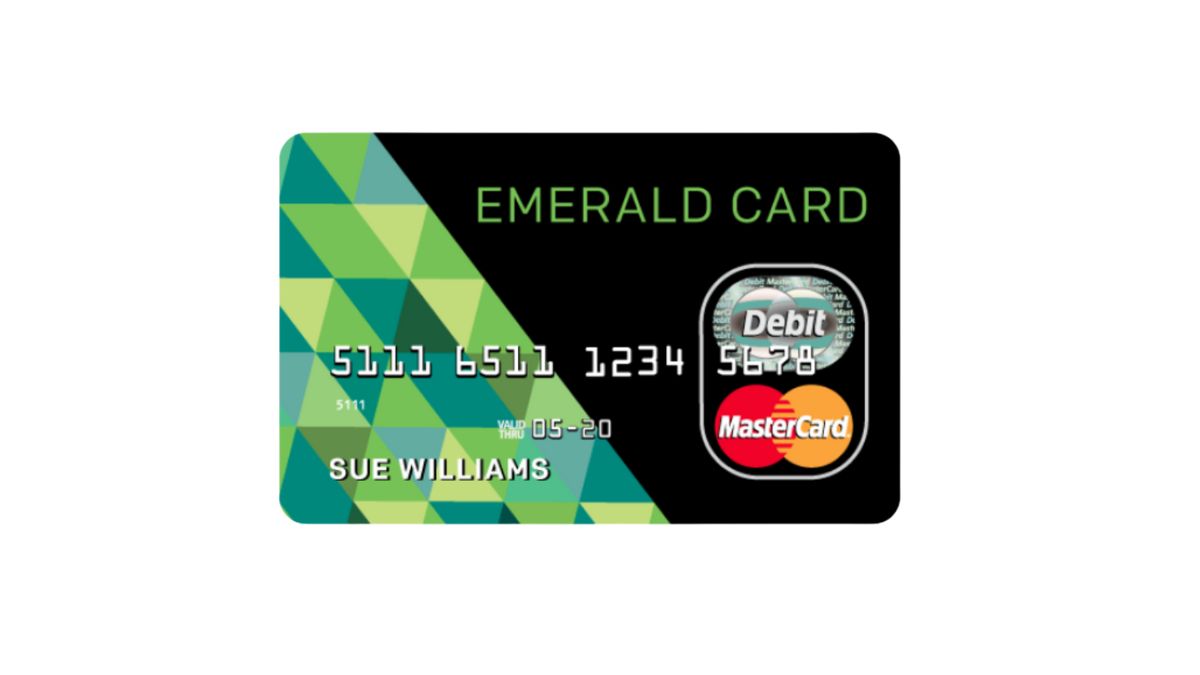

H&R Block Emerald Prepaid Mastercard®: No annual and monthly fees, 0% APR and all credit scores accepted

Advertisement

The H&R Block Emerald Prepaid Mastercard® is a card with many benefits. You can quickly have the card after approval, and it has no associated annual or monthly fees. In addition, the APR is 0%, and since it does not allow financing, it prevents you from having long-term debt. That way, it’s a great card for all types of credit scores and to use as you prefer.

The H&R Block Emerald Prepaid Mastercard® is a card with many benefits. You can quickly have the card after approval, and it has no associated annual or monthly fees. In addition, the APR is 0%, and since it does not allow financing, it prevents you from having long-term debt. That way, it’s a great card for all types of credit scores and to use as you prefer.

You will remain in the same website

This is a great prepaid card choice and will save you from getting into new debt. Check out the main benefits:

The most important thing to remember before applying for H&R Block Emerald Prepaid Mastercard® is that you need a social security number that officially identifies your status as an American citizen. In addition, being 18 years old and living at home with parental supervision will suffice!

The H&R Block Emerald Prepaid Mastercard® is one of the leading credit cards on today’s market. You have two options to apply for this amazing offer: go to MetaBank and choose from there or download their app onto your mobile device (Android/iOS). Once installed it will take less than five minutes! The process starts with filling out some personal information such as name, exactly how much money owed currently alongside social security number etc., then choosing whether or not they want a traditional bank account too which helps them save more during emergencies since funds can be accessed any time without waiting days before getting paid again – sounds great doesn’t It?

This card is a great way to build your credit score. The more you use it, the better! There are some fees associated with loading cash value onto this product which may affect how much room there will be for other purchases on an account, but if used correctly then, these can easily outweigh what was spent in one transaction when considering all future transactions due entirely too them being able protect against fraud without any additional cost attached – something every person wants whether they know its importance yet or not.

The benefits of this card are numerous. It has no monthly or annual fee, and you can use it at any ATM without incurring charges! The only thing left is to withdraw money from your account- which will always be free as long as it’s hooked up through withdrawals at the bank’s ATMs (which makes sense).

The H&R Block Emerald Mastercard® has many benefits and works like a debit card. But you might also be interested in the Netspend® Prepaid Card, which has great conditions.

See how to apply for this card and have this alternative in our post below!

How to apply for the Netspend® Prepaid Card

The Netspend® Prepaid Card is a great option for all credits. Check out how to apply and get your card today.

Trending Topics

What is a hard fork: learn how it affects the crypto market

Ever wondered: What is a hard fork? This term belongs to the world of cryptocurrencies, and today we are going to explain it to you.

Keep Reading

15 Best Secret Websites to Make Money

Don't settle for the ordinary. Find out these secret websites that offer extraordinary opportunities to make money online. Read on!

Keep Reading

How to get out of debt: 10 tips to get your finances back on track

Debt can bring a lot of headaches. But, after all, how to get out of debt? Find out everything in this guide that we've created for you.

Keep ReadingYou may also like

Juno Debit Card Review

Need a good debit card to make your money work? Check out this Juno Debit Card review and find out if it might be what you're looking for.

Keep Reading

U.S. Bank Cash+™ Visa Signature® credit card full review

In our U.S. Bank Cash+™ Visa Signature® card review, you'll learn why this is the perfect product for those who want maximum flexibility!

Keep Reading

Truist Enjoy Beyond Credit Card full review

Read this comprehensive Truist Enjoy Beyond Credit Card review before signing up. You can earn up to 3x points for every dollar spent!

Keep Reading