Great, I've just found the perfect credit card for you!

Merrick Bank Double Your Line Secured Visa: Improve credit score and double your credit limit fast.

Advertisement

The Merrick Bank Double Your Line Secured Visa card will help you improve your credit score by reporting to all major credit bureaus. They will also give you access to your FICO score so that you can track your progress. The initial credit limit is $200, but after just 7 months of on-time payments you may become eligible for doubling that amount.

The Merrick Bank Double Your Line Secured Visa card will help you improve your credit score by reporting to all major credit bureaus. They will also give you access to your FICO score so that you can track your progress. The initial credit limit is $200, but after just 7 months of on-time payments you may become eligible for doubling that amount.

You will remain in the same website

Have a look at some of the benefits of owning one of these.

You will remain in the same website

To download the Merrick Bank goMobile app, simply search for “Merrick Bank goMobile” on the App Store for iOS devices or Google Play for Android devices. Follow the on-screen instructions for a hassle-free installation. Alternatively, visit their website and find download links

Absolutely! While the card’s name highlights doubling your credit line, Merrick Bank understands that not everyone wants or needs such a significant increase. You can request a smaller credit line increase that better suits your current needs and financial goals.

It’s generally not advisable to take out a cash advance with a secured credit card due to high fees, immediate interest accrual, and potential negative impacts on your credit utilization and score. Explore alternative financial options before considering a cash advance.

Currently, Merrick Bank doesn’t offer a product conversion option to switch between secured Visa and Mastercard versions. This means you can’t directly change your card network while keeping your existing account and credit history. But you can enjoy many benefits that come with your Visa, one of the major credit networks in the world.

Trending Topics

10 different types of credit cards: and how to choose yours

Choosing the right credit card can be overwhelming. This guide breaks down 10 different types of credit cards. So, check it out!

Keep Reading

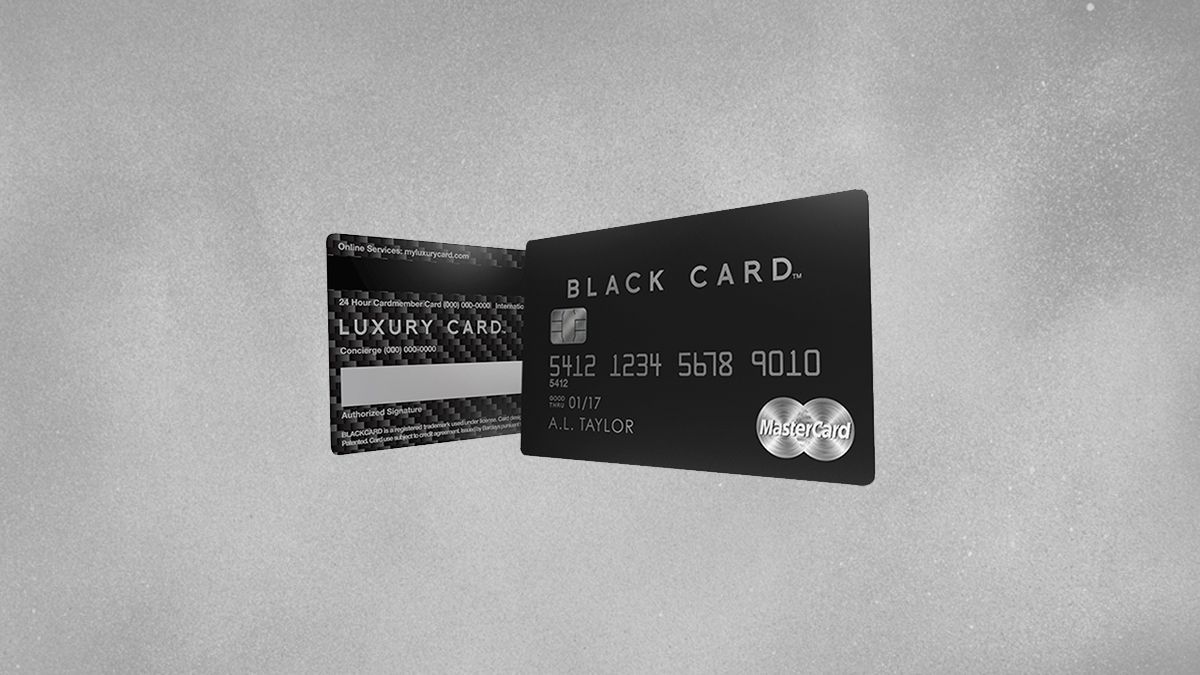

Luxury Black credit card full review

Check out our Luxury Black credit card full review to learn all about its exclusive travel rewards and high-end experiences.

Keep Reading

What are the real advantages of cashback?

The advantages of cashback are powerful in the long term, and in this article you will learn how this works. Read on to find out more!

Keep ReadingYou may also like

Qtrade Investing brokerage platform full review

Qtrade Investing is a brokerage platform which offers you both a mobile and a web-based application, and the best customer service.

Keep Reading

Bear market: what is it in investing terms?

Check this article to find out everything you need to know about what is a bear market! From what they are to how long they last.

Keep Reading

Custom Choice student loan review: is it worth it?

Do you need money to complete your studies? The Custom Choice student loan may be what you are looking for. Learn more!

Keep Reading